Is IFSC and SWIFT Code the Same? Know the Key Differences

Wondering if IFSC and SWIFT codes are the same? Understand the differences between IFSC and SWIFT codes, their uses & how they work in banking transactions

Whether in the banking or the financial world, you find almost all the time where you have a myriad of codes meant to ease the conducting of transactions and secure them as well. Two of such codes, the Indian Financial System Code (IFSC) and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) Code are common. While both serve to identify banks, a common misconception is that "is IFSC and SWIFT code same?" And the short response is that no, they are not.

Understanding the distinct purposes and structures of IFSC and SWIFT code is crucial for anyone involved in financial transactions, especially if you're dealing with both domestic and international money transfers. It is time to explore the major distinctions to debunk these crucial banking identifiers.

What is an IFSC Code?

Indian Financial System Code is also referred to as the IFSC code. It is an 11-character code (a mixture of alphabets and numbers), which is a distinctive identifier of every individual bank branch in India that engages in electronic funds transfer systems. Such systems are:

- NEFT (National Electronic Funds Transfer): A system of electronic fund transfer the bank maintains the information and services under the Reserve Bank of India (RBI).

- RTGS (Real Time Gross Settlement): A Real-time settlement process.

- IMPS (Immediate Payment Service): An interbank electronic money transfer service that is immediate.

Function of IFSC Code: The main idea of IFSC code is that money is sent electronically in one bank account to another account in another branch of the same bank in India and the money goes to the right person in the right place. Online payments and transfer of funds within the country are not possible without valid implementation of IFSC code. It serves as a distinctive location of every bank branch in India.

Structure of an IFSC Code

An IFSC code is an 11-character alphanumeric code, typically structured as follows:

- First 4 characters: Represent the bank's name (alphabetic).

- Fifth character: Always '0' (zero), reserved for future use.

- Last 6 characters: Represent the specific bank branch (alphanumeric).

Example: ICIC0000001 (ICIC represents ICICI Bank, 0 is reserved, 000001 is a branch code)

What is a SWIFT Code?

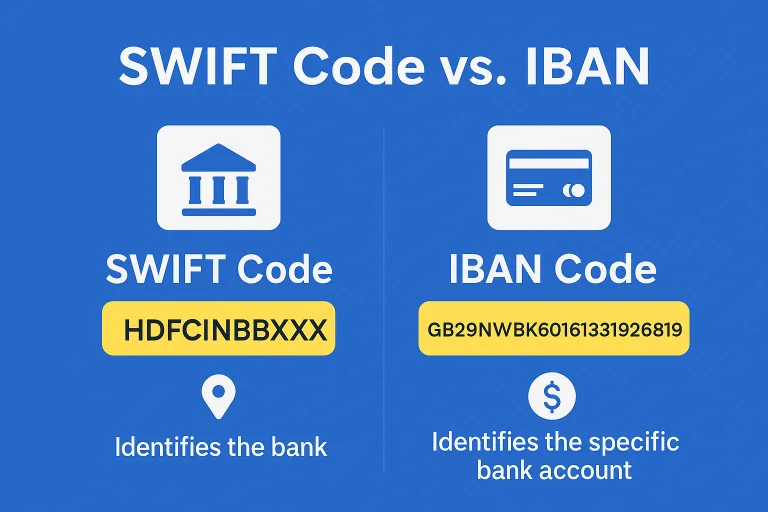

The SWIFT code (also known as a Bank Identifier Code or BIC) stands for Society for Worldwide Interbank Financial Telecommunication. It is a global name code applied in the recognition of banks and financial agencies all over the world. Unlike the IFSC code, which is for domestic Indian transactions, the SWIFT code is essential for international money transfers and communications between banks across different countries.

Purpose of SWIFT Code: The main purpose of a SWIFT code is to facilitate secure and accurate cross-border financial transactions. When you send or receive money from a bank in another country, the SWIFT code ensures that the funds are routed to the correct bank worldwide. It represents a foreign address by a bank.

Structure of a SWIFT Code

A SWIFT code can be 8 or 11 alphanumeric characters long, structured as follows:

- Characters 1-4 (Bank Code): It specifies bank (e.g. HDFC, SBIN).

- 2 numbers (Country Code): The country (e.g. IN for India, US for United States).

- Next 2 characters (Location Code): The name of the city or place, where the bank is situated (alpha-numeric).

- Last 3 characters (Branch Code - Optional): It is the code referring to a specific branch (alphanumeric). When left out, then it is referring to the main office of the bank.

Example: HDFCINBBXXX (HDFC Bank, HDFC = HDFC (b) and IN = India and BB = Mumbai and XXX = main branch).

IFSC Code vs. SWIFT Code: The Key Differences

The confusion around "is IFSC and SWIFT code same" largely stems from their similar function of identifying banks. Their scope and application however, differ in essence. Here's a comparative look at IFSC code vs SWIFT code:

When Do You Need Which Code?

Knowing the distinction is vital to ensure your funds reach the correct destination without delays or complications.

- You need an IFSC Code when:

- Transferring money from your bank account to another bank account within India.

- Making payments for utility bills, loan EMIs, or other transactions via NEFT, RTGS, or IMPS.

- Receiving funds from someone else within India.

- You need a SWIFT Code when:

- Sending money from India to a bank account in another country.

- Receiving money from a person or entity located outside India.

- Engaging in international trade or business transactions involving foreign currency.

How to Find Your IFSC and SWIFT Code

- Finding IFSC Code:

- Chequebook: Printed on cheque leaves.

- Bank Passbook/Statement: Usually mentioned on the first page or transaction statements.

- Bank's Website/Net Banking: Log in to your online banking portal; the IFSC code for your branch is usually displayed.

- RBI Website: The Reserve Bank of India provides a list of all IFSC codes.

- Third-party websites/apps: Reputable financial websites also provide IFSC search tools.

- Finding SWIFT Code:

- Bank's Official Website: Look for sections like "International Transfers," "Wire Transfers," or "Remittances."

- Contact Your Bank: The quickest way is often to call your bank's customer service or visit your branch directly. Not all branches have their own SWIFT code; the bank will provide the code for their main international branch if needed.

- Bank Statement: Sometimes included on bank statements for accounts that deal with international transactions.

- SWIFT Directories: Online tools or directories can help, but always verify with your bank.

Conclusion

While both IFSC and SWIFT codes are essential banking identifiers, they serve distinct purposes. The IFSC code is at your behest when it comes to all the domestic types of fund transfer within India country whether it be within the City or in the other parts of the Indian banking system where your money will reach where it is supposed to be. The SWIFT code, on the other hand, is your passport for international financial transactions, allowing seamless communication and money movement across borders.

Understanding the difference between IFSC and SWIFT code is key to avoiding transaction errors and ensuring your money always goes where it's supposed to, whether it's across the street or across the globe. One should always ensure that the right code is used before sending any bank transfer.

FAQs – IFSC and SWIFT Code

1. Is IFSC and SWIFT code the same?

No. IFSC is used for domestic transfers within India, while SWIFT is used for international fund transfers.

2. Can I use IFSC code for international transfers?

No. International transfers require a SWIFT code, not IFSC.

3. Can one bank have multiple SWIFT codes?

Yes. Large banks may have different SWIFT codes for different branches or types of transactions.

4. Where can I find my IFSC and SWIFT codes?

IFSC is available on your cheque book/passbook. SWIFT codes are listed on your bank’s official website or can be obtained by contacting the bank.

5. What if my branch doesn't have a SWIFT code?

The bank may use a central or intermediary branch SWIFT code to receive international funds and route them to your account.

6. Is the SWIFT code mandatory for receiving money from abroad?

Yes. To receive international payments, you must provide the correct SWIFT code of your bank.

7. Can IFSC and SWIFT codes be used interchangeably?

No. They are not interchangeable and are used for completely different types of transactions.

8. Are there any charges for using SWIFT transfers?

Yes. SWIFT transfers usually involve conversion fees and transfer charges, depending on your bank and the sender's bank.

9. Where can I find the correct SWIFT code for a bank?

You can easily find it using the SWIFT Code Finder tool by Eximpe. Just enter the bank name and country to get the accurate SWIFT/BIC code instantly.