EDPMS vs IDPMS: Key Differences Every Importer and Exporter Should Know

Understand the key differences between EDPMS and IDPMS in international trade. Learn what EDPMS and IDPMS mean, why they matter, and how importers and exporters can stay compliant.

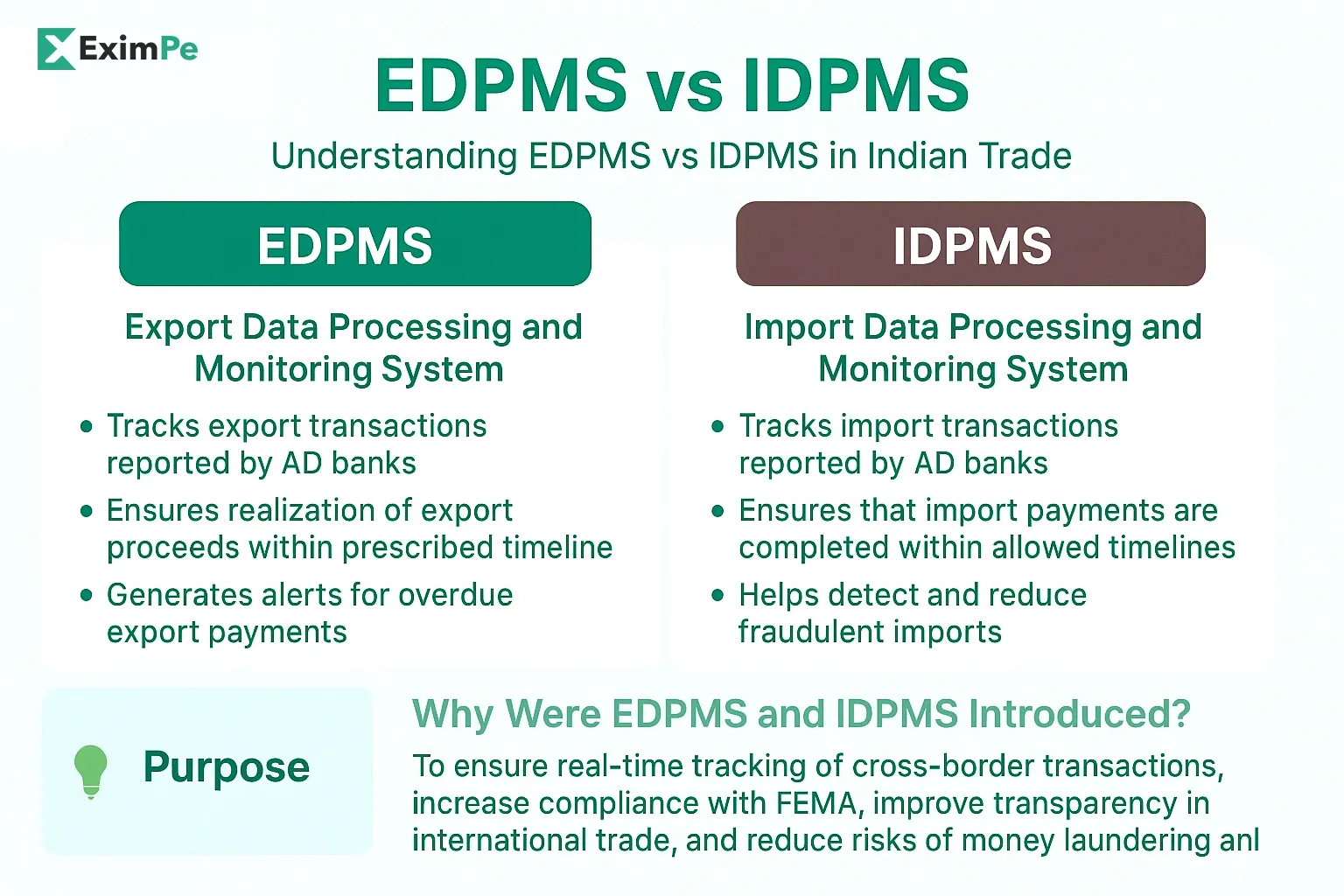

In international trade, compliance with RBI (Reserve Bank of India) regulations is essential. Two important systems that regulate import and export payments are EDPMS (Export Data Processing and Monitoring System) and IDPMS (Import Data Processing and Monitoring System).

Both systems are digital platforms that help the RBI, banks, and businesses track cross-border transactions. But many importers and exporters often confuse them or use the terms interchangeably.

This guide by EximPe will explain EDPMS vs IDPMS, highlight their key differences, and help you understand how to stay compliant with Indian trade regulations.

What is EDPMS?

EDPMS stands for Export Data Processing and Monitoring System. It was introduced by the RBI in 2014 to digitally track export transactions made by Indian exporters.

Key Functions of EDPMS

- Tracks export transactions reported by AD banks.

- Ensures realization of export proceeds within the prescribed timeline.

- Generates alerts for overdue export payments.

- Facilitates issuing of BRC/eBRC required for incentives and GST refunds.

What is IDPMS?

IDPMS stands for Import Data Processing and Monitoring System. It was introduced by the RBI in 2016 to digitally monitor import payments and ensure timely settlement.

Key Functions of IDPMS

- Tracks import transactions reported by AD banks.

- Ensures that import payments are completed within allowed timelines.

- Helps detect and reduce fraudulent imports.

- Allows RBI to monitor forex outflow more effectively.

Why Were EDPMS and IDPMS Introduced?

Before these systems, the process of reporting imports and exports was manual and fragmented. This caused delays, lack of transparency, and compliance issues.

The RBI launched EDPMS and IDPMS to:

- Ensure real-time tracking of cross-border transactions.

- Increase compliance with FEMA (Foreign Exchange Management Act).

- Improve transparency in international trade.

- Reduce risks of money laundering and fraud.

EDPMS vs IDPMS: Key Differences

How Importers and Exporters Can Stay Compliant

- Regularly check your EDPMS/IDPMS status with your AD bank.

- Ensure timely realization of export proceeds (EDPMS).

- Make import payments within RBI timelines (IDPMS).

- Keep documentation updated – invoices, BRC/eBRC, FIRCs.

- Maintain a valid IEC code.

👉 Need to send/receive international payments? Use our SWIFT Code Finder Tool for accurate bank details.

Why Do EDPMS and IDPMS Matter?

- Compliance and Audits: Both systems help avoid penalties by maintaining real-time records and catching mismatches quickly.

- Faster Processing: Digital data reduces errors and delays that were common in paper-heavy processes.

- Enhanced Transparency: Importers and exporters, along with their banks, can track their transaction status online.

- Supports FEMA Regulation: RBI uses both platforms to enforce the Foreign Exchange Management Act (FEMA) rules.

- Integrated Banking: Encourages digitized banking that’s efficient for growing foreign trade.

When Are You Impacted by EDPMS or IDPMS?

- When exporting goods/services from India and receiving foreign currency: EDPMS applies.

- When importing goods to India and paying overseas suppliers: IDPMS applies.

- Banks use data from both systems in forex clearance, trade finance, and regulatory reporting.

Knowing which system applies to your transaction ensures your paperwork is correct, payments are not held up, and compliance-related hurdles are minimized.

Why the Distinction is Crucial for Your Business

For an importer or exporter, failing to understand these systems can lead to severe consequences. Non-compliance is not a simple oversight; it is a serious regulatory issue with direct business impacts.

- For Exporters (EDPMS): If an export payment is not reconciled in the EDPMS, the transaction remains "open" in the RBI's books. A long list of open entries can lead to the exporter being placed on a caution list, which may cause their bank to refuse to process new export documents and prevent them from shipping new goods.

- For Importers (IDPMS): If an import payment is not linked to its Bill of Entry in the IDPMS, it raises a red flag. The importer may be issued a notice and could even face restrictions on making future import payments, stalling their business operations.

Both systems are designed to ensure that the foreign exchange used in Indian trade is legal, transparent, and accounted for. This strengthens the country's financial stability and curbs illicit activities.

Conclusion

Both EDPMS and IDPMS play a vital role in India’s import-export ecosystem. Exporters must comply with EDPMS by ensuring proceeds are realized, while importers must comply with IDPMS by making timely foreign payments.

By understanding their differences and staying compliant, businesses can avoid penalties, ensure smooth trade operations, and build credibility with banks and regulators.

FAQs

What is EDPMS and IDPMS?

EDPMS and IDPMS are RBI systems for monitoring exports and imports digitally. EDPMS tracks export proceeds, while IDPMS tracks import payments.

When was EDPMS introduced?

EDPMS was introduced in 2014 to monitor export transactions digitally.

When was IDPMS introduced?

IDPMS was introduced in 2016 to monitor import payments digitally.

What happens if export proceeds are not realized in EDPMS?

If proceeds are not realized, the exporter may face penalties or restrictions from DGFT and RBI. Related: EDPMS Full Form and Meaning.

What happens if import payments are pending in IDPMS?

If payments are overdue, the importer may face compliance issues, penalties, or restrictions. See: IDPMS Full Form in Banking.

Are EDPMS and IDPMS connected to customs?

Yes. Both systems integrate with ICEGATE (Customs platform) and bank reporting to track trade data.

What is eBRC in EDPMS?

eBRC (electronic Bank Realisation Certificate) confirms that export payments have been received. Read: BRC vs eBRC.

What is FIRC in EDPMS?

FIRC (Foreign Inward Remittance Certificate) is issued by banks as proof of inward foreign remittance. Related: FIRC Full Form and Meaning.

Do exporters/importers need an IEC for EDPMS and IDPMS?

Yes. A valid IEC code is mandatory for both imports and exports.