Our Blog

Insights and updates on global payments and international banking.

Anti-Dumping Duty in India: Meaning, Calculation, Types & Real-World Examples

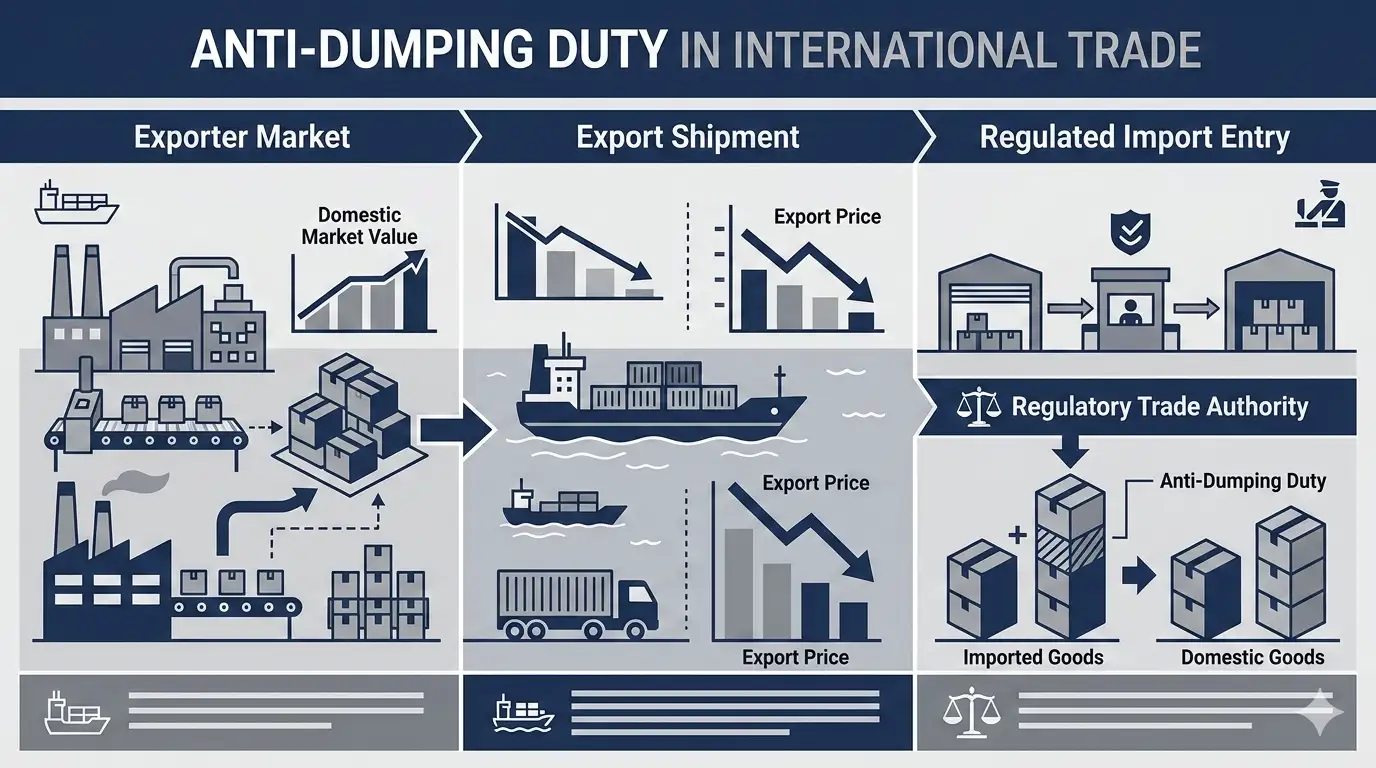

Anti-dumping duty is a special tariff that India imposes on underpriced imports when foreign exporters sell goods in India below their fair value, hurting domestic producers. It is calculated separately from normal customs duty and is targeted at specific products, exporters, and countries rather than applied across the board. What Is Anti-Dumping Duty? Anti-dumping duty (ADD) is a protectionist tariff imposed by a country on imports that are sold at a price below their fair market value in t

CIF, FOB, and Assessable Value: How Customs Calculates Duty on Imports

Customs duty in India is always calculated on the assessable value, which is effectively the CIF value of the goods at the Indian port of import. If an importer misunderstands how to move from FOB to CIF and then to assessable value, they either overpay duty or face valuation disputes and penalties. This guide explains assessable value, CIF vs FOB, conversion rules, duty calculation steps, Rule 10 additions, and common valuation mistakes in a practical way for importers, customs brokers, and log

Customs Clearance Process for Imports in India: Step-by-Step Guide

Customs clearance for imports in India is the process of getting your goods legally approved by Indian Customs so they can enter the country, after you submit documents, pay duties, and meet all regulations. It is very crucial to keep your shipments moving on time and to protect your profits, when done wrong, it leads to delays, penalties, and unhappy customers. Why Customs Clearance is so Crucial for Indian Importers For any Indian importer, D2C brand, or manufacturer, customs clearance is t

Import Export Business in India: The Complete 2026 Starter Guide (Licenses, Products, Financing & Mistakes to Avoid)

Starting an import-export business in India in 2026 means tapping into a huge global demand while leveraging India’s strong manufacturing base and digital payment ecosystem. With IEC registration now fully online, smarter export finance schemes, and RBI-licensed cross-border platforms, it’s far easier to begin if you follow the right steps and avoid common mistakes. Introduction If you’ve ever thought, “I want to sell to the world, but I don’t know where to start,” this guide is for you. In 2

Virtual Bank Accounts: The Complete Guide to Meaning, Types & How They Work (2026)

A global virtual bank account gives your business a local bank account number in the US (ACH routing), UK (sort code), or Europe (IBAN) without opening a physical account in that country. Your international clients pay you like a local transfer. Funds convert and settle into your Indian bank account within 1-2 days, saving 50-75% on fees vs traditional SWIFT wires. What Is a Global Virtual Bank Account? A global virtual bank account is a fully digital bank account in a foreign currency (USD,

D2C Guide: How to Sell Chinese Scarves, Sling Bags & Wallets in India via Personal Import (2026)

India’s fashion accessories market is already worth around US$17.5 billion in 2025 and is growing at about 9.1% CAGR, projected to reach roughly US$28.6 billion by 2031. Scarves, sling bags, and wallets sit right in the sweet spot of this growth, they are impulse buys driven by Instagram trends, influencer looks, and rising disposable income among young urban women. For Chinese factories and traders in Yiwu and Guangzhou, this is a huge opportunity. China is already the world’s primary sourcing

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates

Why Choose EximPe for International Payments?

EximPe Support

How can we help you with your global payments today?