Free Trade Agreements for Importers: The Complete Guide to Cut Duties and Expand Sourcing

Save on import duties with India's FTAs. Complete guide: ROO compliance, tariff reduction, compliance mistakes, documentation explained.

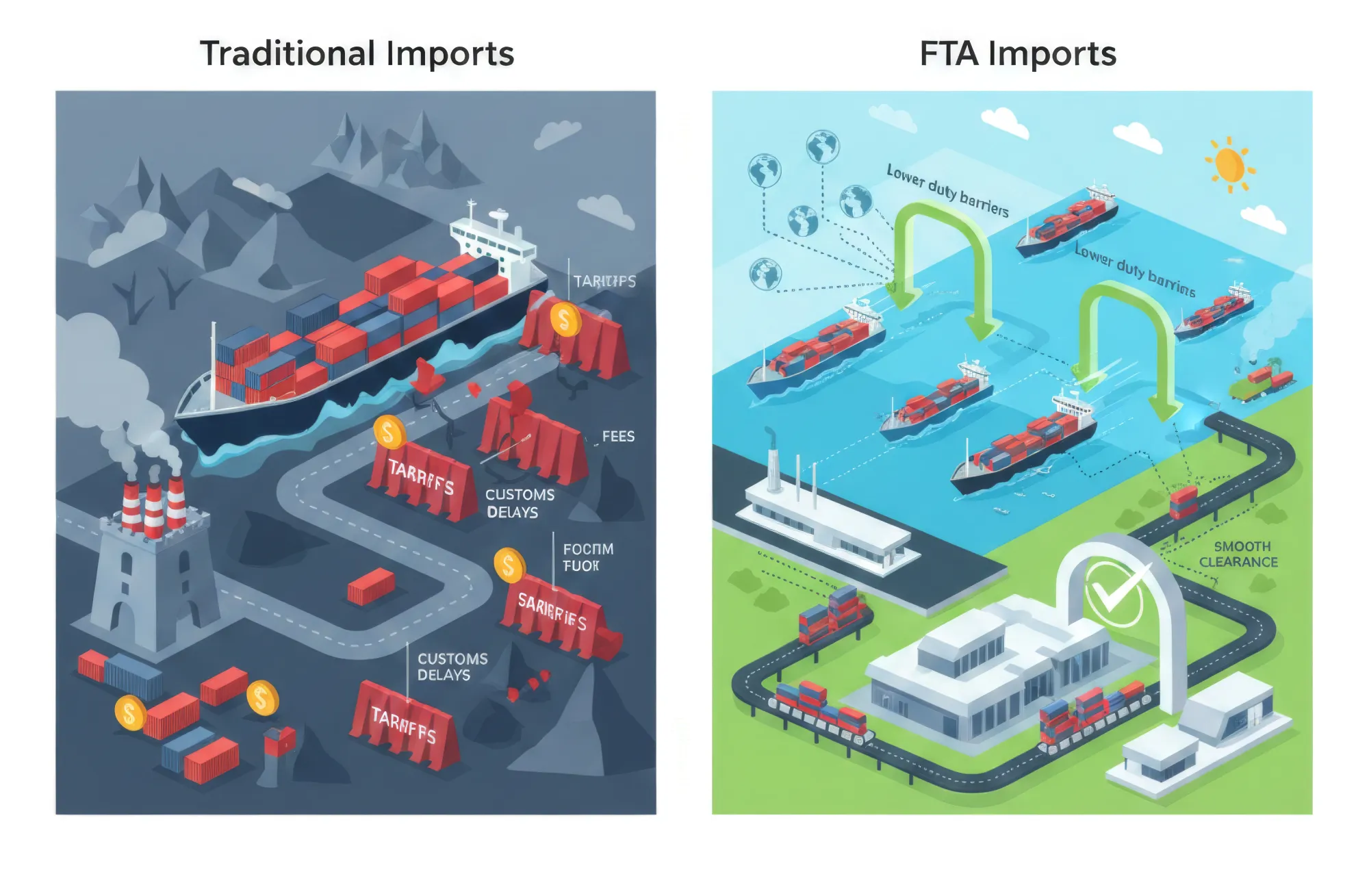

A Free Trade Agreement (FTA) is a formal arrangement between countries to reduce or eliminate customs duties and trade barriers. For importers like you, FTAs mean one thing, paying lower or zero duties on qualifying goods. The real question isn't what an FTA is it's how much you can save and which countries you should source from. This guide shows you exactly how.

What is a Free Trade Agreement?

An FTA is a legal treaty between two or more countries designed to facilitate cross-border trade by removing tariffs, reducing customs duties, and simplifying import procedures. Rather than paying the standard Most-Favored-Nation (MFN) rate—which can range from 5% to 15% depending on your product category—FTA members grant preferential treatment to each other's goods.

Think of it this way: when you import electronics from Vietnam under the ASEAN-India FTA, you might pay 0% duty instead of the typical 5-10% MFN rate. On a $1,000,000 shipment, that difference alone saves you $50,000 to $100,000.

India's Free Trade Agreements: Which Countries Can You Import From?

India has signed comprehensive trade agreements with multiple partners. Here's where you can source goods with preferential duties:

Recently Negotiated Agreements

As of February 2026, India is actively finalizing negotiations with:

- European Union: Near-final stage (11th round completed May 2025)

- United States: Consultation dialogue ongoing

- Canada, Israel, Peru, Chile: Under formal negotiation

- Gulf Cooperation Council (GCC): Framework agreement discussions

Free Trade Agreement Benefits: What's in It for Importers?

Benefit #1: Customs Duty Savings

This is the headline benefit. FTA tariff rates range from 0% to significantly reduced rates compared to MFN duties. Multiply this across your product categories, and FTA savings become a strategic advantage.

Benefit #2: Alternative Sourcing Flexibility

FTAs open your sourcing horizon. Instead of buying exclusively from one country due to cost, you can now diversify suppliers across multiple regions. This reduces your supply chain risk and improves negotiating power with vendors.

Benefit #3: Landed Cost Optimization

Your landed cost is not just the product price, it's the total delivered cost including duties, GST, freight, and insurance.

Landed Cost = Product Cost (CIF) + Duty + GST/VAT + Freight + Insurance + Handling

Benefit #4: Faster Customs Clearance

FTA shipments with proper documentation clear customs faster because:

- Standardized documentation reduces back-and-forth queries

- Digitized Certificate of Origin (COO) system speeds verification

- Customs recognizes FTA compliance patterns, reducing inspection rates

FTA Certificate of Origin & Proof of Origin Requirements

India's customs rules updated on March 18, 2025, replacing "Certificate of Origin" language with "Proof of Origin" across all FTA-related regulations. This change:

- Broadens accepted documentation beyond just Form D

- Increases verification scrutiny to prevent fraudulent FTA claims

- Creates ambiguity for importers unfamiliar with the new framework

What Is Proof of Origin?

Proof of Origin is now the umbrella term covering:

- Form D (Traditional COO)

- Issued by authorized agencies in exporting country

- Example: Export Inspection Council (EIC) in India, similar agencies in Vietnam, Japan, etc.

- Format: Standardized across FTAs

- Supplier Declaration

- Exporter's written statement certifying origin

- Used for shipments under $2,500 or specific product categories

- Must include product description, HS code, FOB value, origin details

- Combined Documentation

- Invoice + packing list + cost sheet collectively proving origin

- Increasingly accepted under new framework

- Requires detailed value addition breakdown

Rules of Origin & FTA Compliance for Importers

Rules of Origin are the criteria that determine whether your imported goods genuinely originate in the FTA partner country or whether they're just transshipped goods from non-partner countries repackaged for FTA benefits.

Without ROO, countries would exploit FTAs: importing goods from anywhere globally, briefly processing them in an FTA country, then claiming FTA origin. ROO prevent this.

Why ROO Compliance Matters

Between 2019-2023, over 1,000 Indian importers misused ASEAN FTA benefits on copper imports. Customs issued show-cause notices demanding:

- Duty differential (difference between 0% FTA rate and applicable MFN rate)

- Interest (calculated from original import date)

- Penalties (up to 25% of duty differential in some cases)

- Total liability: Often ₹1-2 crore per importer

Goods didn't meet ROO criteria, they originated from China or other non-ASEAN countries, not Vietnam as claimed.

DVA Calculation: How to Verify ROO Compliance

Domestic Value Addition Formula:

DVA % = [(FOB Value of Finished Good - Cost of Non-Originating Materials) / FOB Value of Finished Good] × 100

Real example:

If DVA comes to 32%, you fail to meet 35% requirement and lose FTA benefits.

Cumulation Advantage in ASEAN

Here's a critical concept that many importers don't leverage: regional cumulation.

Under ASEAN-India FTA, when calculating value addition, inputs from ANY ASEAN member (Vietnam, Indonesia, Thailand, Malaysia, Singapore, etc.) count as originating material.

For Example - You import plastic components from Vietnam that use resin from Indonesia. Under regional cumulation:

- Vietnam's manufacturing = 25% value addition

- Indonesia's resin production = 15% value addition

- Total counted = 40% (passes 35% DVA requirement)

Without cumulation, you'd only count Vietnam's 25% and fail ROO. This is why sourcing strategy matters under FTAs.

How FTA Tariffs Work

Every product falls under an 8-digit Harmonized System (HS) code. For each HS code, there are different duty rates:

- MFN (Most-Favored-Nation) Rate: Applied to countries without FTA

- FTA Preferential Rate: Lower or zero duty for FTA partners

- Applied Rate: The actual duty you pay

Example across different products:

Common FTA Compliance Mistakes

Mistake #1: Not Verifying Authenticity of Certificate of Origin

Mistake #2: Insufficient Documentation of Value Addition

Mistake #3: Ignoring Third-Country Routing Risks

Mistake #4: Not Maintaining Records for 5+ Years

Mistake #5: Assuming All Goods Automatically Qualify for FTA

FAQ: Questions Importers Ask About FTAs

How Much Can I Realistically Save With FTAs?

5-15% of your total import cost, depending on product category and current duty rates.

What Happens If Customs Rejects My FTA Claim?

You pay full MFN duty + GST immediately; you can appeal and recover if customs was wrong.

Can I Import Without FTA Benefits and Claim Them Later?

No. Duty is locked in at clearance. You can appeal, but recovery is difficult.

How Do I Know If My Product Qualifies for FTA Under Rules of Origin?

How Do I Know If My Product Qualifies for FTA Under Rules of Origin?

What Penalties Apply If I Misuse FTA Benefits?

Severe. Expect duty recovery (from original import date) + 24% annual interest + 25-100% penalty.

Dipankar Biswas

I am an international trade, Supply Chain & Logistics Management professional with more than 8 years of in-depth experience in the Industry. I also create youtube videos @Global Vyapar (200K+ Subscribers).