What Is an IBAN Number? Meaning, Structure, and Uses in International Banking

Learn what an IBAN number means, its structure, and how it’s used in global banking. Includes examples, usage tips, and IBAN information for India

If you’ve ever sent or received money internationally, you might have been asked for your IBAN number. For many, this sparks confusion—especially in countries where IBAN isn’t part of domestic banking.

This guide by EximPe explains what an IBAN number means, why it exists, how it’s structured, and how it’s used in cross-border banking. We’ll also cover its relevance in India.

What Does IBAN Number Mean?

IBAN stands for International Bank Account Number. It’s a standardized way of identifying bank accounts across national borders to ensure error-free international transactions.

- Purpose: Reduce mistakes in international payments by using a globally recognized account format.

- Introduced by: European Committee for Banking Standards (ECBS) and later adopted as an ISO standard (ISO 13616).

- Use: Primarily in Europe, Middle East, and some parts of the Caribbean and Africa. Increasingly accepted worldwide by banks and payment networks.

An IBAN is not a new account number—it’s your existing bank account number with additional elements like country code and check digits to make it internationally recognizable.

Why Was IBAN Introduced?

Before IBAN, international transfers relied on account numbers and bank codes that varied from country to country. This caused delays, rejections, and extra charges due to formatting errors.

With IBAN:

- Banks can validate the number before sending payments.

- Transfers are faster and more accurate.

- The risk of funds going to the wrong account is reduced.

How Does IBAN Work?

The IBAN uses a combination of country code and check digits to verify the validity of the account number before any transaction is processed, thus reducing mistakes such as sending money to the wrong account. This verification helps:

- Lower the risk of failed or delayed international transfers.

- Reduce additional fees linked to handling errors.

- Simplify the work of banks by standardizing account identification globally.

IBAN works alongside other identifiers like the SWIFT/BIC code, which specifies the bank’s identity on an international scale, while IBAN pinpoints the exact account within that bank.

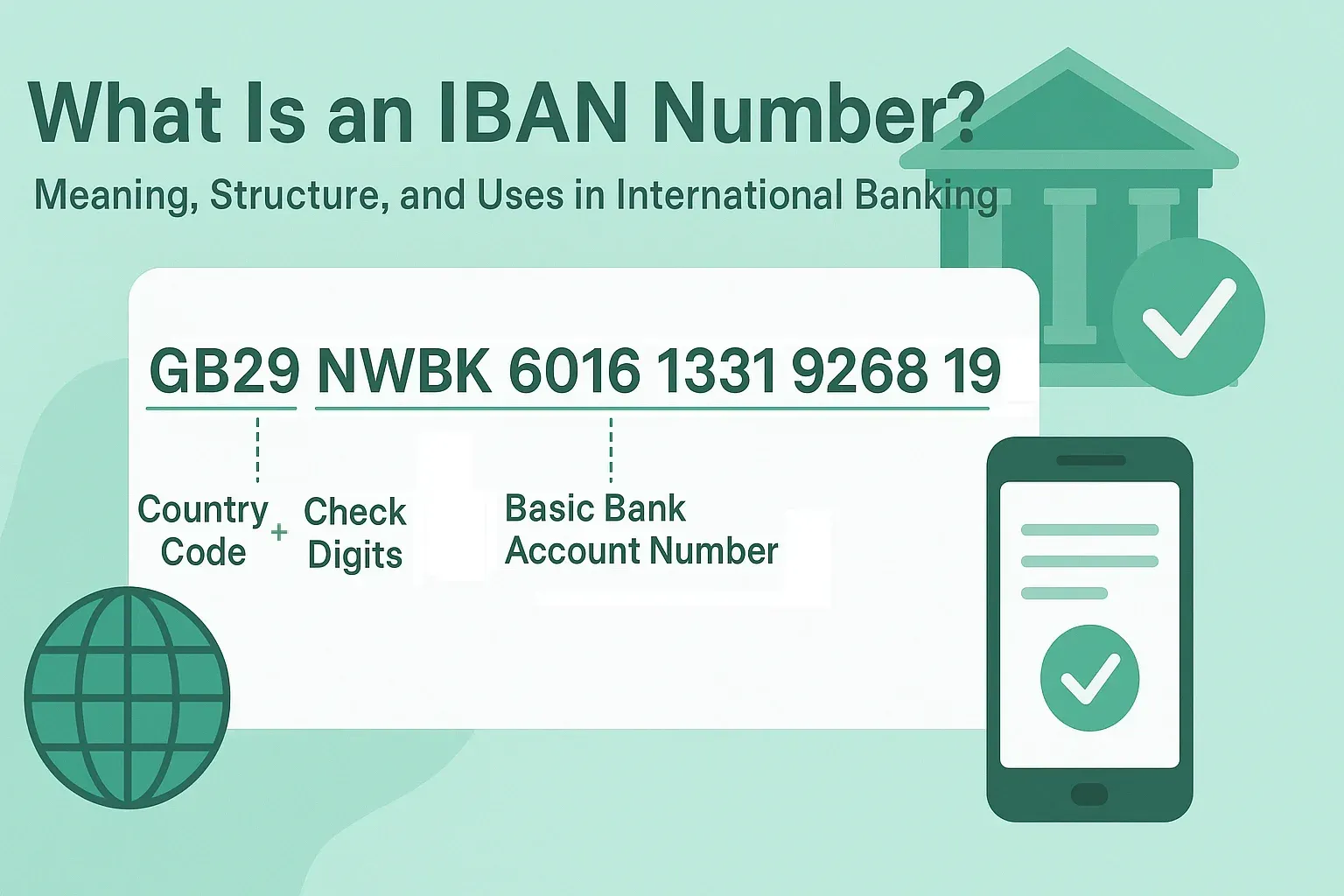

Structure of an IBAN Number

An IBAN can be up to 34 alphanumeric characters, depending on the country.

Structure:

- Country Code – 2 letters (e.g., GB for the United Kingdom, DE for Germany)

- Check Digits – 2 numbers, calculated using a specific algorithm for error detection

- Basic Bank Account Number (BBAN) – Includes bank code, branch code, and account number (length and format vary by country)

Example (UK): GB29 NWBK 6016 1331 9268 19

- GB = Country code

- 29 = Check digits

- NWBK 6016 1331 9268 19 = BBAN (bank + branch + account)

Country-Specific Lengths

How Is an IBAN Used in International Banking?

When you send money abroad:

- The sender’s bank requests the recipient’s IBAN.

- The bank validates the IBAN format and check digits.Funds are routed to the correct country, bank, and account using international payment networks like SWIFT or SEPA.

When you receive money from overseas:

- You provide your IBAN (if applicable in your country) to the sender.

- The sending bank uses it to ensure payment accuracy.

IBAN vs SWIFT Code

In short: IBAN tells the bank where exactly to send the money (account level). SWIFT tells which bank to send it to.

Does India Use IBAN Numbers?

India does not use IBAN numbers for domestic or international banking.

Instead, Indian banks use:

- Account number (domestic)

- IFSC code for domestic payments via NEFT, RTGS, IMPS

- SWIFT/BIC code for international transfers

If you’re sending money to India, you’ll need the recipient’s account number and SWIFT code—not an IBAN.

However, if you’re sending money from India to a country that uses IBAN, you’ll need to provide the recipient’s IBAN along with their SWIFT code.

Benefits of Using an IBAN

- Error reduction: Built-in validation minimizes mistakes.

- Faster processing: Especially in SEPA (Single Euro Payments Area) countries.

- International standardization: Makes banking simpler for global trade and remittances.

- Lower costs: Reduces fees from rejected or returned payments.

Common Mistakes to Avoid

- Confusing IBAN with SWIFT – Both are required in many cases; one does not replace the other.

- Entering spaces or wrong characters – While IBANs are often displayed with spaces for readability, they should be entered without spaces when making payments.

- Using IBAN where it’s not applicable – In non-IBAN countries like the USA or India, providing an IBAN will not work.

How to Find Your IBAN

- Bank statement – Many banks print IBAN on statements in IBAN-adopting countries.

- Online banking – Look under account details.

- Contact your bank – They can provide the correct IBAN format for your account.

- IBAN calculators – Offered by banks, but use official sources to avoid fraud.

Final Thoughts

An IBAN number is a crucial part of today’s global banking system—especially for countries in Europe and the Middle East. While India does not use IBAN, understanding its meaning, structure, and usage can save you time, money, and stress when sending or receiving money internationally.

If you frequently deal with overseas payments, always confirm the correct IBAN with your bank before initiating a transfer.

FAQs

1. What is an IBAN number?

An IBAN number is an internationally recognized format for bank account numbers, used to make cross-border payments accurately and efficiently.

2. Is IBAN the same as my account number?

No. Your IBAN contains your account number plus extra information like country code and check digits.

3. Do I need IBAN for all international transfers?

Not for all. It’s required in countries that have adopted IBAN. Other countries use different formats.

4. What is an IBAN number in India?

India does not use IBAN. Instead, it uses account numbers and SWIFT codes for international transactions.

5. How many digits are in an IBAN?

An IBAN can be up to 34 characters (letters and numbers), depending on the country.

6. How do I check if an IBAN is valid?

Banks and IBAN check tools use algorithms to verify the format and check digits.

7. Can an IBAN replace a SWIFT code?

No. IBAN identifies the account, while SWIFT identifies the bank.

8. Is IBAN safe to share?

Yes. Sharing your IBAN is safe for receiving payments, but never share sensitive login or banking credentials.

9. Can I generate my IBAN online?

Only your bank can provide your official IBAN. Avoid unofficial generators for security reasons.

10. What happens if I use the wrong IBAN?

The payment may be delayed, rejected, or sent to the wrong account—potentially causing financial loss.