How to Find Your IBAN Number: Step-by-Step Guide for Bank Customers

Learn how to find your IBAN number easily. This step-by-step guide shows you how to get your IBAN number from your bank statement, online banking, and more

If you’re sending or receiving money internationally, you might be asked for your IBAN number. Many customers are unsure where to find it or how it’s generated from their account details.

This guide will show you how to find your IBAN number, how to get it from your account number, and where to look depending on your bank and country.

What Is an IBAN Number?

IBAN stands for International Bank Account Number. It’s a globally standardized format for bank account identification that helps process international payments accurately.

An IBAN is made up of:

- Country code (2 letters)

- Check digits (2 numbers)

- Basic Bank Account Number (BBAN) – includes bank code, branch code, and your account number

Example (UK): GB29 NWBK 6016 1331 9268 19

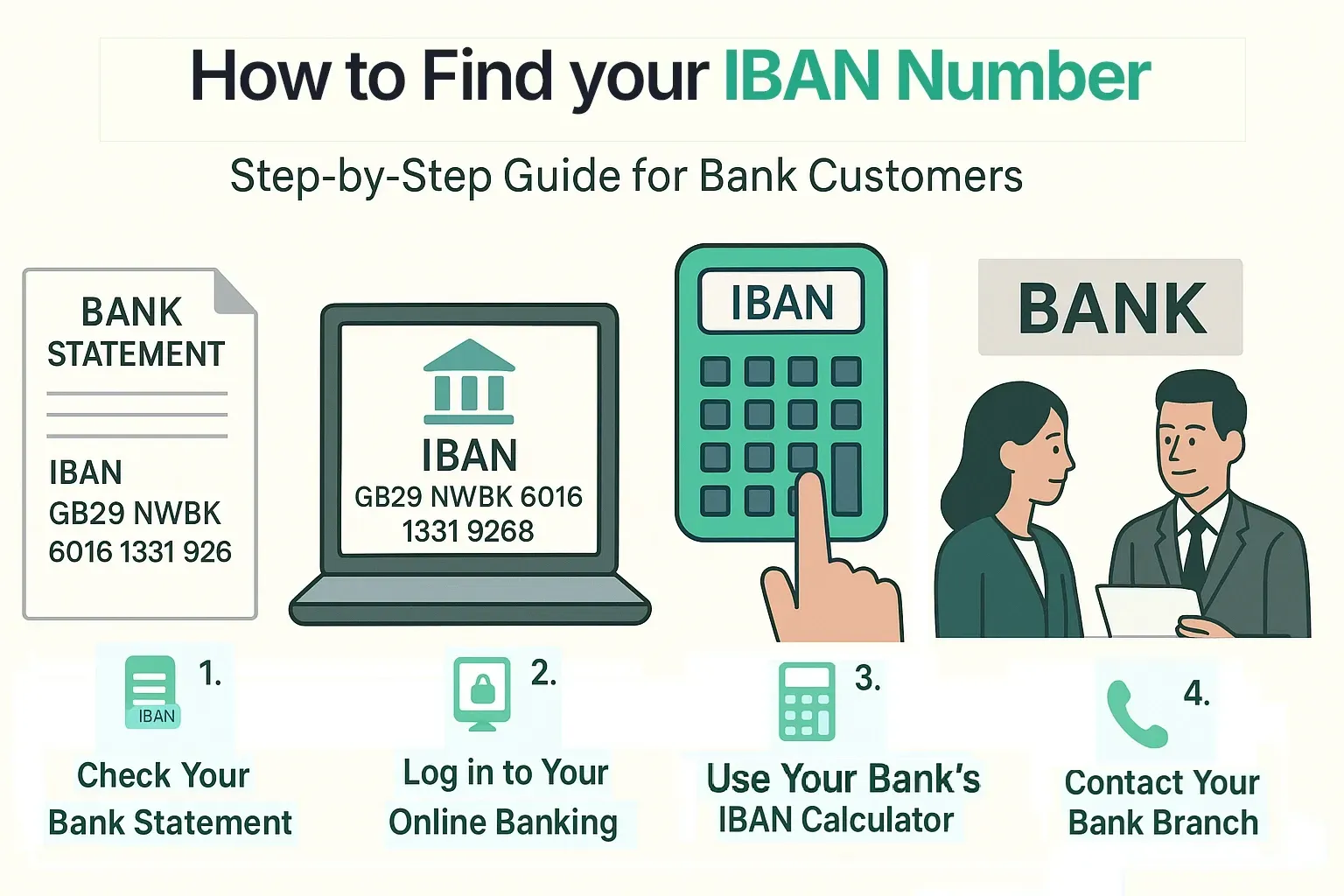

How to Find Your IBAN Number

Finding your IBAN number depends on your country, bank, and the services they provide. Here’s a step-by-step process:

1. Check Your Bank Statement

Most banks in IBAN-adopting countries print the IBAN on paper or PDF bank statements. Look for:

- “IBAN” label near your account details

- Usually placed along with SWIFT/BIC codes

Tip: If you have multiple accounts, make sure you check the statement for the correct account.

2. Log in to Your Online Banking

Many banks display the IBAN in your account details section when you log in to online or mobile banking.

Steps:

- Log in securely to your bank’s website or app

- Go to “Account Information” or “Account Details”

- Look for an “IBAN” field

- Copy it exactly as displayed

3. Use Your Bank’s IBAN Calculator

Some banks provide an IBAN generator or calculator on their website. You enter your domestic account number, branch code, or sort code, and it outputs your IBAN.

Important: Only use your bank’s official website or verified apps to avoid phishing scams.

4. Contact Your Bank Branch

If you can’t find the IBAN online, call your bank’s customer service or visit the nearest branch. They can:

- Verify your identity

- Provide your IBAN instantly

- Guide you on how to share it for safe international transfers

5. Check Your Chequebook or Payment Card Documents

Some banks print IBAN numbers on the back of chequebooks or in account opening documents—especially in countries where IBAN is mandatory.

How to Find IBAN Number from Account Number

If you already have your account number, you can often generate your IBAN using your bank’s official IBAN calculator. This works because:

- The bank’s system knows the BBAN structure for your country

- It adds the correct country code and check digits

Example: If your German account number is 1234567890 and bank code is 50010517, the IBAN calculator might give: DE44 5001 0517 1234 5678 90

⚠ Note: Never use third-party IBAN calculators for security reasons—only your bank’s official tool.

Special Note: IBAN Number in India

India does not use IBAN numbers. For international transfers to/from India:

- You provide your account number.

- You use the IFSC code for intra-India payments.

- You provide the SWIFT/BIC code of your bank branch for international payments.

If you’re an Indian bank customer wanting to find your IBAN, remember the system does not officially use IBAN. Instead, rely on IFSC and SWIFT details provided by your bank.

Safety Tips When Sharing IBAN

- IBAN is safe to share for receiving money—it doesn’t give access to your funds

- Never share banking login credentials or sensitive security codes

- Use secure channels (encrypted email, secure forms, or direct communication)

Common Mistakes When Finding Your IBAN

- Confusing IBAN with SWIFT: SWIFT is the bank identifier; IBAN is the account identifier

- Entering spaces in the wrong place: Some systems require IBAN without spaces

- Using old account documents: IBAN formats may change if the bank updates its structure

Quick Reference Table: Where to Find Your IBAN

FAQs

1. How to find IBAN number from account number?

Use your bank’s official IBAN calculator or contact customer service. They will combine your account number with country code, bank code, and check digits to produce your IBAN.

2. How to get IBAN number in India?

India does not use IBAN. Instead, use your account number and SWIFT code for international transfers.

3. Can I find my IBAN number online?

Yes, in most IBAN countries, you can log in to online banking or use your bank’s mobile app to find it.

4. Is IBAN safe to share?

Yes, IBAN is safe for receiving money, but never share passwords or banking login information.

5. What if I enter the wrong IBAN when making a payment?

The payment may be rejected or sent to the wrong account. Always double-check the IBAN before confirming a transfer.

6. Can I use my SWIFT code instead of IBAN?

No. SWIFT and IBAN serve different purposes—some transfers require both.

7. Do all countries use IBAN?

No. IBAN is used mainly in Europe, the Middle East, and some other regions. Many countries use other identifiers.

8. Can my IBAN change?

Yes, if you change banks or your bank updates its account numbering system. Always confirm before making transfers.

9. What is the difference between IBAN and account number?

An IBAN includes your account number plus extra identifiers like country code and check digits for international use.

10. How long is an IBAN?

It can be up to 34 characters, depending on the country.

11. What If Your Country Does Not Use IBAN?

Some countries, like India, the United States, and Australia, don’t use IBAN numbers. Instead:

- You’ll provide your account number and SWIFT/BIC code

If sending money to an IBAN country, you’ll still need the recipient’s IBAN