What is a Bill of Lading? Meaning, Example, and Importance in Shipping

Understand what a Bill of Lading (B/L) is in shipping. Learn its meaning, format, types, examples, and importance in international trade with this complete guide

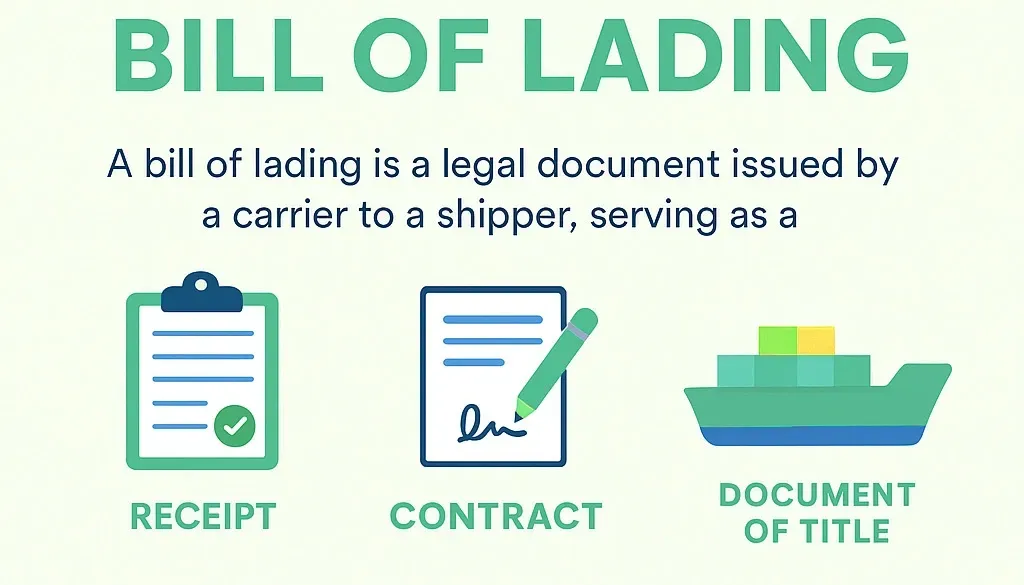

When goods are shipped from one country to another, proper documentation is critical. Among all export-import documents, the Bill of Lading (B/L) stands out as one of the most important. It acts as a contract, a receipt, and a document of title between the exporter, importer, and shipping carrier.

In this blog, we’ll explain what a Bill of Lading is, how it works, its types, and why it plays such a key role in global trade.

What is a Bill of Lading?

A Bill of Lading (B/L) is a legal shipping document issued by a carrier (shipping line, airline, or transporter) to the shipper of goods. It serves as:

- Proof of receipt – confirming goods were received in good condition.

- Contract of carriage – outlining the terms of shipment.

- Document of title – allowing the transfer of ownership of goods while in transit.

In simple terms: A Bill of Lading is like a “shipping passport” for goods — it travels with them until they reach the final buyer.

Bill of Lading in Shipping Terms

In international trade, the Bill of Lading meaning is tied to the trust and security it provides between exporters, importers, and shipping companies.

Without this document:

- The exporter cannot prove that the goods were handed over.

- The importer cannot claim the goods at the destination port.

- Banks will not release payments under trade finance arrangements like Letters of Credit (LCs).

Example of a Bill of Lading

Here’s a simple example:

Scenario: An exporter in India ships 500 cartons of textiles to a buyer in the UK. The carrier issues a Bill of Lading that includes:

- Exporter: XYZ Textiles Pvt. Ltd.

- Importer: London Fabrics Ltd.

- Vessel Name: MSC Harmony

- Port of Loading: Mumbai, India

- Port of Discharge: London, UK

- Description of Goods: 500 cartons of cotton textiles

- Number of Packages: 500

- Freight: Prepaid

- Date of Issue: 12th August 2025

- Signature: Authorized shipping line representative

The buyer will use this Bill of Lading to claim the goods upon arrival in London.

Types of Bill of Lading

Different types of Bills of Lading are used depending on the mode of transport, terms of shipment, and trade agreement.

1. Based on Mode of Transport

- Ocean Bill of Lading: Used for sea shipments.

- Air Waybill: Used for air freight.

- Inland Bill of Lading: Used for inland or domestic shipments.

2. Based on Ownership

- Straight Bill of Lading: Goods are consigned to a specific person and are non-transferable.

- Order Bill of Lading: Transferable by endorsement; used in trade finance.

- Bearer Bill of Lading: Ownership can be transferred simply by handing it over.

3. Based on Freight Terms

- Freight Prepaid: Freight charges paid by the shipper.

- Freight Collect: Freight charges paid by the consignee.

Format and Details in a Bill of Lading

A typical Bill of Lading contains the following sections:

Functions of a Bill of Lading

A Bill of Lading serves three main functions:

1. Receipt of Goods

It confirms that goods have been received in good condition by the carrier.

2. Evidence of Contract

It contains all terms and conditions of transport between the shipper and the carrier.

3. Document of Title

It allows the legal transfer of ownership of goods during shipment — making trade possible even when goods are still in transit.

Importance of a Bill of Lading in Export and Import

A Bill of Lading is essential for smooth trade operations because it:

- Acts as proof of shipment for exporters.

- Enables importers to claim goods at the destination port.

- Ensures payment release under letters of credit.

- Facilitates customs clearance at both ends.

- Prevents fraud by defining exact cargo details and ownership.

Without it, goods cannot be released from customs or claimed by the buyer.

Electronic Bill of Lading (eB/L)

With digital transformation in logistics, many companies now use Electronic Bills of Lading (eB/Ls). These offer advantages such as:

- Faster document exchange

- Reduced paperwork and courier costs

- Lower risk of document loss

- Real-time tracking and security

The International Chamber of Commerce (ICC) and shipping lines are encouraging the adoption of eB/Ls to simplify global trade.

Bill of Lading vs Shipping Bill

👉 To learn more about Shipping Bills, check out our detailed guide: What is a Shipping Bill in Export? Meaning, Format, and Importance

Common Mistakes to Avoid in Bill of Lading

- Incorrect consignee details

- Mismatch between invoice and B/L

- Missing signature or date

- Wrong freight terms (prepaid/collect)

- Not matching LC conditions

Always double-check your Bill of Lading before dispatch to prevent payment or clearance delays.

Conclusion

A Bill of Lading is more than just a transport document — it’s a vital link between exporters, importers, and carriers. Understanding its meaning, format, and purpose ensures smoother shipments, faster payments, and fewer compliance issues.

For exporters and importers, managing documents efficiently can save both time and money — and a correctly issued Bill of Lading is at the heart of that success.

FAQs on Bill of Lading

1. What is a Bill of Lading in simple terms?

A Bill of Lading is a shipping document that acts as proof of shipment, a contract, and ownership document for goods transported by a carrier.

2. Who issues the Bill of Lading?

It is issued by the shipping line, freight forwarder, or carrier to the exporter once the goods are loaded.

3. Is a Bill of Lading required for all shipments?

Yes, it’s mandatory for all international shipments, whether by sea, air, or land.

4. How many copies of Bill of Lading are issued?

Typically, three originals are issued — one for the shipper, one for the consignee, and one for the bank or carrier.

5. Can a Bill of Lading be transferred to another party?

Yes, if it’s an “Order Bill of Lading,” ownership can be transferred by endorsement.

6. What is the difference between a Bill of Lading and an Air Waybill?

A Bill of Lading is used for sea freight, while an Air Waybill is used for air shipments and is non-negotiable.

7. Can the Bill of Lading be digital?

Yes, the Electronic Bill of Lading (eB/L) is increasingly being adopted for faster and paperless trade.

8. What happens if I lose the Bill of Lading?

You must request a duplicate or provide a bank guarantee and indemnity to the carrier for cargo release.

9. Is a Bill of Lading proof of payment?

No, it’s proof of shipment and ownership, not proof of payment.

10. Why is the Bill of Lading important for exporters?

Because it enables them to claim payment under letters of credit and serves as legal evidence of shipment.