Difference Between Excise Duty and Custom Duty Explained

Understand the core differences between Excise Duty (domestic manufacturing) & Custom Duty (imports). Learn about who pays, when it's levied, & its purpose.

For firms conducting manufacturing business or that are in international trade, it is necessary to understand the difference between excise duty and customs Duty for compliance and cost control. Eximpe embraces the belief that understanding such concepts of tax provides clarity in the decision-making and design of a business for any business.

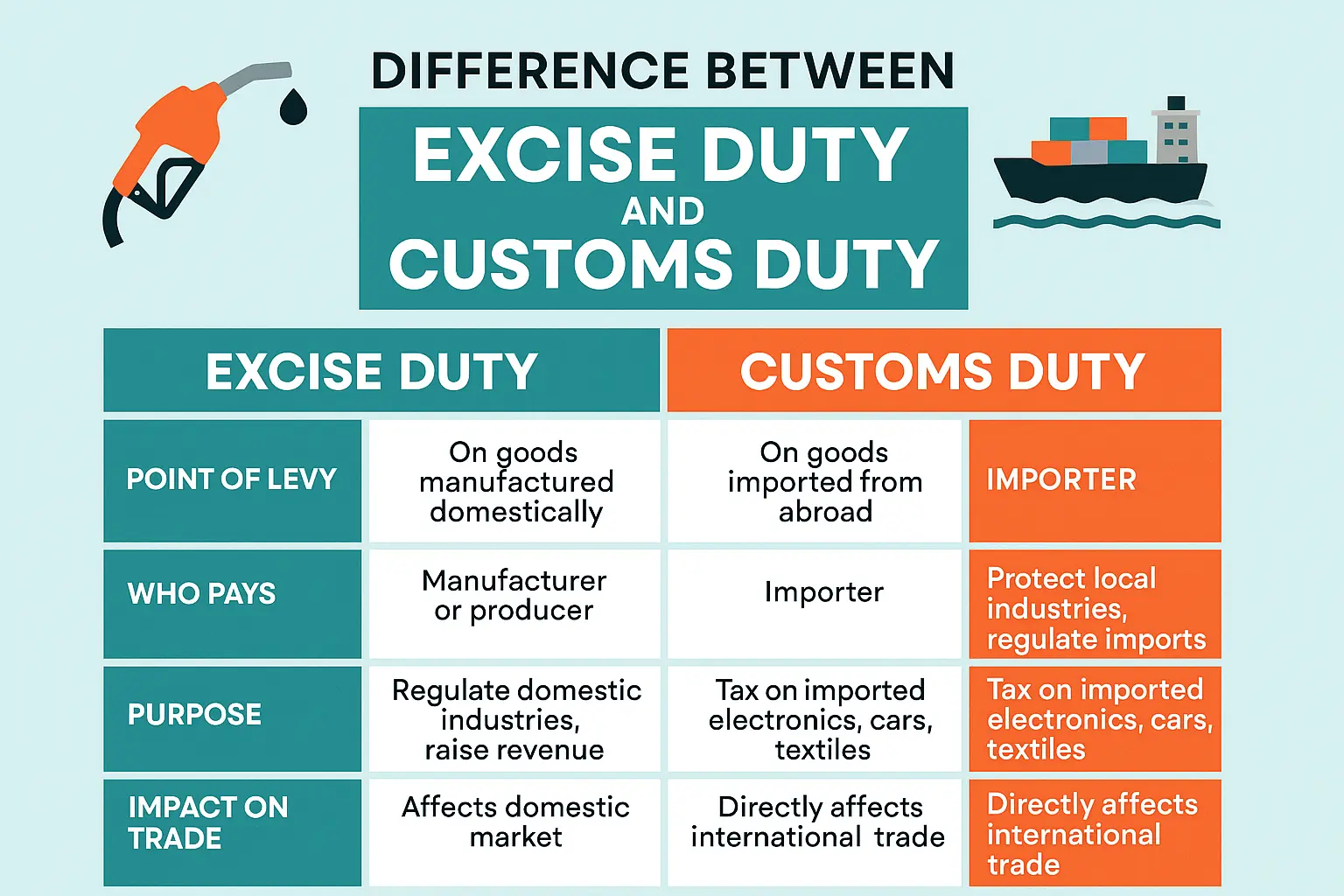

Excise Duty vs Custom Duty: The Basics

- Excise Duty is a tax levied on goods produced within a country. It is collected at the production or manufacturing level and is usually targeted to particular commodities like alcohol, tobacco, fuel, and luxuries. The individual responsible for clearing excise duty is the manufacturer or the producer, but the cost is usually shifted to consumers in the form of increased costs.

- Customs Duty is an amount that is paid on goods when they are brought into a country from overseas. It is obtained at the point of entry (like ports and airports) by the customs. Customs duty is basically used to control international trade, protect indigenous industries, and generate taxes for the government.

Key Differences: Excise Duty vs Custom Duty

Excise Duty Example

Let us say, suppose a company produces 10,000 litres of soft drinks in India. If the rate of excise duty is ₹2 per litre, then the amount of excise duty payable would be ₹20,000. This may be seen in the price that consumers end up paying.

Custom Duty Example

A business brings $10,00,000 smartphones into India. At the rate of basic customs duty, 10% if there is an importer who has to pay a Customs duty of ₹1,00,000 at the port of entry. This raises the landed cost of imported goods, which can be sold at a higher price in the market.

Types and Calculation

- Excise Duty can be:

- Ad valorem (percentage of value)

- Specific (fixed amount per unit)

- Compound (combination of both)

For instance, the excise tax on fuel can be as per litre (specific), while that on luxury cars can be as a percentage of the value of the car(ad valorem).

- Custom Duty includes:

- Basic Customs Duty

- Countervailing Duty (CVD)

- Special Additional Duty (SAD)

- Anti-Dumping Duty

For example, if foreign steel has been sold below fair market value in the United States, anti-dumping Duty can be placed against it in order to safeguard domestic producers.

Why the Difference Matters

The knowledge of the difference between customs Duty and excise duty is important for businesses because:

- Avoid compliance issues and penalties

- Accurately estimate product costs

- Devise pricing for domestic and imported things

Conclusion

In short, excise duty vs custom duty reduces to where the tax is put. Custom Duty on imports and excise duty on domestic manufacturing. Both of them are very critical in determining the country's economy, pricing, and fair competition. For firms such as Eximpe, keeping in touch with these regulations will enhance the smooth running of both local and global markets.

FAQs

Who is responsible for paying excise duty and customs duty?

Excise duty is paid by the manufacturer or producer of goods within the country, while customs duty is paid by the importer when goods enter the country.

At what stage are excise duty and customs duty levied?

Excise duty is levied at the manufacturing or production stage on domestic goods, whereas customs duty is charged at the point of entry (such as ports or airports) on imported goods.

What is the main purpose of excise duty vs customs duty?

Excise duty primarily regulates domestic industries and generates revenue from goods produced locally. Customs duty is designed to protect local industries, regulate imports, and generate revenue from international trade.

How do excise duty and customs duty impact product pricing?

Excise duty increases the price of domestically manufactured goods, while customs duty raises the landed cost of imported goods, both of which are often passed on to consumers.

Are there different types of excise and customs duties?

Yes, excise duty can be ad valorem, specific, or compound, while customs duty includes types like Basic Customs Duty, Countervailing Duty, Special Additional Duty, and Anti-Dumping Duty.