How to Apply for IEC Code Online: A Step-by-Step Guide (2025)

Learn how to apply for IEC code online in India in 2025 with this step-by-step guide & also about the Process, documents required & fees for exporters & importers

A journey into international trade be it an exotic goods import business or exporting your goods into international markets is a thrilling idea to any Indian business. But, even before you can ship your initial consignment or get your first international payment, it is important that you take an essential step first and that is to acquire your Importer-Exporter Code (IEC).

The IEC Code is your mandatory license for cross-border trade in India. Fortunately, the process of getting one has been significantly streamlined by the Directorate General of Foreign Trade (DGFT), making it entirely online and relatively quick. If you've been wondering how to apply for IEC Code in 2025, you've come to the right place. This comprehensive, step-by-step guide by EximPe will walk you through the entire IEC Code apply process, ensuring a smooth and hassle-free experience.

What is IEC Code and Why Do You Need It?

Before diving into the application process, let's briefly recap what the IEC Code is and why it's indispensable for your business:

IEC full form is Importer-Exporter Code. It's a 10-digit alphanumeric code issued by the DGFT. It acts as a unique identification number for businesses and individuals engaged in import and export activities in India.

Why is it crucial?

- Mandatory for Customs: Without an IEC, your goods cannot clear Indian customs for either import or export.

- Access to Incentives: It's a prerequisite for availing various export promotion schemes, subsidies, and GST refunds offered by the Government of India.

- Facilitates Banking Transactions: Banks require your IEC for processing foreign currency payments related to your international trade.

- Lifetime Validity (with Annual Confirmation): Once issued, it's valid for the lifetime of your business, requiring only a mandatory annual online update/confirmation of details between April and June (even if no changes).

Now that you understand its importance, let's look at how to apply for IEC Code online.

Pre-Requisites for Your IEC Code Application

Before you begin the online application, ensure you have the following ready to make the process swift:

- Permanent Account Number (PAN): This is the foundational identity for your IEC. The IEC will be issued against your entity's PAN (or individual's PAN for proprietorships).

- Valid Mobile Number & Email ID: For OTP verification and communication from DGFT.

- Active Bank Account: In the name of your business entity (or your individual name for proprietorship). You'll need to provide bank details and a cancelled cheque/bank certificate.

- Digital Signature Certificate (DSC) (Optional but Recommended): While Aadhaar-based OTP authentication is available, a Class 2 or Class 3 DSC for the authorized signatory makes the signing process smoother, especially for companies/LLPs.

- Scanned Documents: Ready for upload in the specified format (usually PDF or JPG).

Documents Required for IEC Code Application (2025)

Ensure you have clear scanned copies of the following documents:

- PAN Card:

- For Proprietorship/Individual: PAN card copy of the proprietor/individual.

- For Company/LLP/Partnership/Trust/HUF/Society: PAN card copy of the entity.

- Proof of Establishment/Incorporation/Registration:

- Proprietorship: Aadhaar Card of the proprietor (can also serve as address proof).

- Partnership Firm: Partnership Deed.

- Limited Liability Partnership (LLP): Certificate of Incorporation issued by MCA.

- Private/Public Limited Company: Certificate of Incorporation issued by MCA.

- Trust/HUF/Society: Registration Certificate.

- Proof of Address of Business Premises: (Any one of the following, in the name of the entity/proprietor)

- Sale Deed (if self-owned)

- Rent Agreement / Lease Deed (if rented/leased)

- Latest Electricity Bill / Telephone Landline Bill / Post-paid Mobile Bill (not older than 2 months)

- Aadhaar Card (for proprietorship/individual, if not used as PAN proof).

- Note: If the address proof is not in the name of the applicant firm, a No Objection Certificate (NOC) from the premises owner in favour of the firm, along with the owner's address proof, might be required (upload as a single PDF).

- Proof of Firm's Bank Account:

- Cancelled Cheque (pre-printed with firm's name and account number)

- Bank Certificate (issued by the bank, confirming firm's name, account number, and IFSC code)

- Digital Photograph:

- Passport-sized digital photograph (3x3 cms) of the Proprietor/Managing Partner/Director/Karta/Managing Trustee signing the application.

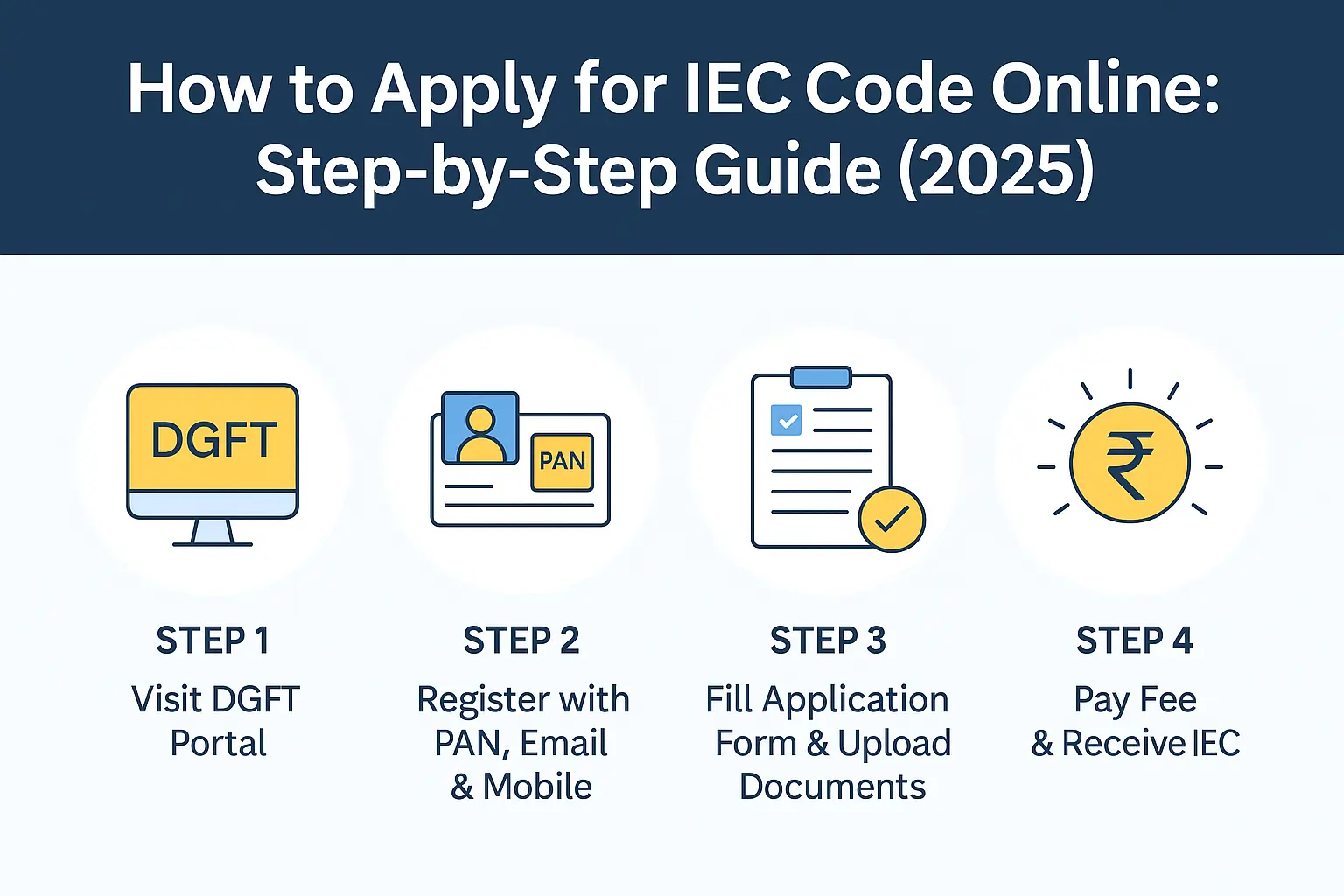

How to Apply for IEC Code Online: Step-by-Step Guide (2025)

The entire IEC Code apply process is conducted on the DGFT's redesigned online portal. Follow these steps carefully:

Step 1: Visit the DGFT Website & Register/Login

- Go to the official website of the Directorate General of Foreign Trade (DGFT): www.dgft.gov.in

- For New Users: Click on "Login" and then "Register" on the top right. Select "Importer/Exporter" as your user type. You'll need to provide your PAN, mobile number, and email ID for OTP verification to complete the registration. Set up your password.

- For Existing Users: Simply log in using your registered username (email ID) and password.

Step 2: Start a Fresh IEC Application

- Once logged in, navigate to "Services" -> "IEC Profile Management" -> "Apply for IEC."

- Click on the "Start Fresh Application" button. If you've previously started an application and saved it as a draft, you can click "Proceed with Existing Application."

Step 3: Fill Out the General Information (ANF 2A)

The application form is structured into several sections. Fill them out accurately:

- Firm's Details:

- Select the Nature of Concern/Firm (e.g., Proprietorship, Partnership, Private Limited Company).

- Enter your Firm Name exactly as per your PAN.

- Your PAN details will likely auto-populate.

- Select your preferred activities (e.g., Exporter, Importer, Both).

- Enter your GSTIN (Goods and Services Tax Identification Number), if applicable. (Note: GSTIN is not mandatory for IEC, but highly recommended for most businesses).

- Enter your Firm's Mobile Number and Email ID.

- Enter your Firm's Address details. Attach a digital copy of your Address Proof.

Step 4: Provide Details of Proprietor/ Partner/ Director/ Karta/Managing Trustee

- This section requires details of the key personnel responsible for the business.

- Enter their Name, PAN, Aadhaar Number, Date of Birth, and Designation.

- Upload a digital photograph of the authorized signatory.

- Ensure all details match their respective ID proofs.

Step 5: Enter Bank Account Details

- Provide the Bank Account Number, Bank Name, Branch Name, and IFSC Code of your primary bank account used for international trade transactions.

- Upload a scanned copy of the cancelled cheque or Bank Certificate clearly showing these details.

Step 6: Other Details (Optional but Recommended)

- This section allows you to provide information about the export sectors you prefer to operate in. While optional, providing this can help DGFT better understand your business profile.

- You may also be asked to state the reason for applying for IEC (e.g., "Starting import/export business," "Compliance requirement").

Step 7: Declaration and Application Summary

- Carefully read the declaration and accept the terms and conditions by checking the box.

- Enter the 'Place' where you are making the application from.

- Review the entire application summary to ensure all details are correct and no mandatory fields are left blank.

Step 8: Sign the Application & Make Payment

- Click on the "Sign" button. You will be prompted to sign the application using either:

- Digital Signature Certificate (DSC): Attach your DSC token and select your certificate.

- Aadhaar-based e-Sign (OTP): Enter your Aadhaar number and verify with the OTP sent to your Aadhaar-registered mobile number.

- After successful signing, you will be redirected to the payment gateway (BharatKosh).

- The government application fee for a new IEC Code is ₹500. Pay this amount online using Net Banking, Debit Card, Credit Card, or UPI.

- Upon successful payment, you will be redirected back to the DGFT website, and a payment receipt will be displayed. You can download this receipt for your records.

Step 9: Submission and IEC Generation

- After successful payment, your application will be automatically submitted for processing.

- The DGFT system will verify your details with the Income Tax Department and other relevant databases.

- If all information is correct and documents are valid, your IEC Code is typically generated within 1 to 7 working days, sometimes even instantly.

- You will receive an email notification on your registered email ID, and you can download your e-IEC certificate directly from your dashboard on the DGFT portal. The certificate will include a QR code for easy verification.

How to Check IEC Status Online?

Once you have applied for your IEC code through the DGFT portal, you can easily track its status online. Here is a step-by-step guide:

Step 1: Visit DGFT Official Portal

- Go to the DGFT website

- Click on the “Services” section in the top menu.

Step 2: Login to Your DGFT Dashboard

- Click on “Login” at the top right corner.

- Enter your username (email ID) and password you created during IEC application registration.

- Complete the OTP verification if prompted.

Step 3: Go to ‘My IEC’ Section

- After successful login, navigate to the left side menu.

- Click on “My IEC” under the IEC Profile Management section.

- Here you will find options related to your IEC profile, status, and modifications.

Step 4: Enter Your ARN (Application Reference Number)

- When you applied for IEC, you received an Application Reference Number (ARN) on your registered email and screen after payment.

- Enter this ARN in the IEC status tracking field.

Step 5: Check Status and Download IEC Certificate

- Once you submit the ARN, the system will display your IEC application status:

- Under Processing: Your application is being reviewed

- Approved: IEC has been issued and is ready for download

- Rejected: Application needs corrections or re-submission

- If approved, you can directly download your e-IEC certificate (PDF) from the portal for your business and customs records.

✅ Quick Tips

✔️ Always note down your ARN immediately after applying

✔️ Check the registered email inbox and spam folder for IEC approval intimation

✔️ If the status is pending for more than 3-4 working days, contact DGFT support for clarification

Post-Issuance: Annual Updation and Compliance

Remember, while your IEC Code has lifelong validity, it is mandatory to update or confirm your IEC details electronically every year between April and June, even if there are no changes. Failure to do so will lead to de-activation of your IEC, preventing you from conducting import/export operations. You can reactivate it by completing the required annual update.

Conclusion

Getting your IEC Code is one initial process that should be taken by any business that wants to invest in the global trade market. It has now become simple; with a simple online application with the DGFT, it is now simpler than before, to acquire this important identification number. With your papers in order and this instruction on the step-by-step process of how to apply IEC Code online, it may serve as a fast and easy route in the coming years to the global business in the 2025 and beyond.

FAQs

1. What is IEC code?

IEC stands for Importer Exporter Code, a 10-digit number issued by DGFT to carry out import-export activities in India.

2. How to apply for IEC code online?

Register on the DGFT portal, fill Form ANF-2A, upload required documents, pay ₹500 fee, and get your IEC within 1-2 days.

3. What is the fee for IEC code in 2025?

₹500, payable online during application submission.

4. Is IEC required for services exports?

Yes, especially if you want to claim export incentives or receive payments in foreign currency under RBI and DGFT guidelines.

5. How long does it take to get IEC code?

Generally, it is issued within 1-2 working days after successful verification.

6. Does IEC code expire?

No. IEC is valid for lifetime unless cancelled or surrendered.

7. Can an individual apply for IEC code?

Yes. Individuals using their personal PAN can apply and conduct export-import business as proprietors.

8. Can IEC details be modified later?

Yes, you can update address, bank, contact details anytime through DGFT online portal.

9. Is GST mandatory for IEC application?

No, but it is advisable to link GSTIN if you are registered under GST.

10. What is e-IEC?

IEC issued in electronic format (PDF certificate) by DGFT is known as e-IEC and is valid for all legal and compliance purposes.