List of Major Banks and Their SWIFT Codes in India

Complete list of Indian bank SWIFT codes including HDFC, SBI, ICICI, Axis, and Bank of Baroda. Ensure accuracy in cross-border payments and wire transfers.

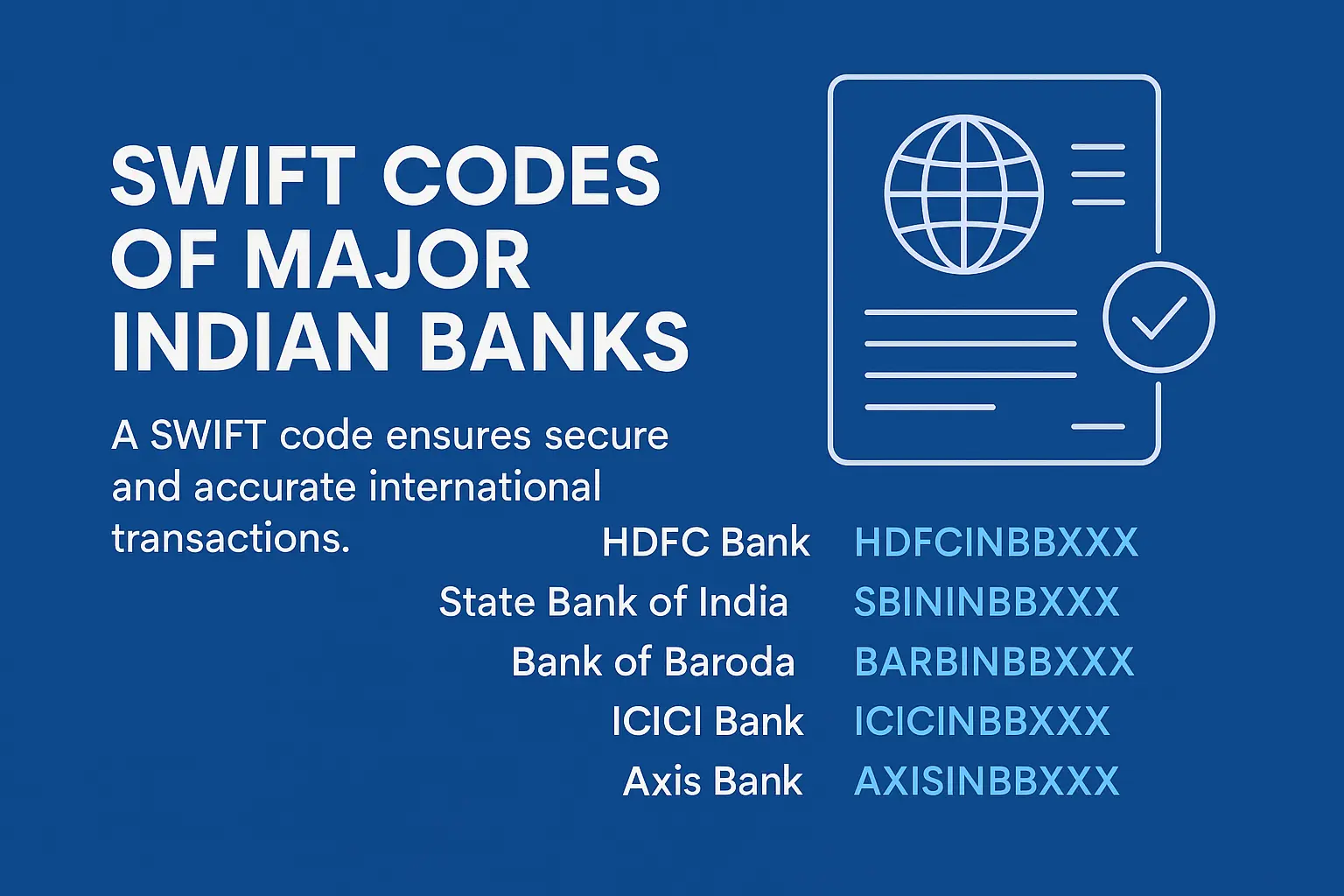

Having the exact SWIFT code is very important for people dealing with international trade and even individuals making international money transfers. Accurate international transactions depend on information accuracy. At EximPe, we have compiled a detailed guide that includes the SWIFT codes of major Indian banks like HDFC Bank, State Bank of India, Bank of Baroda, ICICI Bank and Axis Bank.

What is a SWIFT Code?

Each of the banks owns a unique SWIFT code, and each bank branch will also possess a SWIFT code. This facilitates safe and swift cross-border transactions between major banks. Each bank (and most of its branches) will possess a unique SWIFT Code. This guarantees that funds sent from a bank will reach their intended destination both swiftly and safely. For individuals engaged in cross-border capital importing, exporting, or moving capital over borders, the correct SWIFT Code is critical. They can easily avoid transaction delays and increase the safety of the transfer. SWIFT Codes are important for cross-border financial operations because the right code has to be known and used to enable delay and disruption-free financial operations nationally and internationally.

Major Indian Banks and Their SWIFT Codes

HDFC Bank SWIFT Code

The general HDFC Bank SWIFT code is HDFCINBBXXX, though each HDFC branch might have its respective codes based on its location and services offered. For instance, the Mumbai branch uses HDFCINBBXXX, whereas the branches in Bangalore and Delhi use HDFCINBBBNG and HDFCINBBDEL, respectively. Always check with your local branch for the HDFC Bank SWIFT code prior to any international wire transfer.

State Bank of India SWIFT Code

SBI's primary SWIFT code is SBININBBXXX, and, like the other major banks, SBI tends to have branch-specific SWIFT codes. For verification, it is advisable to check with your branch or the recipient for the most accurate code.

Bank of Baroda SWIFT Code

Bank of Baroda's primary SWIFT code is BARBINBBXXX. Remember that different branches and types of commerce may use different numbers, so verify with the bank or intended recipient.

ICICI Bank SWIFT Code

ICICI Bank's SWIFT code is ICICINBBXXX. This code is well-known for international wire transfers and commercial transactions. Check with your bank to see if there are branch-specific codes because, as with other banks, they might exist.

Axis Bank SWIFT Code

Axis Bank's primary SWIFT code used for international transactions is AXISINBBXXX. For seamless integration, check whether your branch employs a different number for other services, especially non-standard ones.

Why Are SWIFT Codes Important?

- Accuracy: Ensures your funds are routed to the correct bank and branch.

- Security: Enables secure international money transfers.

- Speed: Facilitates faster processing of cross-border payments.

Final Tips from Eximpe

- Always use the correct SWIFT code for your bank and branch to avoid delays or failed transactions.

- For large transactions or business payments, confirm the SWIFT code with your bank before sending.

- Keep this list handy for quick reference, and reach out to Eximpe for more guidance on international trade and payments.

By staying informed about SWIFT, whether it's the HDFC Bank SWIFT code, State Bank of India SWIFT code, Bank of Baroda SWIFT code, ICICI Bank SWIFT code, or Axis Bank SWIFT code-you ensure smooth and secure global transactions for your business.

FAQs

What is a SWIFT code, and why do I need it for international transfers?

A SWIFT code is a unique identifier for banks used in international transactions to ensure your funds reach the correct bank and branch securely and quickly.

Are SWIFT codes the same for all branches of a bank?

No, while some banks have a general SWIFT code for their head office, many branches have their own specific SWIFT codes. Always confirm with your branch before making a transfer.

Where can I find the SWIFT code for my Indian bank branch?

You can find your branch’s SWIFT code by contacting your bank directly, checking your bank statement, or visiting the official bank website.

What happens if I use the wrong SWIFT code for a transfer?

Using an incorrect SWIFT code can lead to delays, failed transactions, or funds being sent to the wrong bank or branch.

Do all Indian banks support international wire transfers via SWIFT?

Most major Indian banks support SWIFT for international transfers, but it’s best to check with your bank or Eximpe for confirmation and guidance.