How SWIFT Codes Are Used in India's Banking System

Learn how SWIFT codes work in India's banking system. Find codes for HDFC, SBI, ICICI & more. Make secure global payments faster with EximPe's Guide.

In the new global economy, international payments are the fuel for cross-border trade and investment. The SWIFT Code or SWIFT Bank Code are the same and are used to transfer and receive funds from one bank to another bank and from one country to another country. A digital-first payments platform, EximPe leverages the SWIFT network to offer Indian exporters and importers fast, compliant, and frictionless global transactions.

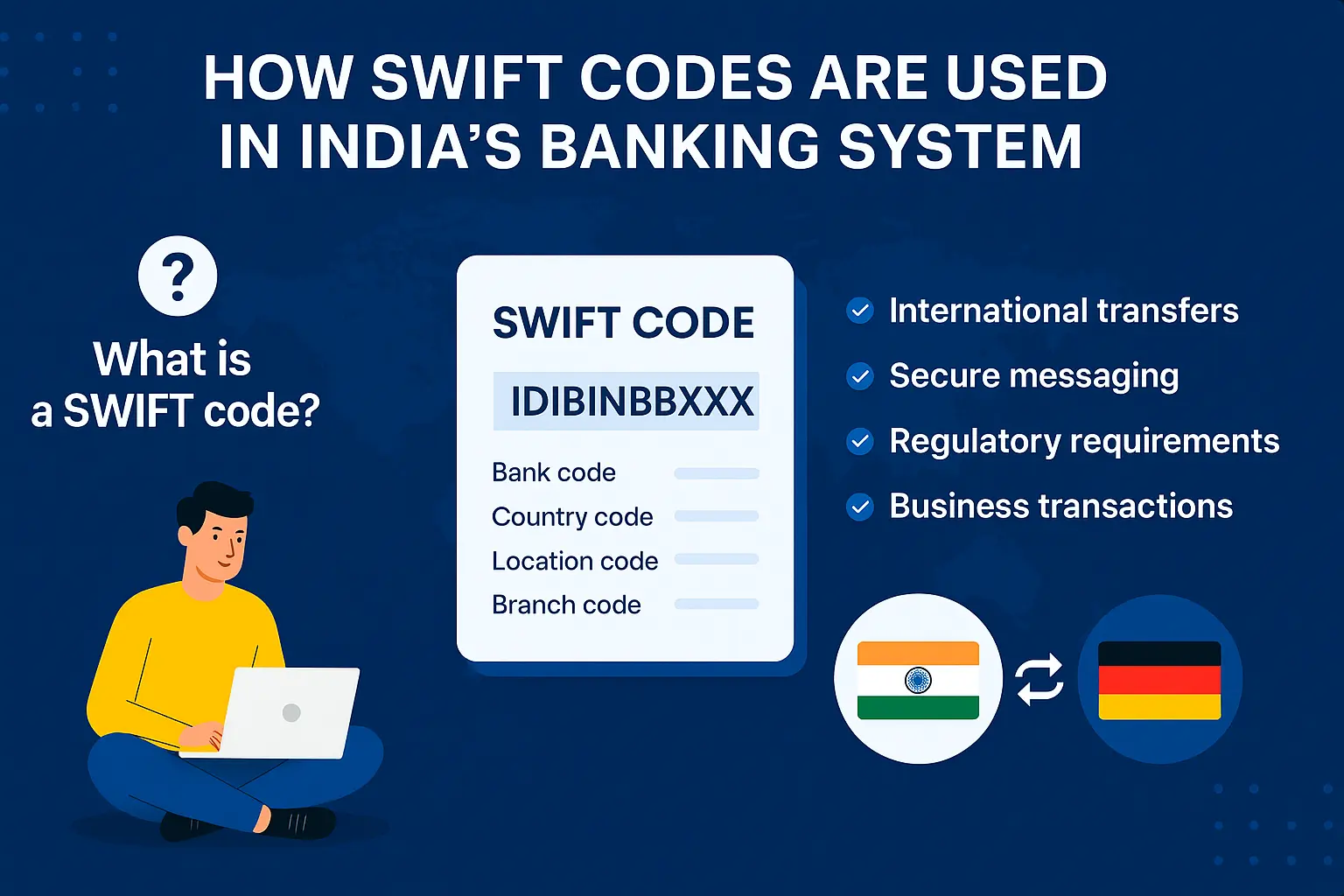

What Is a SWIFT Code?

You can regard this as the 'postal code' for banks; it sends your money to the right financial institution, regardless of where in the world that institution happens to be. In India, a SWIFT code consists of 8 to 11 characters, formatted as follows:

- First 4 characters: Bank code

- Next 2 characters: Country code (for India – IN)

- Next 2 characters: Service code

- Last 3 Characters (OPTIONAL): Branch code

For example, the Indian Bank's SWIFT code is IDIBINBBXXX, where 'IDIB' stands for the bank, 'IN' is for India, 'BB' identifies the location, and 'XXX' signifies the branch.

Why Are SWIFT Codes Important in India's Banking System?

The function of the SWIFT code in India is as follows:

- International Wire Transfers: It helps Indian banks to transfer funds to any bank in the world quickly and securely.

- Secure Messaging: The bank exchanges secure messages such as payment instructions and compliance-related information using the SWIFT code.

- Regulatory requirements: They assist Indian banks in meeting AML standards and global regulatory guidelines.

- Business Transactions: Indian exporters and importers use SWIFT codes to make and receive payments for goods and services from other countries.

How to Find the SWIFT Code of an Indian Bank

You can find the SWIFT code for your Indian bank by:

- Check your bank's official website or account statements.

- Using your EximPe dashboard, where your SWIFT code and IBAN details are displayed after account setup for easy sharing with international clients.

- Contact your bank branch directly.

How SWIFT Codes Work in Practice

Say an Indian company needs to pay a supplier in Germany—the business punches in the German bank's SWIFT code and other details on EximPe's platform. An EximPe partner bank then dispatches a secure message through the SWIFT network, queuing the payment to the right overseas bank and account. The German bank confirms the SWIFT code, sends the money, and the money arrives quickly and safely.

SWIFT Code vs. IFSC Code

Although both codes serve as identifiers for banks, the IFSC code is exclusively for domestic transfers within India, such as NEFT, RTGS, and IMPS. By contrast, the SWIFT code is for international fund transfers and global interbank communication.

Why Choose EximPe for International Payments?

At EximPe, we have developed our payment system on the SWIFT network to make sure:

- "Fast, trusted, and transparent cross-border payments."

- Real-time monitoring and verification

- There are no hidden banking fees and competitive FX rates.

With EximPe, Indian companies now find it easy to venture into global markets as they are able to verify their transactions with the help of widely-accepted SWIFT codes.

Conclusion

For any business or person in India involved in cross-border payments, truly understanding the SWIFT code and how to use it is essential. With platforms like EximPe, though, using the SWIFT bank code has become something of a walk in the park, allowing Indian companies to expand their horizons and do safe, secure, and—most importantly—compliant business all over the world.

FAQs

What is a SWIFT code, and why do I need it for international payments?

A SWIFT code is a unique identifier for banks worldwide, essential for sending or receiving international payments securely and ensuring funds reach the correct bank and branch.

How can I find the SWIFT code for my Indian bank using EximPe?

You can view your bank’s SWIFT code and IBAN details directly on your EximPe dashboard after account setup or check your bank’s official website or statements.

Are SWIFT codes used for domestic transfers within India?

No, SWIFT codes are only for international transactions. Domestic transfers within India use IFSC codes instead.

What happens if I use the wrong SWIFT code for a transaction?

Using the wrong SWIFT code may delay your payment, cause it to be returned, or even send funds to the wrong destination, so always verify the code before sending money.

How does EximPe make international payments easier for Indian businesses?

EximPe leverages the SWIFT network for fast, secure, and transparent cross-border payments, with real-time monitoring and competitive FX rates, helping Indian businesses expand globally with confidence.