Difference Between Custom Duty and GST: A Clear Comparison

Navigating import and export taxes in India? Understand the difference between Customs Duty and GST (IGST) and how they apply to your business.

The distinction between customs duty and GST is important for all the businesses involved in international trade; this distinction helps in compliance and cost management. Eximpe understands that dealing with these taxes may be confusing, but here is a clear comparison that should give you informed decision-making.

Custom Duty Meaning

Custom duty refers to a tax that is charged on goods whenever such goods cross international boundaries while being imported or exported. In India, the customs duty is provided by the Customs Act of 1962 and is managed by the Central Board of Indirect Taxes and Customs (CBIC). Its primary objectives are:

- Generating revenue for the government

- Protecting domestic industries from foreign competition

- Regulating and monitoring the movement of goods

- Preventing illegal trade and smuggling

Rates of custom duty will be based on the classification of the product, its origin and its composition. The most popular are Basic Customs Duty(BCD), Social Welfare Surcharge, Anti-Dumping Duty, and Safeguard Duty. In most cases, BCD is about 10%, though it will depend on the product.

GST (Goods and Services Tax) Explained

GST is a sophisticated tax on the supply of goods and services across India. It is also known as the Goods and Services Tax. It was a combination of various indirect taxes, and the tax system was simplified, making compliance easy for businesses. GST is categorized as:

- Intra-state supplies – CGST (Central GST)

- State GST (SGST) in the case of intra-state supplies

- Interstate and import IGST.

GST is intended to provide a single market, avoid cascading taxes, and allow an easy flow of input tax credits.

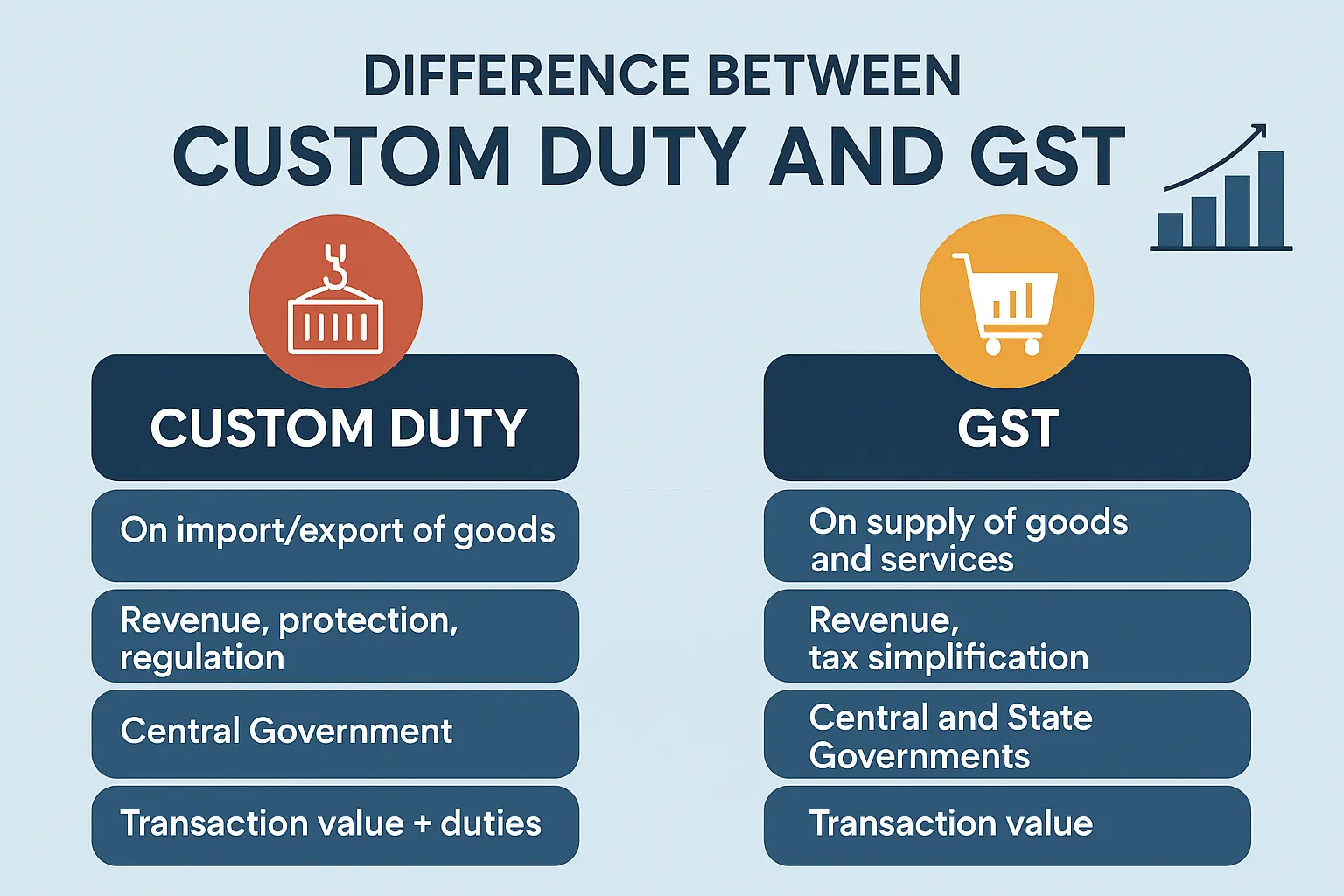

Custom Duty and GST: Key Differences

How Custom Duty and GST Interact

When goods are imported into India, both customs duty and GST are applicable:

- First, custom duties (such as BCD and Social Welfare Surcharge) are calculated on the assessable value of the goods.

- Then, IGST (a component of GST) is levied on the total value, which includes the assessable value plus custom duties.

- IGST paid on imports can generally be claimed as input tax credit, reducing the overall tax burden for businesses.

Real-World Relevance for Businesses

The Indian importers and exporters need to understand the difference between the customs duty and GST:

- Cost Management: Accurate calculation avoids overpayment and guarantees a competitive rate of payment.

- Compliance: Keeps away from penalties and a hassle-free customs clearance.

- Cash Flow: It can enhance liquidity by input tax credit on GST during imports.

Conclusion

Custom duty and GST have separate but complementary functions in India's tax system. Although customs duty aims to control international trade and shield domestic industries from external forces, GST simplifies the taxation of goods and services in the country. For companies, and for those that engage in cross-border trade in particular, both are important to running efficiently and effectively.

Keep up to date with Eximpe to learn about the latest trade regulations, and let us help you ease your way into the global business world!

FAQs

Is customs duty the same as GST on imports?

No, customs duty is a tax on goods crossing international borders. At the same time, GST (specifically IGST on imports) is a tax on the supply of goods and services within India, including imports. Both are levied separately on imported goods.

Who collects customs duty and GST in India?

Customs duty is collected by the Central Board of Indirect Taxes and Customs (CBIC), while GST is collected by both the central and state governments, depending on the type of supply.

Can I claim an input tax credit for GST paid on imports?

Yes, the IGST paid on imported goods can generally be claimed as input tax credit, helping reduce your overall GST liability.

Are exports subject to customs duty or GST?

Exports are usually exempt from customs duty and are zero-rated under GST, meaning no GST is payable on exports, and input tax credit can be claimed.

How are customs duty and GST calculated on imports?

First, customs duties (like BCD and surcharges) are calculated on the assessable value of goods. Then, IGST is levied on the total of assessable value plus customs duties.