AD Code Registration Fees, Documents Required, and Process Explained

Discover the details of AD Code registration fees, required documents, the comprehensive process for exporters in India, and registration on ICEGATE.

If you’re planning to export goods from India, AD Code registration is a crucial compliance step. The Authorized Dealer (AD) Code links your bank account with customs, enabling smooth foreign exchange transactions and customs clearance. This guide by EximPe covers the fees, documents required, and the step-by-step process for AD Code registration, ensuring you avoid common mistakes and delays.

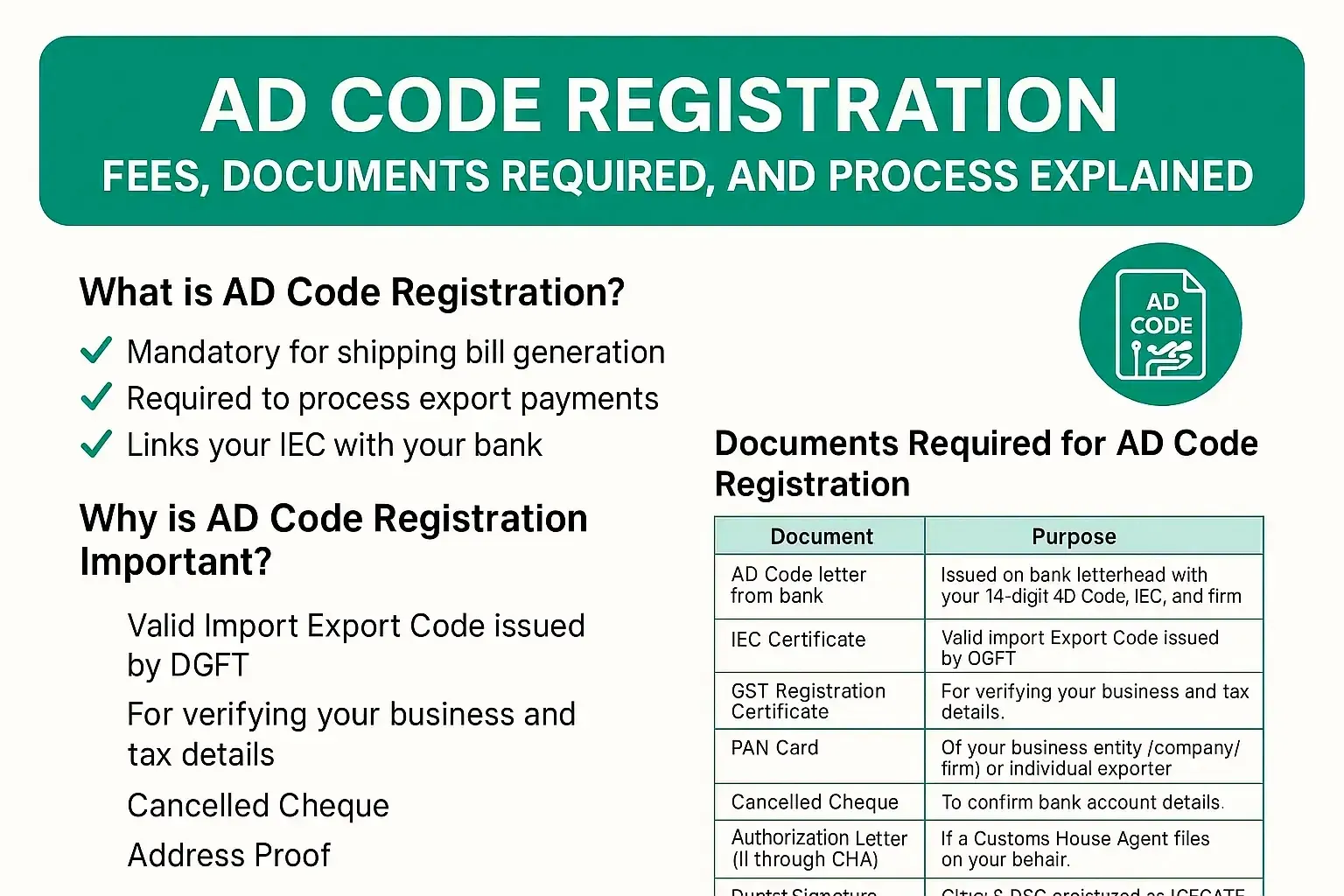

What is AD Code Registration?

Every exporter needs an AD Code, a special code provided by a bank branch approved by the RBI, in order to process shipping bills and obtain export incentives. For customs clearance at every port you export from, you must register your AD Code on the ICEGATE portal, the Indian Customs digital platform.

Why is AD Code Registration Important?

✔️ Mandatory for shipping bill generation ✔️ Required to process export payments ✔️ Links your IEC with your bank for compliance under FEMA and RBI guidelines

Documents Required for AD Code Registration

Here is a checklist of documents needed:

AD Code Registration Fees

- Government Fee: There is no official government fee for AD Code registration on the ICEGATE portal. The process itself is free from the customs side.

- Professional/Consultant Fee: If you hire a consultant or service provider, expect to pay a one-time fee ranging from ₹2,999 to ₹4,500 (exclusive of GST), depending on the provider and services included. This covers document preparation, application submission, and follow-up.

- Digital Signature Certificate (DSC) Cost: A Class 3 DSC is required for online registration and typically costs around ₹3,700 (plus taxes), if you don’t already have one.

Step-by-Step Process for AD Code Registration

Step 1: Obtain AD Code from Your Bank

- Approach your bank branch (authorized by RBI for foreign exchange).

- Submit a request for an AD Code letter, along with your IEC, PAN, and business details.

- The bank will verify your credentials and issue a 14-digit AD Code on its official letterhead.

Step 2: Register on the ICEGATE Portal

- Visit the ICEGATE portal.

- Register your company using your IEC, PAN, email, and phone number if not already registered.

- Obtain and configure a Class 3 DSC for digital signing of your application.

Step 3: Log In and Start AD Code Registration

- Log in to ICEGATE with your credentials.

- Navigate to Bank Account Management or AD Code Registration under the “Financial Services” section.

Step 4: Fill in AD Code Details and Upload Documents

- Enter your IEC, select the port of export, and input your AD Code and bank details.

- Upload all required documents in the prescribed format and size.

Step 5: Submit Application and Digital Signature

- Review all details for accuracy (especially port selection and name matching with IEC/GST/PAN).

- Sign the application with your DSC and submit online.

Step 6: Track Application and Receive Confirmation

- Once submitted, you’ll receive an acknowledgment or URT number for tracking.

- Approval typically takes 1–2 working days if all documents are in order.

- A confirmation email is sent to your registered address once approved.

Common Mistakes to Avoid while registering your AD Code

- Wrong Port Selection: Register your AD Code for the correct port; each port requires separate registration.

- Name/Detail Mismatch: Ensure all details match exactly across IEC, GST, PAN, and bank documents.

- Uploading Incorrect/Unreadable Documents: Only upload clear, legible, and valid documents.

- Delayed Registration: Don’t wait until the last minute; register well before your shipment date.

Conclusion

For any Indian exporter, registering for the AD Code is an essential compliance step. Although there are several steps involved, a successful registration can be guaranteed by carefully preparing the AD Code registration documents, being aware of the specific registration fees, and adhering to the above-described process. By properly completing this formality, you enable your company to facilitate safe financial transactions, expedite customs clearance, and access the entire range of government export benefits, thereby advancing your goals for international trade in 2025.

FAQs

1. What is AD Code registration fee in ICEGATE?

ICEGATE does not charge any fee. Charges only apply if you hire an agent for registration assistance.

2. Can I register AD Code without DSC?

No. Class 3 DSC is mandatory for AD Code registration on ICEGATE.

3. How long does AD Code registration take?

Generally, 1-3 working days after submission.

4. Is AD Code registration required for each port?

Yes. You need to register your AD Code separately for every port of export.

5. Can I use the same AD Code for multiple ports?

Yes, but it must be registered individually on ICEGATE for each port.

6. Who issues AD Code?

Your bank branch’s forex or Authorised Dealer department.

7. Is there a validity for AD Code registration?

No expiry, but if you change bank or branch, a new AD Code registration is required.

8. What if my AD Code registration is rejected?

Check the rejection remarks, correct the issues, and re-submit with updated documents.

9. Can CHA register AD Code on my behalf?

Yes, with an authorisation letter and your DSC, your CHA can register it.

10. Why is AD Code registration important for exporters?

Without AD Code registration, shipping bills cannot be generated, halting your exports and foreign exchange realisation.