How to File TDS Returns Online: Step-by-Step Guide

Step-by-step TDS e-filing guide for employers & businesses. Includes quarterly deadlines, common mistakes to avoid, and how to claim refunds.

Online E-filing TDS return is an important task for businesses and professionals to ensure that tax deducted at source (TDS) from customers is correctly deposited with the IT department. We make the above process easier for you at Eximpe. Here is your complete step-by-step guide on how to file a TDS return online, claim income tax TDS refund, penalties for late filing and more live coverage of TDS.

What is TDS Return?

TDS return is required to be filed by the deductors in every quarter to the Income Tax Department, and it shows the TDS. He has deducted the deposit on salary, rent, professional fees, and interest payments in detail. All those who deduct tax at source are compulsorily required to file TDS Returns.

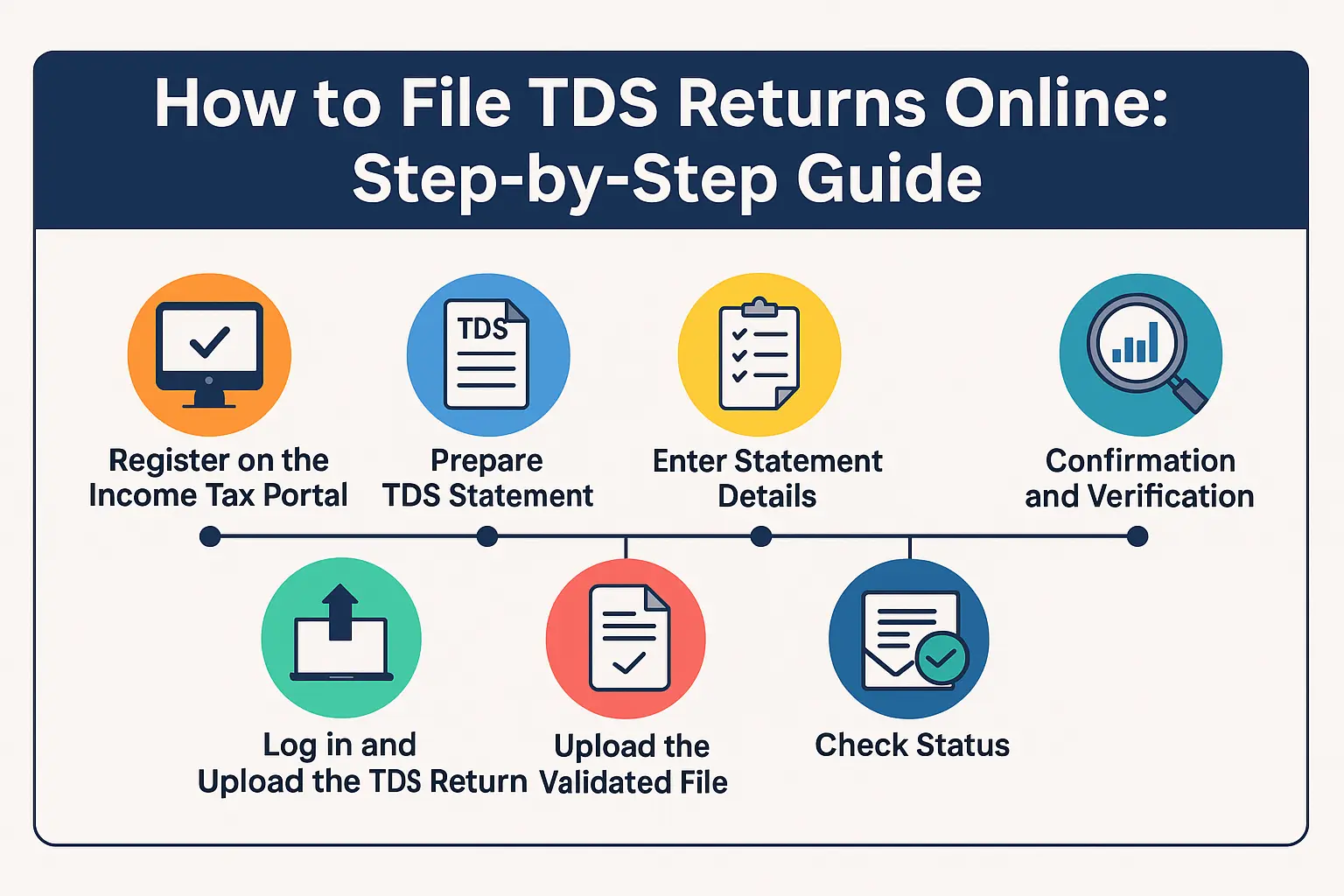

Step-by-Step Guide: How to File TDS Return Online

Register on the Income Tax Portal

- Make sure that your TAN is registered on the e-filing portal. If not, fill out our quick registration.

Prepare TDS Statement

- Use the government-recommended software (e.g., Saral TDS) to prepare the TDS statement in the required format. Validate the file using the File Validation Utility (FVU) provided by NSDL.

Log in and Upload the TDS Return

- Visit the Income Tax e-filing website and log in with your TAN credentials.

- Go to the ‘TDS’ section and select ‘Upload TDS’.

Enter Statement Details

- Fill in the required statement details and validate them.

Upload the Validated File

- Upload the zipped TDS file along with the digital signature (DSC) or use the Electronic Verification Code (EVC) or Aadhaar OTP for verification.

Confirmation and Verification

- Upon successful upload, you’ll receive a confirmation message and an email. Complete e-verification using EVC, Net Banking, or Aadhaar OTP if required.

Check Status

- To view the status, login, go to ‘TDS’, and select ‘View Filed TDS’ to check whether your return has been accepted or rejected.

How Much Time It Takes to Process TDS Return

TDS returns are generally processed a few days to a couple of weeks after being filed, depending on the quantity and correctness of the data, says Money.com. However, the real credit of the TDS refund of income tax (if applicable) may take 1-6 months after filing your income tax return and e-verification.

Income Tax TDS Refund: How to Claim

If you have deducted TDS over and above the permissible level, you can claim an income tax TDS refund when filing your income tax return. Also, your bank account is pre-validated, and IFSC is correct. The refund, if any, is paid through direct credit to a bank account.

Penalty for Late Filing of TDS Return

Timely filing is essential. The penalty for late filing of a TDS return is ₹200 per day under Section 234E, up to the TDS amount. Additionally, under Section 271H, penalties can range from ₹10,000 to ₹1,00,000 for incorrect or delayed returns. Severe delays or non-payment may even attract prosecution.

Conclusion

Knowing how to file TDS returns online ensures compliance, avoids hefty penalties for late filing of TDS returns, and streamlines the process to claim any income tax TDS refund. At Eximpe, we recommend keeping all documents ready, verifying details before submission, and filing well before the due date for a hassle-free experience. If you need expert assistance, our team is here to help you navigate every step of the process.

Stay compliant and stay confident with Eximpe.

FAQs

What is a TDS return, and who needs to file it?

A TDS return is a quarterly statement that must be filed by anyone who deducts tax at source (TDS) on payments such as salary, rent, professional fees, or interest. All deductors are required to file TDS returns with the Income Tax Department.

What documents are required to file a TDS return online?

You need your TAN, PAN details of the deductor and deductees, TDS payment challan details, and previous TDS return information (if applicable) before starting the online filing process.

What are the due dates for filing TDS returns for FY 2025-26?

The quarterly due dates are:

- Q1 (April–June): 31st July 2025

- Q2 (July–September): 31st October 2025

- Q3 (October–December): 31st January 2026

- Q4 (January–March): 31st May 2026.

What penalties apply for late filing of TDS returns?

A late filing fee of ₹200 per day is charged under Section 234E, up to the amount of TDS. Additional penalties under Section 271H can range from ₹10,000 to ₹1,00,000 for incorrect or delayed returns.

How can Eximpe help with TDS return filing?

Eximpe provides expert assistance at every step of the online TDS return filing process, helping you prepare, validate, and submit your returns accurately and on time for a hassle-free experience.