How Does Cross-Border Payment Work?

Understand how cross-border payments work, from initiation to settlement. Learn about methods, regulations, fees, exchange rates, and benefits for global businesses

An increasingly globalized economy created an encouraging situation for cross-border payments. It has enabled businesses to buy and sell goods and services across borders, thus encouraging trade and commerce. However, making cross-border payments is quite complicated, and it involves a number of steps, regulations, and financial institutions. It takes it upon itself to unravel how cross-border payments work, the methods available, and the factors that influence these transactions.

Understanding Cross-Border Payments

Cross-border payments refer to financial transactions that cut across borders to foreign countries; thus, it could be either a B2B transaction or a consumer who purchases goods and products from any other country's online stores or even direct transfers by an individual to his relatives who are residents in another country. Such payments are complex because currency, banking, regulations, and even the method of payment are all different in any given country.

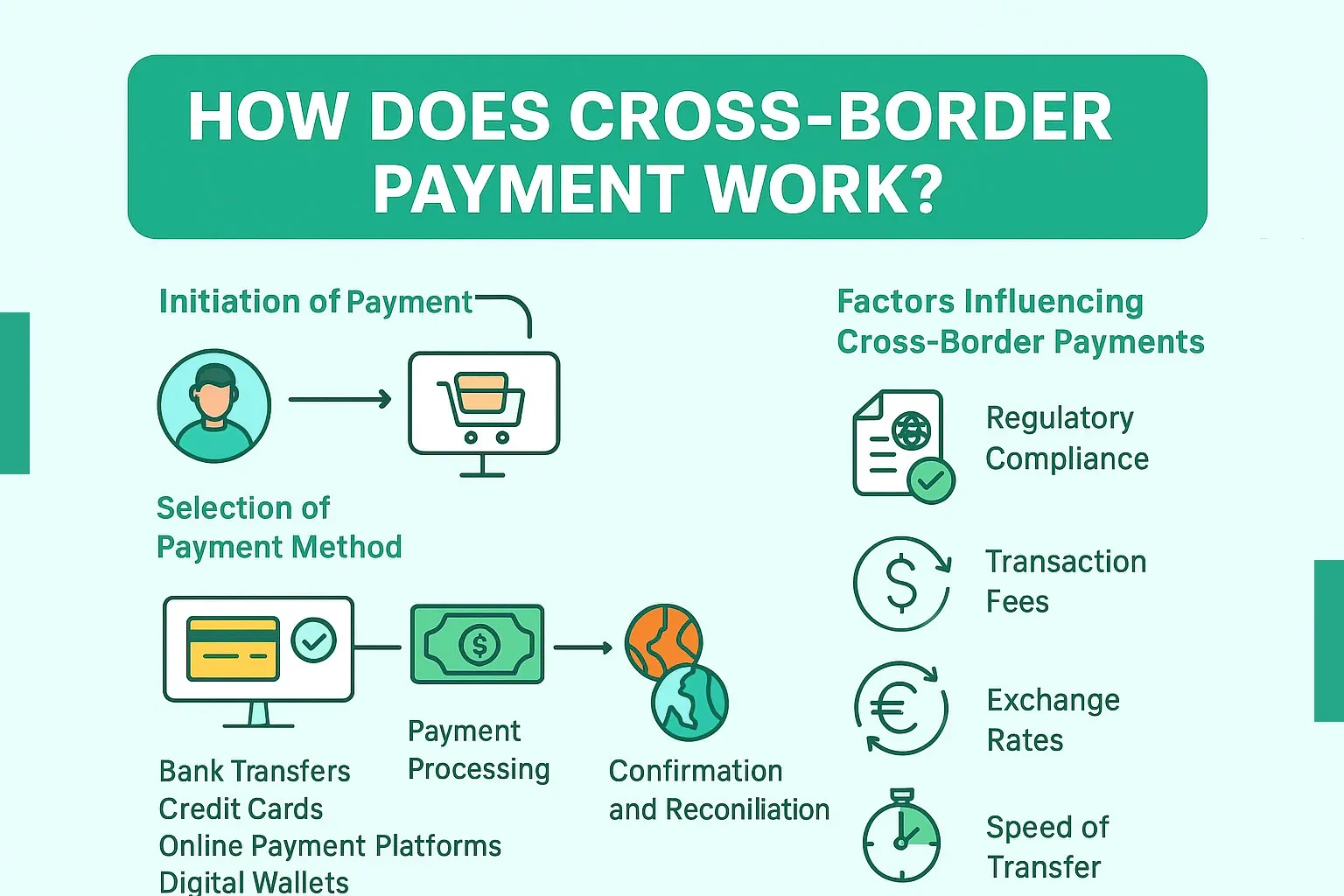

The Steps Involved in Cross-Border Payments

Initiation of Payment

In the case of the process, a purchasing decision would start on the part of the buyer, who may buy or acquire the goods and services to be obtained from another seller country. Under normal circumstances, they would have to negotiate terms of payment as well as the total amount in the currency, method of payment, etc.

Selection of Payment Method

There are several methods available for making cross-border payments, including:

- Bank Transfers: Traditional wire transfers or Automated Clearing House (ACH) payments.

- Credit Cards: Highly used by customers for purchasing but attract high charges to the businesses.

- Online Payment Platforms: PayPal, Stripe, and so on, are services that make cross-border transactions easier.

- Digital Wallets: This comprises saving money and making transactions easily using money stored in a digital wallet.

- Letters of Credit: A financial instrument wherein the bank promises to pay the seller after meeting the next given conditions.

Gathering Required Information

To initiate a cross-border payment, the sender must gather essential information about the recipient. This includes:

- Bank account details (such as IBAN or SWIFT codes)

- Currency of the transaction

- Any regulatory requirements specific to the countries involved

Payment Processing

With all of this information aligned, the sender then proceeds to request payment using the method that the sender has chosen. For example, if the sender chooses to use a bank transfer, then their bank will then withdraw it from their account. The bank then initiates this transfer through either correspondent banks or a network such as SWIFT (Society for Worldwide Interbank Financial Telecommunication).

Currency Conversion

Conversions are involved for a different currency. There are no fixed exchange rates, meaning they will keep changing. So, it would be best to check the prevailing exchange rates ahead of the transfer so you take home the best deal for your money.

Settlement

After settling the payment, if the banks were involved in the transaction, they cleared the funds between them. This will take, though, a number of days since intermediary banks have to undertake their compliance checks and other regulatory requirements. The recipient's bank will credit his account after they have received the funds.

Confirmation and Reconciliation

Both parties receive confirmation of the transaction once it is completed. The sender may need to reconcile their accounts to ensure that all payments have been processed accurately.

Factors Influencing Cross-Border Payments

Several factors can affect how cross-border payments work:

- Regulatory Compliance: Money transfer regulations differ country-wise with respect to anti-money laundering, know your customer, and other applicable legal provisions. Thus, an entity has to be highly compliant with the country's regulatory requirements to avoid legal hassle and maintain smooth flow.

- Transaction Fees: Cross-border payments also attract higher charges than domestic transactions since they require additional processes and costs for the exchange of currency. It is essential to compare and contrast fees across different types of payments and service providers to minimize fees.

- Exchange Rates: Depending on the exchange rate used in converting from one currency to another, there will be slight differences in every transaction that might not be negligible for a business in general. The business should pay close attention to changes in exchange rates and attempt to hedge against fluctuations by using various hedging strategies to overcome currency risk.

- Speed of Transfer: Once again, that depends on the method chosen: from a few hours to several days. In preparing for this type of transfer, businesses must align their cash flow accordingly as part of the planning process.

Benefits of Cross-Border Payments

Despite their complexities, cross-border payments offer numerous benefits:

- Market Expansion: Expand into markets and cross borders to reach new markets worldwide. Businesses expand through international transactions by opening up international markets to them.

- Increased Sales Opportunities: Foreign access allows firms to enter the diversified revenue stream and diversify from sales made domestically.

- Competitive Advantage: Companies that may manage cross-border payments efficiently shall have a competitive advantage over competitors that face significant challenges in managing international transactions.

Final Thoughts

To be able to compete within an ever-growing marketplace across borders, there is a need to be knowledgeable about how cross-border payments are made. This can be done by gaining knowledge of various types of payment methods, knowledge of those involved, and much more, and then taking into account considerations such as regulatory compliance and transaction fees. As you navigate through cross-border complexities, it is important to note that such payment management not only smooths up the operations but also contributes positively to the growth potential of your business in an ever more interconnected world.