What is Section 80C, and How can Tax Deduction Under Section 80C be claimed?

Maximize your tax savings! Complete guide to Section 80C deductions - eligible investments, claim process, and smart strategies for FY 2024-25.

Anyone looking to do proper tax planning in India must know about section 80C of the Income Tax Act. At EximPe, we recognize that optimizing your finances matters a lot—especially for trading businesses that want to make the most of every rupee. I’ve put together a detailed guide on section 80C, its rewards and how to use it this assessment year.

What is Section 80C of the Income Tax Act?

This section of the Income Tax Act lets people and HUFs reduce their tax burden by directing their investments and expenses into the mentioned options. You can deduct up to ₹1.5 lakh under 80C in a financial year, which may greatly cut your taxes.

Eligible Investments and Expenses Under Section 80C

To claim a deduction under section 80C, you can invest in or spend on a variety of instruments and expenses, including:

- Life insurance premiums (for self, spouse, or children)

- Public Provident Fund (PPF)

- Employees’ Provident Fund (EPF)

- Equity Linked Savings Scheme (ELSS)

- National Savings Certificate (NSC)

- 5-year tax-saving fixed deposits with banks or post offices

- Sukanya Samriddhi Yojana (SSY)

- Tuition fees for up to two children

- Principal repayment of a home loan

- Senior Citizens Savings Scheme (SCSS)

- Unit Linked Insurance Plans (ULIPs)

Each of these investments or expenses has its lock-in period and specific conditions, so it’s important to plan according to your financial goals.

Who Can Claim 80C Deduction?

- Only individuals and HUFs are eligible for Section 80C benefits.

- Companies, partnership firms, and LLPs cannot claim deductions under section 80C.

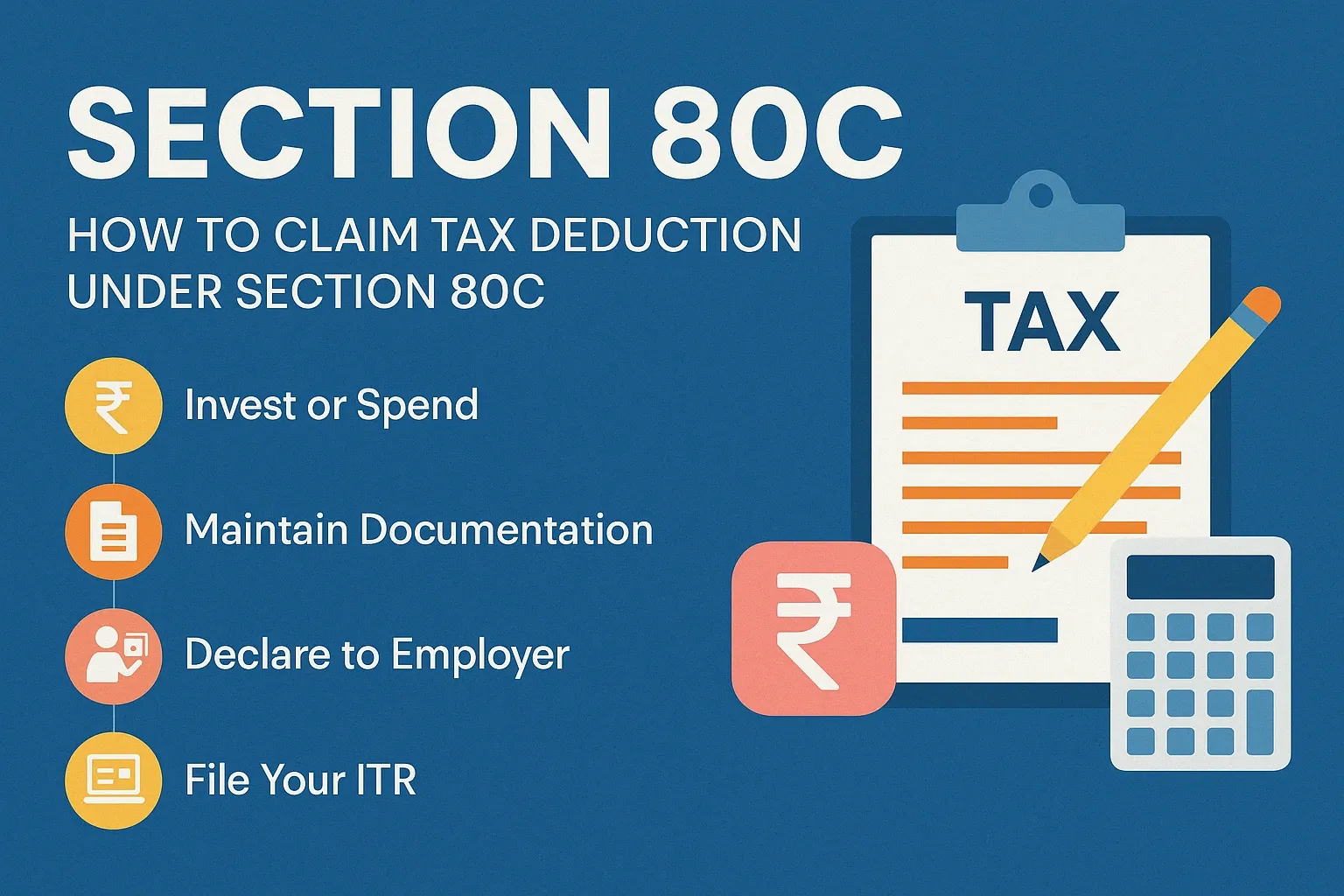

How to Claim Tax Deduction Under Section 80C

Claiming your 80C deduction is straightforward if you follow these steps:

- Invest or Spend: Make investments you are allowed to make payments during the financial year (April 1 to March 31). Always keep copies of your investments, receipts and certificates as proof.

- Maintain Documentation: Always keep copies of your investments, receipts and certificates as proof.

- Declare to Employer: If you are a salaried employee, submit proof to your employer to ensure the correct TDS deduction.

- File Your ITR: While filing your Income Tax Return, declare your section 80C investments under the appropriate section. The deduction is subtracted from your gross total income to arrive at your net taxable income.

- Check the Regime: Be aware that 80C deductions can be taken only in the old tax regime. When you go with the new plan, main deductions like section 80C are largely removed (except for a few special cases).

Maximizing Your 80C Deduction

To make the most of section 80C of the Income Tax Act:

- Make your investments early in the year to take advantage of compounding results.

- Use different tools that qualify for the FTC to improve both your profits and your way of managing risk.

- Review what you own in your investments each year to match your updated aims and regulations.

Conclusion

Taking advantage of section 80C is an easy way to cut your taxes and plan your future finances. We urge all our clients, especially those involved in export-import, to consider tax planning when making broader financial decisions. When you don’t have to pay extra tax, you have one more rupee to put towards your business growth. If there is anything about section 80C or global payment and compliance you find confusing, let EximPe assist you.

FAQs

- Who can claim tax deductions under Section 80C?

Only individuals and Hindu Undivided Families (HUFs) are eligible to claim deductions under Section 80C. Companies, partnership firms, and LLPs cannot claim this benefit.

- What is the maximum deduction limit under Section 80C?

You can claim a maximum deduction of ₹1.5 lakh in a financial year under Section 80C.

- Can I claim 80C deductions if I choose the new tax regime?

No, Section 80C deductions are available only under the old tax regime. The new tax regime does not allow most common deductions, including 80C, except for a few specific cases.

- What types of investments qualify for Section 80C deductions?

Eligible investments include life insurance premiums, PPF, EPF, ELSS, NSC, 5-year tax-saving FDs, Sukanya Samriddhi Yojana, tuition fees, principal repayment of a home loan, SCSS, and ULIPs.

- How do I claim Section 80C deductions as a salaried employee?

Submit proof of your eligible investments and expenses to your employer for correct TDS deduction, and declare them while filing your Income Tax Return under the appropriate section.