Sea IGM Tracking, Status & Functions on ICEGATE: Complete Guide for Indian Importers

Complete guide to Sea IGM tracking on ICEGATE. Check IGM status, common errors, functions, compliance for Indian imports and faqs

Sea IGM (Import General Manifest) is a legal declaration filed by shipping lines with Indian Customs before cargo arrives at an Indian port. It contains details of all goods being imported—container numbers, Bill of Lading references, descriptions, weight, and is mandatory for customs clearance under Section 30 of the Customs Act, 1962. Tracking your Sea IGM status on ICEGATE helps identify errors early, avoid cargo holds, and ensures smooth customs processing.

What is Sea IGM? Understanding Its Role in Customs

Sea IGM stands for Sea Import General Manifest. It's essentially a cargo declaration submitted electronically to Indian Customs by the carrier (shipping company or their agent) before or shortly after a vessel arrives at an Indian port. The document lists every container, package, and shipment on board, serving as the first checkpoint for customs authorities to verify what's coming into the country.

Sea IGM filing is mandatory under Section 30 of the Customs Act, 1962. Without a properly filed IGM, customs will not permit any clearance activities, and your cargo sits detained at the port until the issue is resolved.

Four Critical Functions of Sea IGM

Who Files It?

The carrier or shipping line is solely responsible for filing the IGM, not the importer. However, they rely on accurate data from freight forwarders, consolidators, and exporters. If you're an importer, your responsibility is ensuring the data submitted matches your Bill of Lading and invoice when you file your Bill of Entry later.

How to Check Sea IGM Status on ICEGATE:

ICEGATE (Indian Customs Electronic Gateway) is the official online platform where all customs declarations and tracking happens. It's the single window platform for all customs and cargo related queries at Indian ports.

Step-by-Step Process to Track Your Sea IGM

Step 1: Visit the ICEGATE Tracking Portal

- Go to

- https://enquiry.icegate.gov.in/enquiryatices/

- You do NOT need to log in for public enquiry tracking

- Look for the "SEA IGM" tracking section

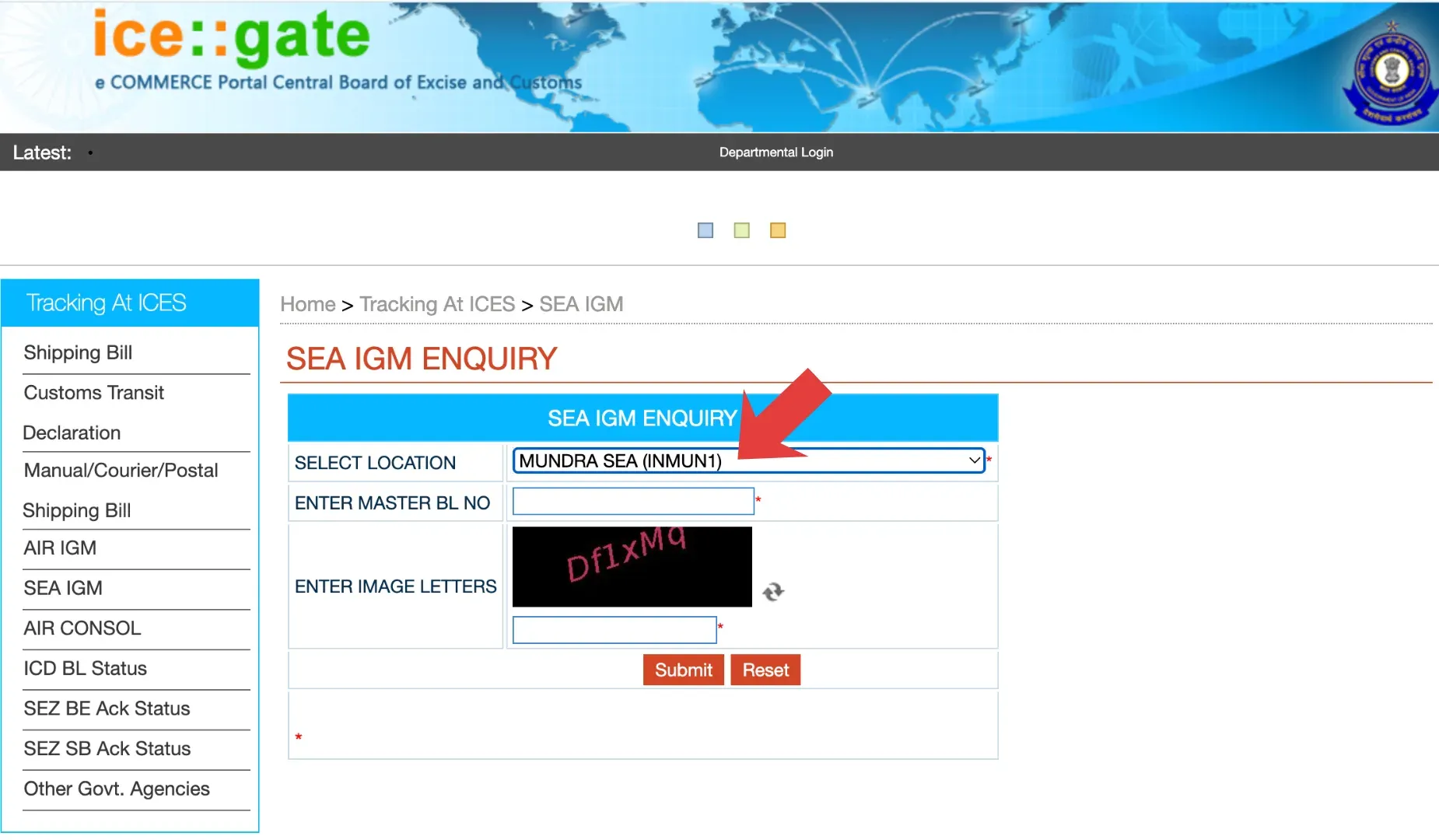

Step 2: Select Your Location

- Choose your discharge port (e.g., Nhava Sheva, Chennai, Cochin, Kolkata, Mundra, etc.)

- This is where your cargo will arrive

Step 3: Enter the MABL (Master Bill of Lading Number)

Step 4: Add Security Verification

- Enter the image letters displayed (CAPTCHA verification)

- Click "Submit" or "Search"

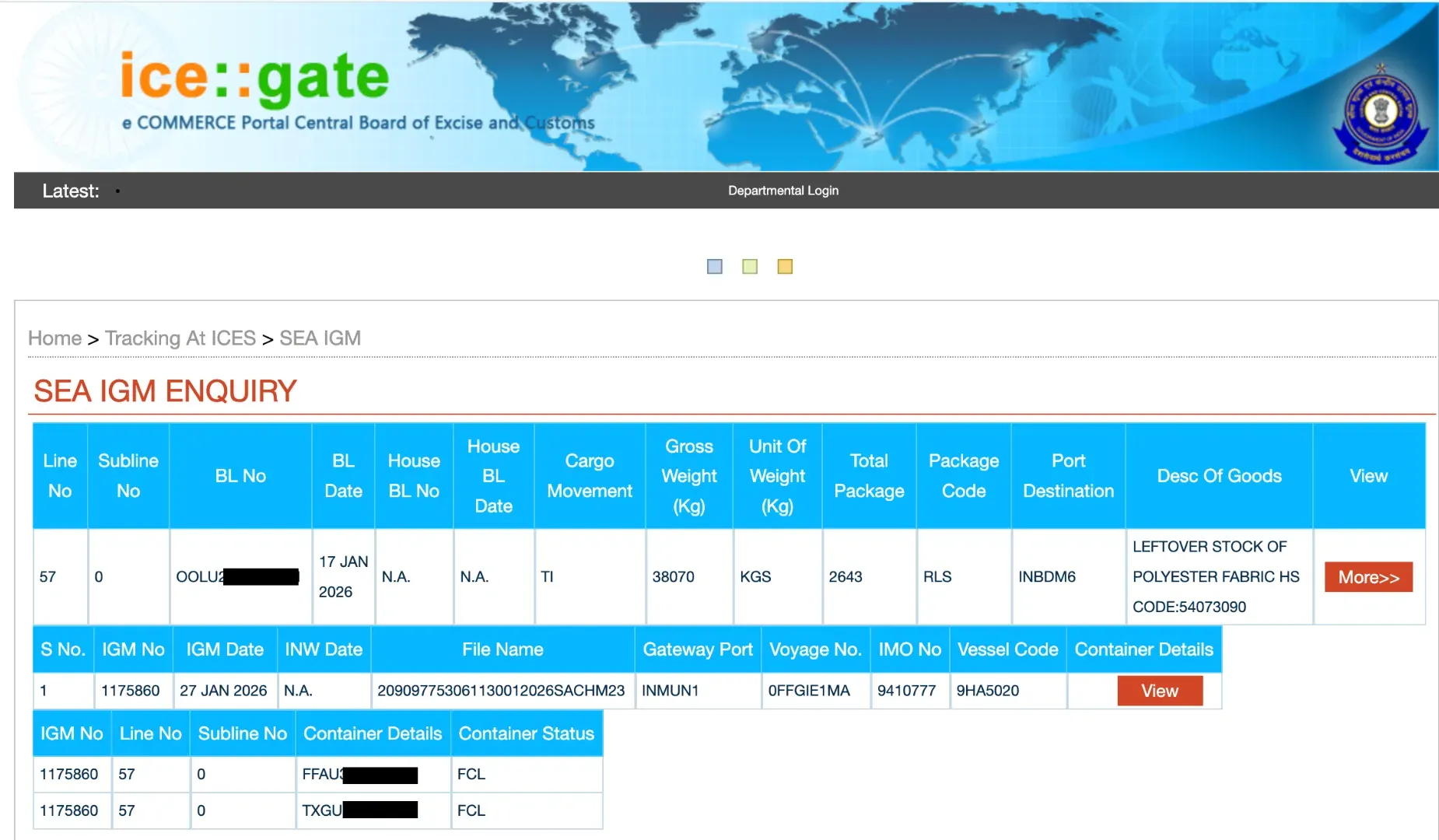

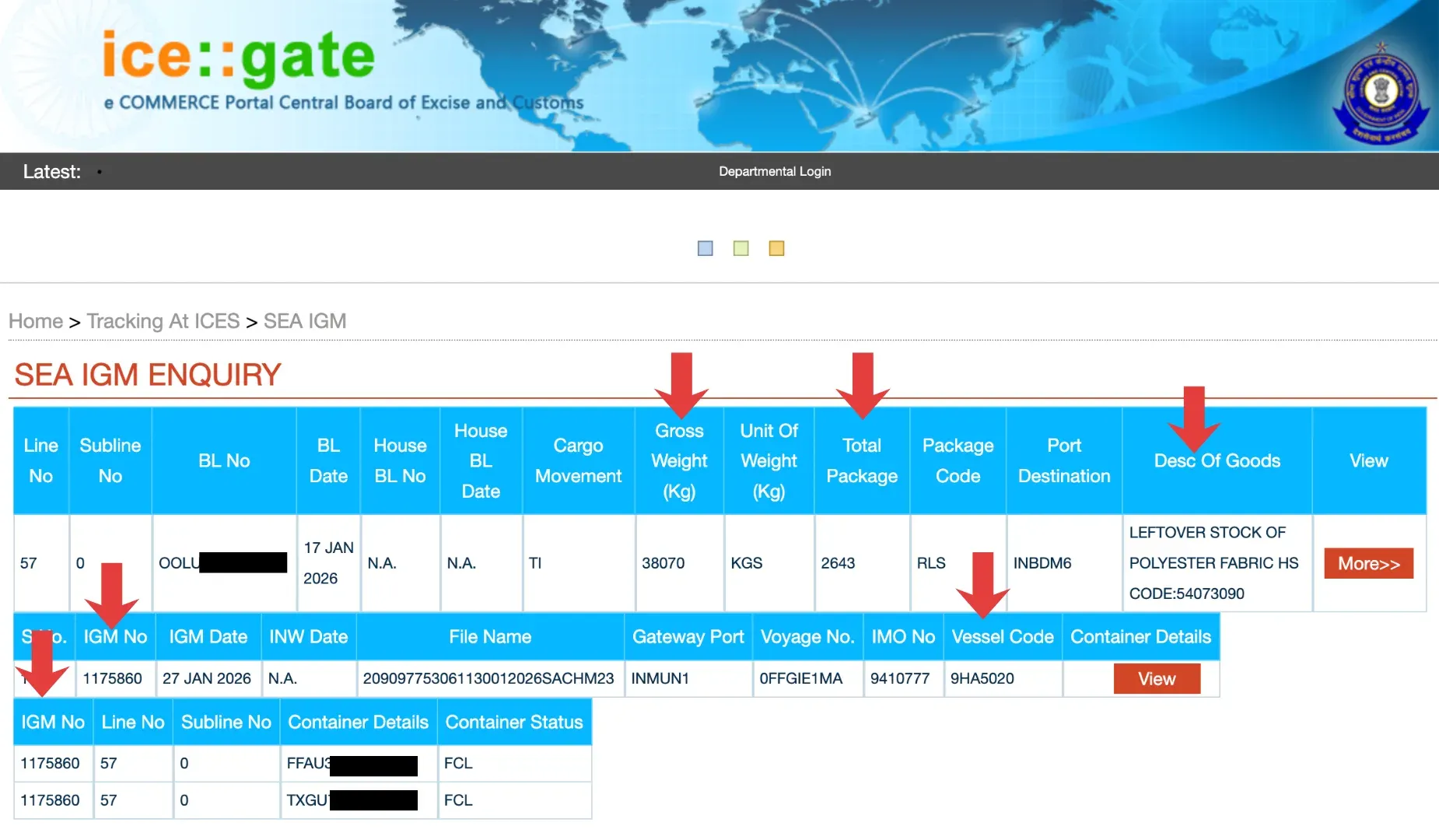

Step 5: Review IGM StatusOnce submitted, the system displays:

- IGM Status: Filed, Held, Amended, or Approved

- Vessel Details: Name, arrival date, port

- Cargo Summary: Number of containers, packages, total weight

- Any Holds or Mismatches: Specific errors requiring attention

- Amendment History: If corrections were made

Understanding IGM Status Codes

Filed - IGM received by customs

Approved/Entered - Customs accepted the manifest

Held - Customs flagged an issue

Amended - Changes were made to the manifest

Pending Correction - Error detected, awaiting amendment

Top 5 Sea IGM Errors That Delay Cargo

Mistake #1: Container or Seal Number Mismatch

A single digit difference in container numbers—say CN123456 vs CN123457—will cause customs to hold your shipment.

Mistake #2: Bill of Lading (BL) Number Mismatch

If the BL number in the IGM doesn't match your physical Bill of Lading, customs will mark it as an error.

Mistake #3: Missing or Generic Cargo Description

Descriptions like "goods" or "merchandise" trigger mandatory examination. Customs wants specificity—e.g., "100 cartons of polyester fabric, 50 kg each" instead of "textiles."

Mistake #4: Wrong or Missing HS Code

The Harmonized System (HS) code determines duty rates and import restrictions. A wrong code can lead to examination holds or duty miscalculations.

Mistake #5: Late Filing of IGM

Under the new SCMTR (Sea Cargo Manifest & Transhipment Regulations, 2018), IGM must be filed at least 48 hours before vessel arrival (for long-voyage shipments, up to 72-96 hours). Late filing invites penalties up to ₹50,000.

FAQ: Answers to Common Sea IGM Questions

Can I file IGM as an importer, or must the shipping line do it?

Only the shipping line can file IGM. You cannot file it directly.

What's the difference between IGM, SGM, and Bill of Entry?

IGM = vessel-level manifest | SGM = corrections to IGM | Bill of Entry = item-level customs clearance

What happens if my IGM shows a mismatch with the Bill of Entry?

Customs rejects the Bill of Entry, and cargo remains held until the mismatch is resolved.

My cargo shows a "hold" on ICEGATE. What do I do?

Contact your CHA immediately. Identify the hold reason and file amendment or provide requested documentation.

Can I file Bill of Entry before IGM is fully processed?

Yes, you can file Advanced Bill of Entry, but risks exist if IGM has issues.

Arjun Abraham Zacharia

With 20 years of experience in startups, mobile, commerce, social commerce, and fintech, I am the founder of EximPe, a B2B cross border payments and trade finance platform for SME exporters and importers.