HDFC, SBI, Axis, ICICI Bank Numbers: All You Need to Know

Find out if HDFC, SBI, ICICI, Axis, and other Indian banks have IBAN numbers, what to use instead & how to locate your bank details for international transfers

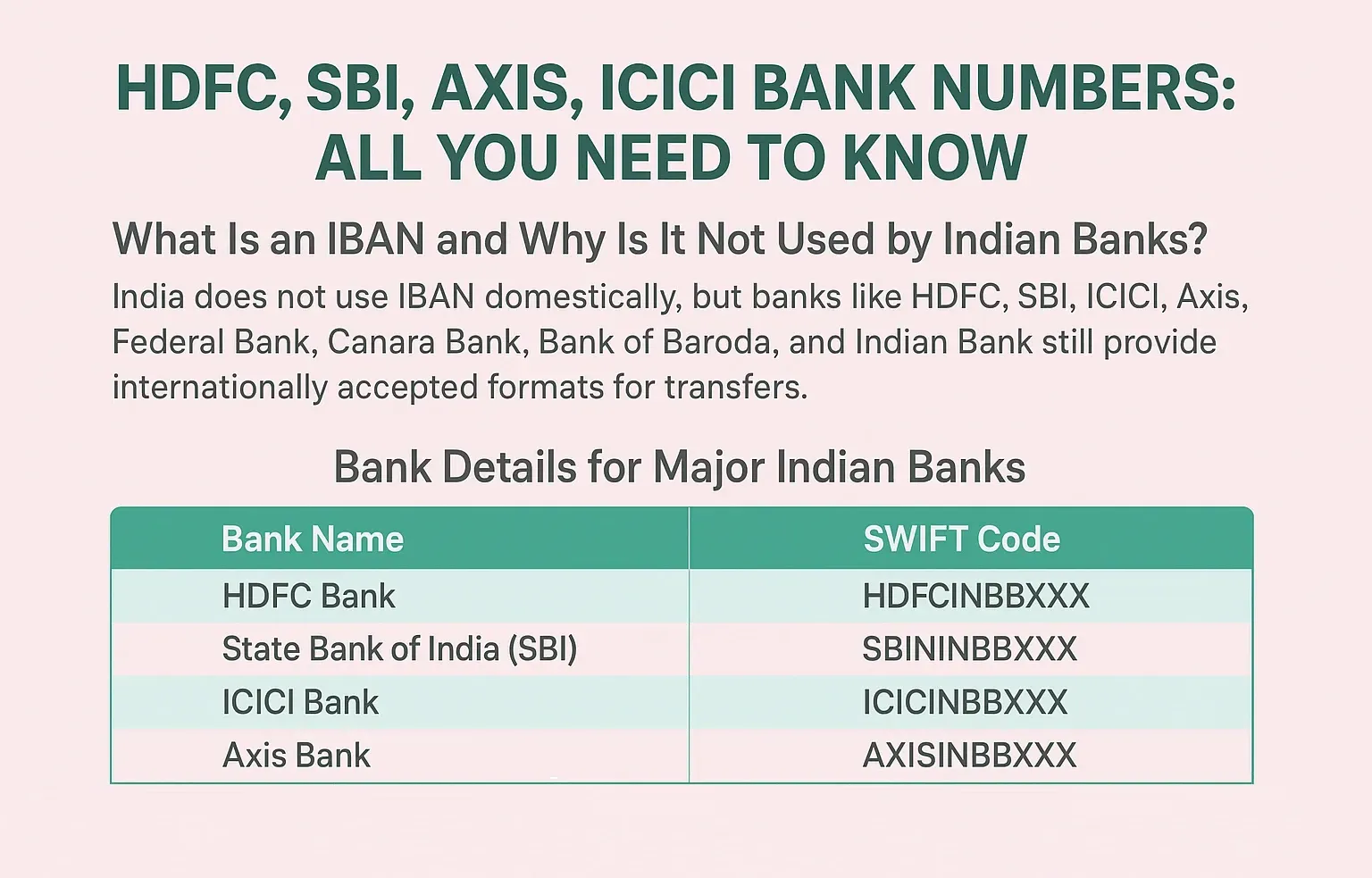

If you’ve been asked for an IBAN number when sending or receiving money internationally from India, you might be confused. India does not use IBAN domestically, but banks like HDFC, SBI, ICICI, Axis, Federal Bank, Canara Bank, Bank of Baroda, and Indian Bank still provide internationally accepted formats for transfers.

This guide will clarify whether Indian banks have IBAN numbers, what to use instead, and how to find the details for major banks in India.

What Is an IBAN and Why Is It Not Used by Indian Banks?

IBAN is an internationally accepted standard for identifying bank accounts across borders, primarily used in Europe and a few other countries. India, however, has not adopted this system. Instead, Indian banks use:

- IFSC Code (Indian Financial System Code) for domestic transactions.

- SWIFT Code (also called BIC - Bank Identifier Code) for international wire transfers.

For cross-border payments to Indian banks, you need the SWIFT code instead of an IBAN number.

Bank Details for Major Indian Banks

1. HDFC Bank

- IBAN: Not available

- What to use/Alternatives: Account number + SWIFT code

- SWIFT Code of HDFC Bank:

The main SWIFT code for HDFC Bank is HDFCINBBXXX.

- “HDFC” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

2. State Bank of India (SBI)

- IBAN: Not available

- What to use/Alternatives: Account number + SWIFT code

- SWIFT Code of SBI:

The main SWIFT code for SBI is SBININBBXXX.

- “SBI” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

3. ICICI Bank

- IBAN: Not available

- What to use/Alternatives: Account number + SWIFT code

- SWIFT Code of ICICI Bank:

The main SWIFT code for ICICI bank is ICICINBBXXX.

- “ICICI” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

4. Axis Bank

- IBAN: Not available

- What to use/Alternatives: Account number + SWIFT code

- SWIFT Code of Axis Bank:

The main SWIFT code for Axis bank is AXISINBBXXX.

- “Axis” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

5. Federal Bank

- IBAN: Not available

- What to use/Alternatives: Account number + SWIFT code

- SWIFT Code of Federal Bank:

The main SWIFT code for Federal Bank is FDRLINBBXXX.

- “FDR” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

6. Canara Bank

- IBAN: Not available

- What to use: Account number + SWIFT code

- SWIFT Code of Axis Bank:

The main SWIFT code for Canara Bank is CNRBINBBXXX.

- “CNR” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

7. Bank of Baroda

- IBAN: Not available

- What to use: Account number + SWIFT code

- SWIFT Code of Bank of Baroda:

The main SWIFT code for Canara Bank is BARBINBBXXX.

- “BARB” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

8. Indian Bank

- IBAN: Not available

- What to use: Account number + SWIFT code

- SWIFT Code of Bank of Baroda:

The main SWIFT code for Indian Bank is IDIBINBBXXX.

- “IDIB” represents the bank name.

- “IN” is the country code for India.

- “BB” represents Mumbai, the city of the bank’s head office.

- Additional characters specify branches if needed.

Popular Indian banks and their SWIFT codes.

Tip: To verify the exact SWIFT code for your branch, you can use the EximPe SWIFT Code Finder.

Why You Might Still Be Asked for an IBAN

If you’re sending money to someone abroad in a country that uses IBAN, the sender’s bank or payment service will request:

- Recipient’s IBAN (because their country requires it)

- SWIFT/BIC code of the recipient’s bank

When you’re on the receiving end in India, you’ll never provide an IBAN—only the details mentioned earlier.

How to Find Your SWIFT Code and Account Details

- Check your bank passbook or statement – Often printed with account details.

- Online banking portal – Under account information.

- Bank website – Many have SWIFT code directories.

- Contact your branch – Especially if you’re unsure which SWIFT code applies.

How to Successfully Receive an International Transfer to India

To ensure a smooth and error-free international inward remittance, follow these steps and provide the sender with the following information:

- Your Full Name: As it appears on your bank account.

- Your Bank's Name: The full name of your bank (e.g., HDFC Bank, State Bank of India).

- Your Full Account Number: Double-check that all digits are correct.

- Your Bank's SWIFT/BIC Code: The correct SWIFT code for your bank. This is the most crucial piece of information for the international transfer.

- Your Branch's IFSC Code: While optional for the initial international transfer, providing the IFSC code can help your bank's internal system process the payment faster once it arrives in India.

- Your Address: Your complete address as registered with your bank.

By providing these details, you are giving the sender all the necessary information to complete the transfer, bypassing the need for an IBAN entirely.

Conclusion

It's clear that the search for an IBAN number for HDFC, SBI, Axis, ICICI, or any other Indian bank will lead to the same conclusion: they do not have one. The Indian banking system is robust and has its own set of identifiers for both domestic and international transactions.

For a seamless international transfer, you simply need to provide your full account number, your bank’s SWIFT/BIC code, and your full name. Understanding this distinction not only prevents confusion but also empowers you to manage your global finances with greater confidence and accuracy in 2025.

FAQs

1. Does HDFC have an IBAN number?

No. HDFC does not issue IBAN numbers. Use your account number and HDFC SWIFT code instead.

2. What is the IBAN number of SBI?

SBI does not have an IBAN number. Use your account number and SBI SWIFT code.

3. Does ICICI Bank use IBAN?

No. ICICI Bank does not issue IBAN numbers; it uses account number + SWIFT code for international transfers.

4. What is the Axis Bank IBAN number?

Axis Bank does not have an IBAN. Use SWIFT code and account number instead.

5. What is the IBAN number of Federal Bank in India?

Federal Bank does not have an IBAN number.

6. What is the Canara Bank IBAN number?

Canara Bank does not issue IBAN numbers.

7. Does Bank of Baroda have an IBAN number?

No. Bank of Baroda does not have IBAN numbers; only SWIFT codes are used.

8. Does Indian Bank have an IBAN number?

No. Indian Bank does not use IBAN numbers.

9. Why don’t Indian banks have IBAN?

Because India is not part of the IBAN system; instead, banks use SWIFT/BIC codes for global payments.

10. Does EximPe provide a SWIFT code finder?

Yes. EximPe offers a free SWIFT Code Finder tool that allows you to quickly search and verify the SWIFT/BIC codes of banks in India and abroad. You can try it here: EximPe SWIFT Code Finder.