SCOMET: Full Form, Declaration, List & What Importers-Exporters Must Know

What is SCOMET? Full form, declaration format, 9 categories, and why importers-exporters of dual-use goods in India must understand SCOMET compliance.

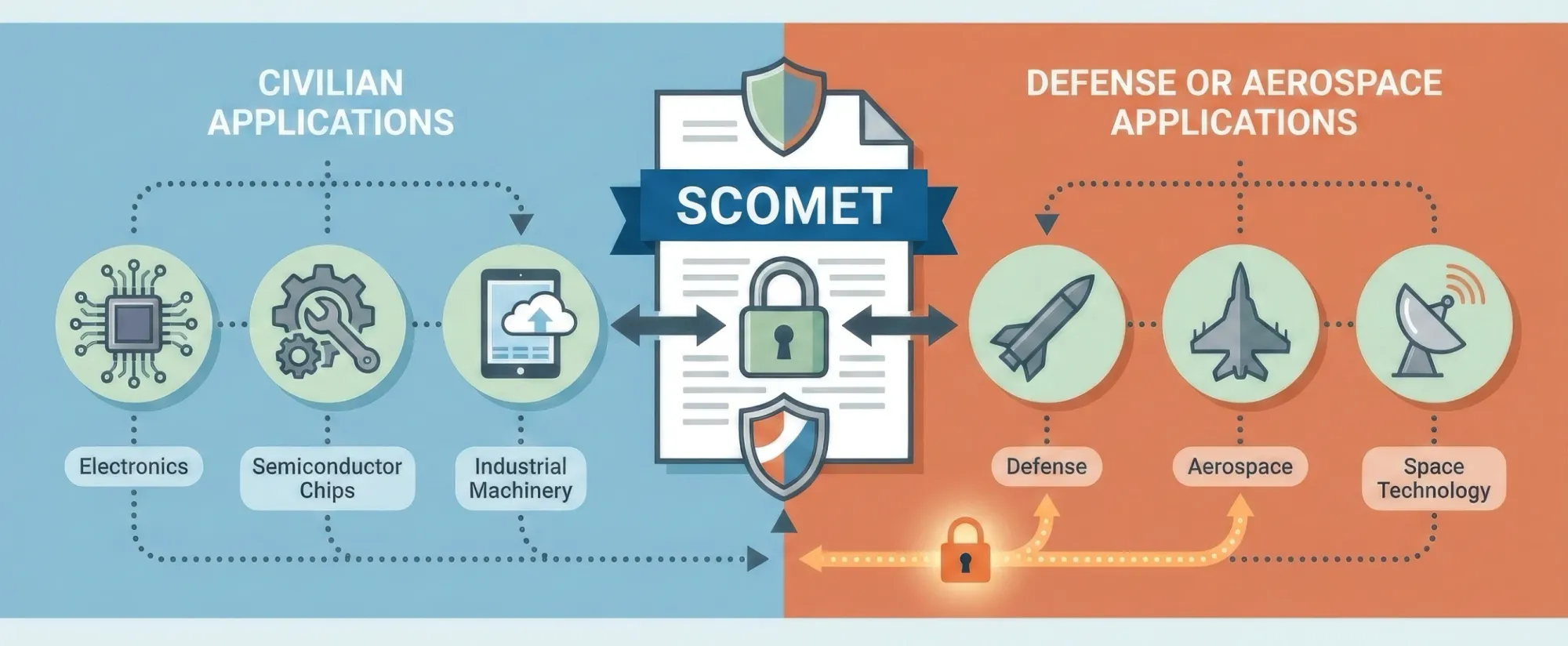

SCOMET stands for Special Chemicals, Organisms, Materials, Equipment and Technologies, India's master control list of dual-use items regulated by DGFT. If you import/ Export chemicals, electronics, sensors, aerospace components, or software, SCOMET compliance affects you. Even though it's primarily an export control framework.

What is SCOMET?

SCOMET is India's national export control list of sensitive items that have both civilian and military applications, Commonly called dual-use goods. It is maintained and regulated by the Directorate General of Foreign Trade (DGFT) under India's Foreign Trade Policy (FTP).

Legal framework:

- FTDR Act, 1992 (Foreign Trade Development & Regulation Act) — Chapter IVA

- Foreign Trade Policy 2023 — Chapter 10

- Handbook of Procedures — Para 2.73 and related provisions

- Weapons of Mass Destruction Act, 2005 — overarching criminal statute

India's SCOMET list is aligned with four international export control regimes:

- Wassenaar Arrangement (conventional arms and dual-use goods)

- Missile Technology Control Regime (MTCR)

- Australia Group (chemical and biological weapons precursors)

- Nuclear Suppliers Group (NSG)

SCOMET mainly controls exports. But importers are affected too, through catch-all provisions, End-User Certificate (EUC) obligations, the WMD Act 2005, and re-export restrictions. If you import dual-use raw materials and re-export finished products, SCOMET applies on your outbound shipment.

India recently added a new Category 7 to the SCOMET list in September 2025, covering semiconductors, quantum technologies, and cryogenic systems, effective October 23, 2025.

SCOMET Categories

The SCOMET list currently contains 9 categories (0–8):

Why SCOMET Matters for Importers

SCOMET is not just an exporter's problem. It affects importers directly:

Catch-All Provision (Para 10.05, FTP 2023)

Even if your imported item is NOT on the SCOMET list, if you know or have reason to believe it could be used for WMD, missiles, or military purposes, you're required to report it or seek authorization. This applies to importers too, not just exporters.

WMD Act, 2005

The Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act, 2005 makes it a criminal offence to deal in, including import items related to WMD without proper authorization. Penalties include imprisonment up to life and fines starting at ₹3 lakh, extendable to ₹20 lakh.

End-User Certificate (EUC) Obligation

If you're importing SCOMET items from abroad, your foreign supplier's government may require you to provide an End-User Certificate guaranteeing:

- Peaceful/civilian end-use only

- No diversion to unauthorized parties

- No re-transfer without consent of the originating government

This is mandatory when importing dual-use goods from countries like Germany, Japan, USA, South Korea, and most EU nations.

Re-Export Restrictions

If you import dual-use raw materials and re-export finished products, SCOMET export authorization may be required for the outbound shipment. You need to check both the import classification and the export classification of your product.

Importer: SCOMET is not just an exporter's problem. If you import chemicals, electronics, sensors, aerospace parts, or software from countries like Germany, Japan, USA, or South Korea, your supplier may require an EUC from you before shipping.

SCOMET Declaration: What It Is & When You Need It

A SCOMET Declaration is a self-declaration by the exporter (or their customs broker) filed alongside the shipping bill at customs. It confirms one of two things:

- The goods being exported do NOT fall under the SCOMET list, OR

- The exporter has a valid SCOMET license/authorization from DGFT

Mandatory for every export shipment from India.

Format: A simple declaration on company letterhead stating:

"We have gone through DGFT Notification and Appendix 3 and declare that the goods under shipment for export [description] do not fall under the SCOMET list of items under Appendix 3."

Signed by an authorized signatory and submitted to the Deputy/Assistant Commissioner of Customs.

If goods ARE on the SCOMET list: The declaration alone is not enough, you need a SCOMET export authorization/license from DGFT (applied via Form ANF 2N on the DGFT portal).

If you're an importer who also re-exports, you'll need to file SCOMET declarations on your export shipments. Many importers forget this when they process and re-export goods.

How to Check If Your Product Falls Under SCOMET

Step 1: Identify your product's exact technical specifications, not just the broad category. SCOMET classification is based on technical parameters (purity levels, frequencies, tolerances, power ratings), not just HS codes.

Step 2: Visit DGFT website > SCOMET section (dgft.gov.in) > Download the latest SCOMET list (updated September 2025, effective October 2025).

Step 3: Cross-check your product against all 9 categories (0–8) — pay special attention to sub-items and technical notes.

Step 4: If unsure, file a Commodity Classification Request with DGFT's SCOMET Cell for official clarification. The Inter-Ministerial Working Group (IMWG) reviews ambiguous cases.

Step 5: If your product IS listed > Apply for SCOMET export authorization before shipping (Form ANF 2N).

Step 6: If your product is NOT listed > File a standard SCOMET self-declaration with your shipping bill.

Don't rely on HS code alone. A chemical at 95% purity may be unrestricted, but the same chemical at 99% purity could be SCOMET-listed. Classification is technical, not just tariff-based.

Penalties for SCOMET Non-Compliance

The consequences are severe, and, even negligence (not just intentional violation) attracts penalties.

- Unauthorized export of SCOMET items: Goods seized, IEC suspended or cancelled, criminal prosecution under FTDR Act

- FTDR Act penalties: Fine of ₹10,000 to five times the value of goods exported. In a recent August 2025 case, DGFT imposed ₹50 lakh penalty on a company that self-disclosed unauthorized SCOMET exports worth ₹200+ crore

- WMD Act violations: Imprisonment from 6 months to 5 years (first offence), up to 7 years (repeat offence), plus fines starting at ₹3 lakh

- Catch-all violations: Export privileges revoked, company placed on Denied Entity List (DEL)

- Customs rejection: Shipments held at port, demurrage charges accumulate daily

- Reputational damage: Company flagged by DGFT, affecting all future IEC operations

FAQs

What is the full form of SCOMET?

SCOMET stands for Special Chemicals, Organisms, Materials, Equipment and Technologies. India's national control list of dual-use items regulated by DGFT.

Is SCOMET declaration mandatory for all exports from India?

A SCOMET self-declaration must be filed with the shipping bill for every export consignment, even if the goods are not listed under SCOMET.

Does SCOMET apply to importers?

SCOMET primarily controls exports, but importers are affected through the catch-all provision, WMD Act 2005, End-User Certificate obligations, and re-export restrictions on dual-use goods.

What is an End-User Certificate (EUC) in SCOMET?

An EUC is a guarantee from the Indian importer (or end-user) to the exporting country's government, certifying peaceful end-use, non-diversion, and no unauthorized re-transfer of dual-use items.

How many categories are in the SCOMET list?

Nine categories, Category 0 through Category 8. Category 7 was added in October 2025 covering emerging technologies.

What is SCOMET Category 7?

Added effective October 23, 2025, Category 7 covers advanced semiconductors, quantum technologies, cryogenic systems, and related software and know-how, divided into sub-categories 7A through 7E.

Dipankar Biswas

I am an international trade, Supply Chain & Logistics Management professional with more than 8 years of in-depth experience in the Industry. I also create youtube videos @Global Vyapar (200K+ Subscribers).