How to Find Your UTR Number for Bank Transactions

Learn how to find your UTR number for bank transactions quickly & easily. Find multiple methods to check your UTR reference number for NEFT, RTGS, IMPS & UPI transfers

When you make an electronic fund transfer in India, like NEFT, RTGS, IMPS, or UPI, a UTR number (Unique Transaction Reference number) is created for that transaction. This alphanumeric code is important because it helps you track, verify, and fix issues related to your transaction. Many people wonder how to find their UTR number. This guide by EximPe will answer that question and more in an easy-to-understand way.

What is a UTR Number in Bank Transactions?

A UTR number is a unique identifier assigned to every electronic fund transfer in India. Think of it as a transaction’s unique ID that helps banks and customers keep track of payments and receipts. The length and format of the UTR may vary depending on the type of transfer:

- NEFT transactions: Usually 16 characters

- RTGS transactions: Typically 22 characters

- UPI transactions: Usually 12 digits

The UTR number helps in tracking the status, serves as proof of payment, and can assist in resolving disputes.

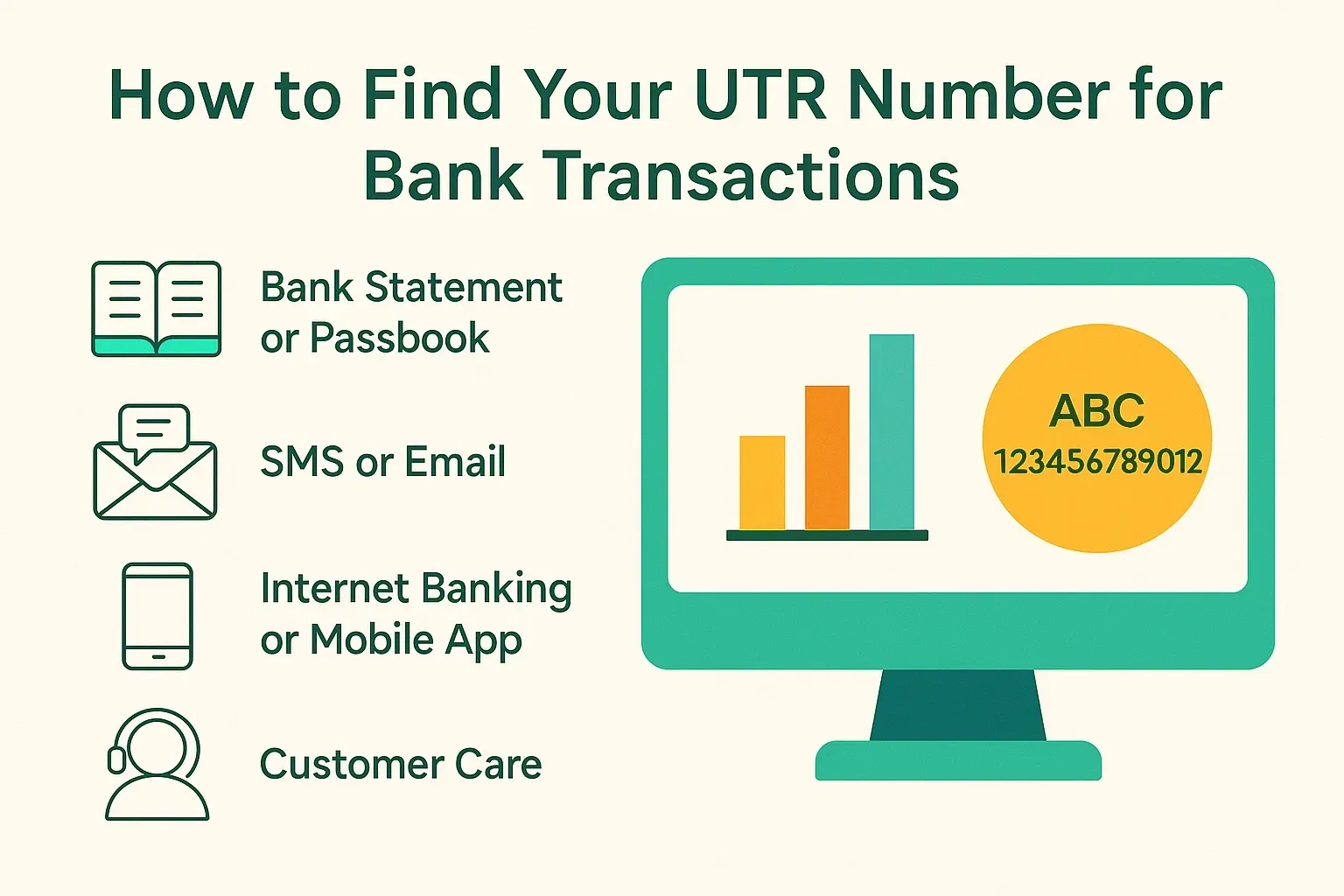

How to Find Your UTR Number: Step-by-Step Methods

There are several easy ways to check your UTR number based on what is most convenient for you. Here are the most common:

1. Check Your Bank Statement or Passbook

- Log in to your bank’s internet banking portal or open your mobile banking app.

- Access your account transaction history or download your bank statement.

- Find the transaction you want to check (look by date, amount, or recipient).

- The UTR number will be displayed in the transaction details, often labeled as Reference Number, UTR Number, or Unique Transaction Reference.

Physical passbooks printed by the bank also include this information beside each transaction.

2. View Transaction Confirmation SMS or Email

When you complete an electronic transfer, your bank usually sends a confirmation message via SMS or email that includes the UTR number.

- Search for messages or emails from your bank around the transaction date.

- The UTR number will be included in the transaction details in the message content.

- Save or note it down for your records.

3. Use Internet Banking or Mobile App

- Log in securely to your bank’s internet banking platform or mobile banking application.

- Navigate to Transaction History or Account Statement.

- Select the specific transaction.

- You will find the UTR number displayed in the transaction details page.

This method is fast and convenient, especially for recent transactions.

4. Contact Your Bank’s Customer Care

If you cannot find the UTR number through the above methods:

- Call your bank’s customer support helpline.

- Provide necessary details like transaction date, amount, sender/receiver accounts.

- Request the UTR number for the specific transaction.

- Banks will guide you or provide the number after verifying your identity.

Why is the UTR Number Important?

- Tracking Transactions: It allows you and your bank to trace where a payment is at any time.

- Proof of Payment: Often used by businesses and individuals as official confirmation of completed transactions.

- Resolving Disputes: If a transaction doesn’t complete or shows delays, UTR helps customer care identify the problem quickly.

- Preventing Errors: Ensures each transaction is uniquely identifiable, avoiding mix-ups.

What Does a UTR Number Look Like?

The format varies depending on the transfer type but usually includes:

- Bank code or IFSC

- Transaction date (often in YYYYMMDD format)

- A unique sequence number

Example:

- NEFT: HDFC123456789012 (16 characters)

- RTGS: HDFC20240724123456789012 (22 characters)

- UPI: 123456789012 (12 digits)

Key Considerations When Searching for Your UTR

- Payment Method Specifics: Remember that the format of the UTR number (length and structure) varies depending on the payment system used (NEFT, RTGS, IMPS, UPI). Don't expect an NEFT UTR to look exactly like an RTGS one.

- Timelines for Generation:

- RTGS/IMPS/UPI: UTR numbers are generally generated almost instantly as these are real-time or near real-time payment systems.

- NEFT: Since NEFT operates in half-hourly batches, the UTR might be generated a few minutes to an hour after you initiate the transaction, once it enters a processing batch.

- Sharing Your UTR: It is generally safe to share your UTR reference number with the recipient or your bank. It's a transaction identifier and doesn't expose sensitive account information.

Conclusion

Understanding what a UTR number is in banking and knowing how to find it for your transactions is a valuable skill in today's digital economy. Whether you use net banking, a mobile app, or check your bank statement, the UTR reference number gives you a unique identification for easy tracking, quick dispute resolution, and precise record-keeping. Make it a habit to note or save your UTR for important transactions. This way, you can feel secure about your financial activities.

FAQs

1. What is UTR number in bank transactions?

UTR is a Unique Transaction Reference number assigned to NEFT and RTGS transfers for identification and tracking.

2. How can I check my UTR number?

You can find it in your SMS/email confirmation, internet banking transaction history, mobile banking app, or bank account statement.

3. Is UTR number required for IMPS transfers?

No. IMPS uses RRN (Reference Retrieval Number), while UTR is used for NEFT and RTGS.

4. Can I track my payment using UTR number?

Yes, you can contact your bank with the UTR number to check payment status or resolve delays.

5. Who generates the UTR number?

The remitting bank (your bank) generates the UTR when processing your NEFT or RTGS payment.

6. What is the full form of UTR?

The full form of UTR is Unique Transaction Reference number.

7. Is UTR number permanent?

Yes, once generated, it remains as the unique identifier for that transaction forever in bank records.

8. Can I find UTR number in bank passbook?

If your passbook prints detailed transaction remarks, it will show the UTR number alongside the payment entry.

9. How long does it take for a UTR number to generate?

It is generated immediately upon successful NEFT or RTGS processing.

10. What to do if I lost my UTR number?

Contact your bank with transaction details to retrieve your UTR number for future reference.