What is an HSN Code? Beginner’s Guide for Indian Importers & Exporters (2026)

Complete HSN code guide for import-export: What is HSN, how to find correct code, HSN Vs SAC, India’s context and FAQs

HSN code is a six-digit international standardized system used to classify and identify internationally traded goods for customs purposes. The acronym stands for "Harmonized System of Nomenclature." In India, it's called the HSN code or ITC-HS code when extended to eight digits. These codes determine your import duties, taxes, export benefits, and whether your shipment faces customs delays at the port.

For importers, a single digit error in the HSN code can mean the difference between paying 5% customs duty and 25% customs duty on the same product. For exporters, using the wrong code can disqualify you from export incentives like DRAWBACK or RODTEP benefits worth lakhs of rupees. This is why understanding HSN codes thoroughly is critical for anyone involved in cross-border trade.

What is an HS Code?

The system is called "Harmonized" because every country in the world uses the same first six digits to classify products. This creates harmony in international trade. An importer in India, Germany, Brazil, or Japan can all reference the same base code for the same product. This uniformity prevents confusion, prevents disputes, and makes trade smoother across borders.

It was introduced by World Customs Organization (WCO), an independent organization based in Brussels, in 1988. Before that, each country had its own classification system, and international trade was far more complicated and prone to disputes.

The Six-Digit International Base Code

The international HS code consists of six digits + two country specific digits, divided into four pairs. Each pair has a specific meaning:

HSN CODE: 8 5 1 7 1 2 0 0

In India HS Code is a 8-digit System

In India, the system is known as ITC-HS (Indian Trade Classification based on Harmonized System). It consists of 8 digits:

- First 6 digits: International HS Code

- Last 2 digits: Indian subclassification

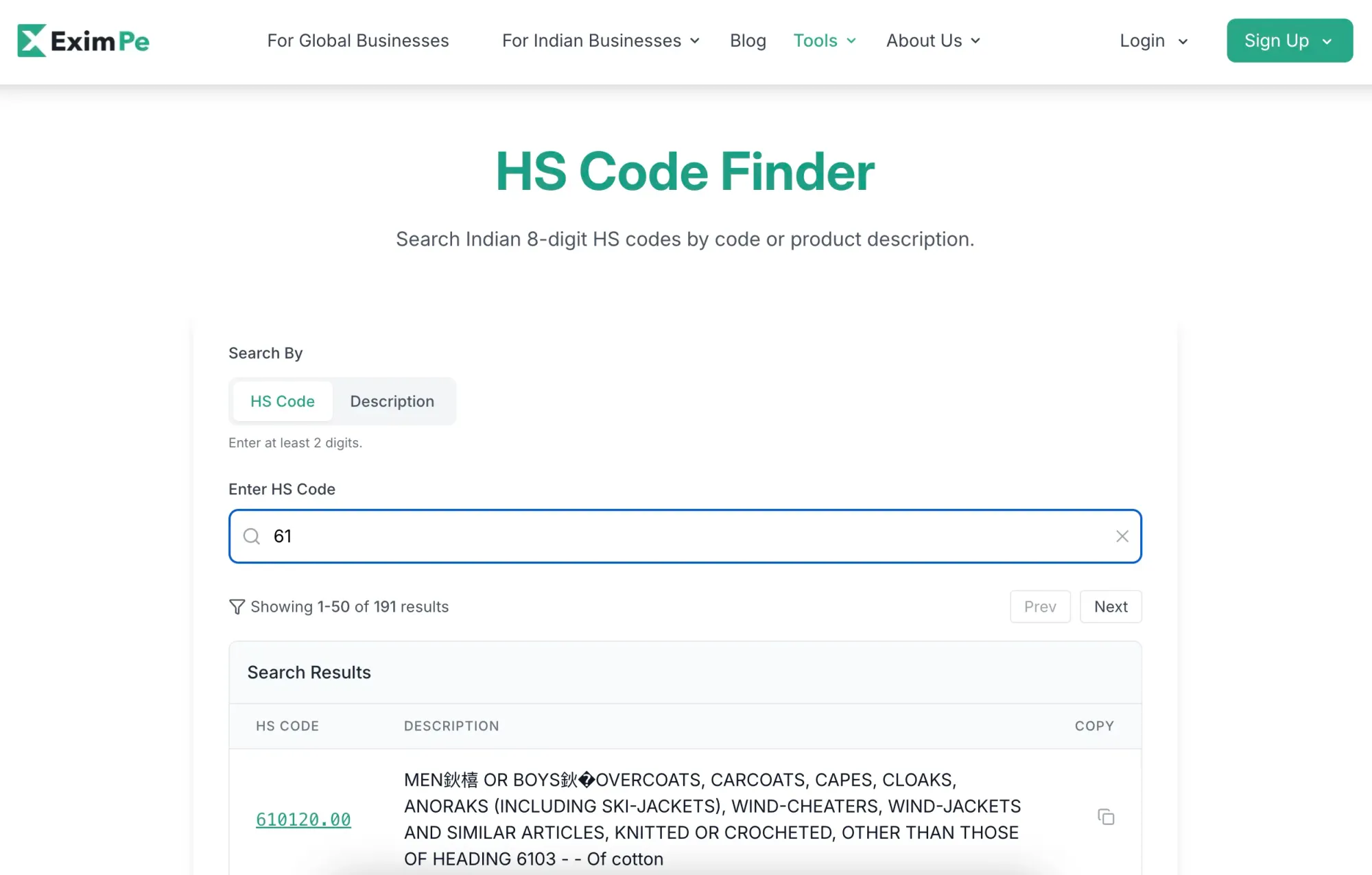

You can easily search and find Indian 8-digit HS codes using EximPe’s HS Code Finder Tool to simplify customs documentation and compliance.

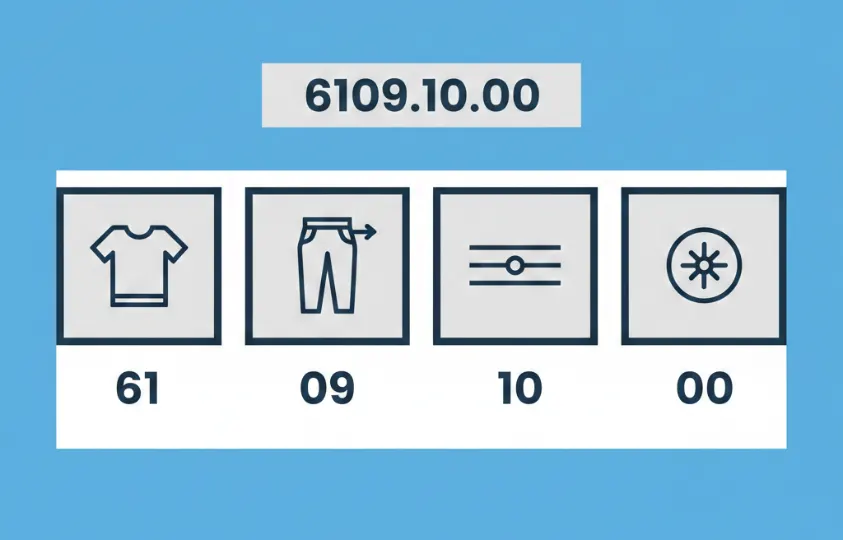

Example of an HS Code:

Let’s take HS code 6109.10.00 for example:

- 61 – Articles of apparel and clothing accessories, knitted or crocheted

- 09 – T-shirts, singlets and other vests

- 10 – Of cotton

- 00 – Country-specific breakdown (used in India, the U.S., etc.)

Organized by Complexity

The HS system is organized by the degree of manufacturing complexity.

Natural commodities and raw materials appear in the early sections. As you progress through the sections, products become increasingly processed and complex.

Why are HS Codes Important?

1. Customs Compliance

When officials look at HS codes, they can figure out the nature of goods. If the HS codes are wrong, this may lead to delays, being charged, or having the goods taken away.

2. Calculating your Duties and Taxes

The classification of a product will determine how much its duty will be. Proper coding guarantees the correct tariffs are chose.

3. The analysis and statistics of global trade

States and trade-related bodies rely on HS codes to oversee trade, see how goods are moved, and plan their trade activities.

4. The process of Documentation and Logistics

Companies insert HS codes on important trade documents, such as the commercial invoice, the shipping bill, and the Bill of Entry.

How to Find the Correct HS Code for Your Product

These are the steps you can take to find the correct HS code.

1. Make use of a legally certified HS Code search tool.

EximPe's HS Code Finder Tool provides easy ways to search for products using select keywords or descriptions.

2. Use Official Government Resources for HSN Classification

- Indian Tariff Portal (indiantradeportal.in)

- DGFT Portal (dgft.gov.in)

- CBIC Website (cbic.gov.in)

3. Get in touch with Your Customs Broker or Freight Forwarder

They have knowledge that allows them to organize goods accurately and move through customs steps properly.

What is HS Code in Import and Export?

In both imports and exports, HS codes:

- Determine duties and taxes

- Are mandatory on shipping invoices

- Guide import/export restrictions

- Help with accurate product classification

For example:

- Importers must declare the HS code to Indian Customs while filing the Bill of Entry.

- Exporters must include it on shipping documents while filing the Shipping Bill.

HSN Code vs SAC Code

A lot of people confuse HSN with SAC code, and they're actually very different.

SAC = Service Accounting Code — A 6-digit code used to classify services under India's GST system.

SAC codes are for services; HSN codes are for goods.

Conclusion

Everyone involved in international trade, including importers, exporters, and logistics people, needs to grasp what HS codes do. The HS code forms the backbone of documentation needed for the global trading system.

With the use of EximPe, you do not need much time to accurately categorize goods and reduce costs. Get started now in making your trade operations less complicated.

FAQs: HS Code & Its Uses in Trade

What is the meaning of HS Code?

HS Code means Harmonized System Code, developed by WCO to create a universal system of naming and coding traded products.

Where can I find the HS code list for Indian products?

You can access the Indian HS code list through CBIC, DGFT, or tools like EximPe’s HS code search.

Are HS codes different in every country?

The first 6 digits are standard globally. However, countries like India add extra digits (up to 8 or 10) for national classification.

HSN vs SAC Code – Which One Do I Use?

Use HSN Code if: You sell physical goods (clothes, phones, food, furniture, etc.)

Use SAC Code if: You provide services (consulting, restaurant, freight, rent, etc.)