How to Sell Chinese Home Decor in India: Candles, Vases & Photo Frames — A Personal Import D2C Shipping Guide (2026)

Learn how to sell candles, vases & photo frames directly to Indian buyers via personal import D2C model. No IEC, BIS or compliance needed.

Selling Chinese home decor directly to Indian consumers is much easier than most overseas sellers think. If you want to sell International home decor in India without opening a company, getting an import license, or dealing with BIS certification, the simplest route is the personal import D2C model. You ship each order directly to the Indian buyer’s name via courier, customs clears it as a personal consignment, and the buyer pays the applicable duty. This guide explains exactly how to do it.

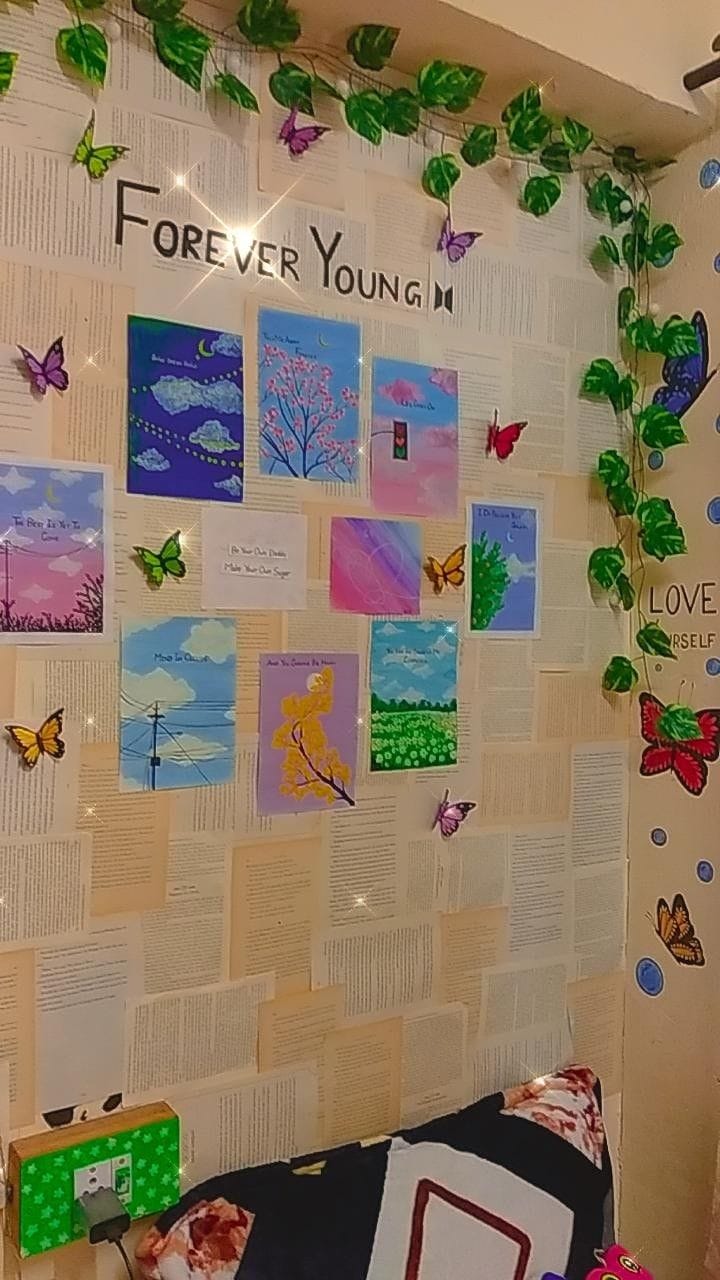

Why Indian Home Decor Is a Massive Opportunity

India’s home decor market is forecast to cross USD 27 billion by 2027, driven by rising disposable incomes, urbanisation, and social-media-inspired “aesthetic homes.”

Chinese origin candles, ceramic vases, photo frames, wall art, and small decor pieces already dominate many Indian marketplaces because they offer design variety at aggressive prices.

However, commercial importing into India can be compliance-heavy, involving BIS, WPC, LMPC, IEC, GST registration, and other certifications. The solution for testing demand quickly is the personal import D2C model, where the Indian end-customer is treated as the importer and you ship directly to them.

What Is the Personal Import D2C Model?

The personal import D2C (Direct-to-Consumer) model is simple:

- The overseas seller, ship each order directly in the name of the Indian buyer.

- The parcel moves via courier (DHL, FedEx, UPS, Aramex) or postal services (China Post >> India Post).

- At Indian customs, the shipment is treated as a personal import, not as a B2B/commercial import.

- Customs duty and IGST is paid by the India buyer, usually to the courier at or before delivery.

Personal import vs commercial import

High-potential home decor categories

- Scented / pillar candles, tealights

- Ceramic decorative vases

- Glass vases / decor glassware

- Wooden photo frames

- Metal photo frames & small statuettes

- Wall art, artificial flowers, small decor

Step-by-Step: How to Sell Home Decor to India Using Personal Import

Step 1: Set Up Your Online Storefront

Choose where Indian buyers will see and order your products:

- Instagram Shop: Great for visual discovery. Use Reels and product tags.

- WhatsApp Business Catalogue: Perfect for one-to-one selling and repeat buyers.

- Shopify / WooCommerce store: For a full e-commerce experience with INR display.

- Marketplace-style landing page: Even a simple one-page catalog with payment link.

Either include estimated customs duty in your pricing or clearly mention:“Indian customs duty and taxes extra, payable to courier on delivery.”

Step 2: Collect Payment from Indian Buyers

You need a cross-border payment setup like EximPe to Collect INR locally from buyers and settle to you offshore. EximPe is a RBI licensed cross-border payment platform.

Step 3: Pack & Ship Directly to the Indian Buyer

Use sturdy packaging, home decor breaks easily. Then:

- Choose carrier: India Post, DHL, FedEx, UPS, Aramex, or China Post/ePacket.

- On the airway bill / shipping label:

- Consignee = Indian buyer’s full name and address

- Include phone & email (for KYC SMS/WhatsApp links)

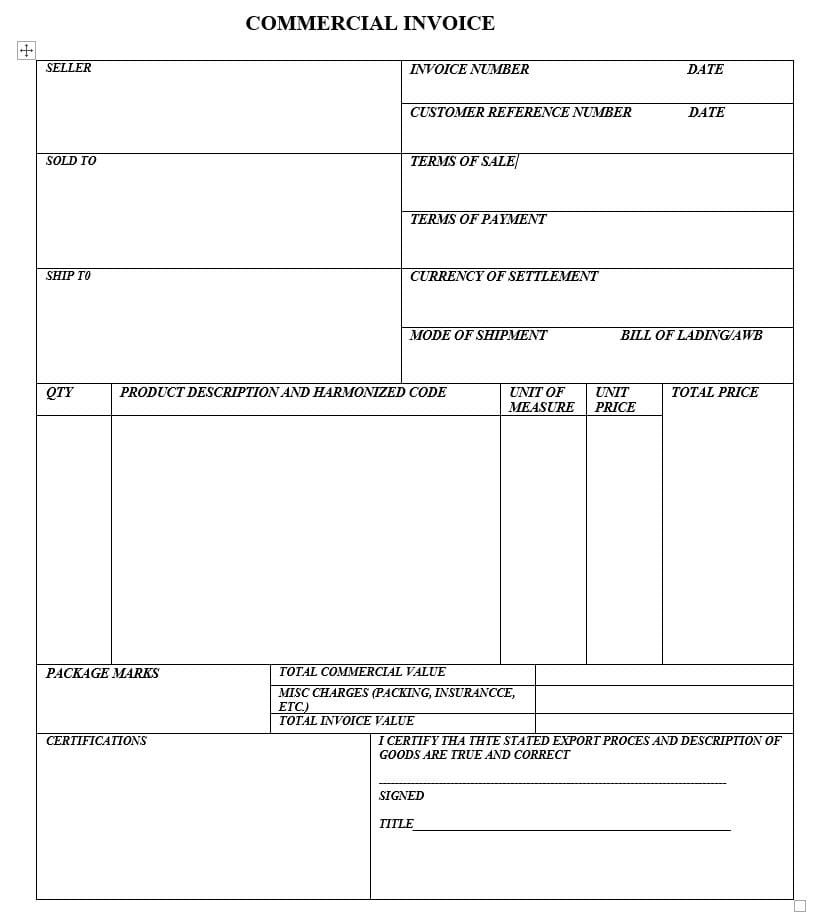

Include a commercial invoice inside and electronically (for the courier):

- Product description (e.g., “Scented soy wax candle – 500 g”)

- HS code (e.g., 3406 for candles, 7013 for glass vases, 8306 for metal frames)

- Quantity, unit price, total invoice value

- Currency (USD or CNY)

- Statement like: “Personal use, not for resale”

Never under declare value, customs has reference price databases and can raise values.

Step 4: Courier Handles Customs Clearance in India

For personal imports, the courier company acts as your customs broker:

- Shipment arrives at Indian gateway (Delhi, Mumbai, Bengaluru, etc.).

- Courier files customs entry using your invoice and HS code.

- Indian buyer receives SMS/email to complete KYC (Aadhaar/PAN and address proof), this is mandatory for imports into India, even for individuals.

- Customs assesses duty + IGST, courier pays on behalf of buyer, then:

- Collects it online before delivery, or

- Collects it cash/card on delivery.

India does not have a broad “de minimis” threshold like the US, even low-value parcels are generally dutiable.

Step 5: Buyer Receives the Product

Once duty is cleared and paid:

- Courier attempts delivery to buyer’s address.

- Delivery timeline:

- Express couriers: about 3–7 working days, China to metro India.

- Economy air / postal: 10–15 days depending on route and clearance.

- Buyer opens the parcel, hopefully posts an unboxing video, and you get your first India testimonial.

Customs Duty on Home Decor Items, What the Indian Buyer will Pay

Indian customs calculates duty using a standard structure:

- Assessable (CIF) value = product cost + shipping + insurance (if any)

- Total Duty =

- Basic Customs Duty (BCD)

- Social Welfare Surcharge (SWS) – usually 10% of BCD

- IGST on (CIF + BCD + SWS)

- Basic Customs Duty (BCD)

Exact rates change via budgets/notifications, so always verify on ICEGATE or a tariff portal before promising a final landed price.

Example: Scented candle set shipped to India

Assume:

- Product + shipping (CIF) = ₹2,000

- HS 3406 (candles): public tariff references show BCD around 20–25% and IGST 12%; SWS typically 10% of BCD.eximguru+2

Illustrative calculation using BCD 25% and IGST 12%:

- BCD = 25% of ₹2,000 = ₹500

- SWS = 10% of ₹500 = ₹50

- Subtotal for IGST = ₹2,000 + ₹500 + ₹50 = ₹2,550

- IGST = 12% of ₹2,550 = ₹306

- Total duty ≈ ₹500 + ₹50 + ₹306 = ₹856

So the buyer pays ₹856 in duty on a ₹2,000 CIF parcel → effective duty load ≈ 43% of CIF value.

What Compliance You DON’T Need (The Biggest Advantage)

Under a genuine personal import (consignee is the individual, goods for personal use), the overseas seller typically does NOT need:

- IEC (Import Export Code) in India

- BIS certification for the product (BIS QCOs apply to goods placed on the Indian market commercially, not one-off personal imports)

- WPC ETA for wireless modules (personal-use exemptions apply, though repeated imports can raise questions)

- LMPC (Legal Metrology Packaged Commodities) registration or MRP printing rules (these apply to retail packs sold in India, not foreign parcels to individuals)

- GST registration in India

- FSSAI licence (unless shipping food products at scale, still, personal-use quantities are generally treated differently)

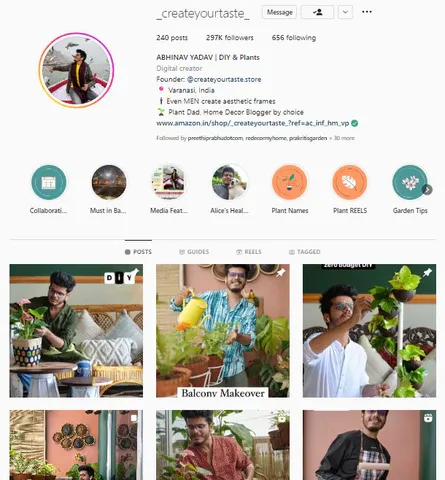

How to Market & Sell Home Decor to Indian Buyers

India is a mobile-first, social-first market. Visual platforms work best for home decor.

Best Channels

- Instagram Reels (visual storytelling)

- WhatsApp Business (direct selling)

- Shopify store (professional look)

- Pinterest boards

- YouTube “room makeover” videos

Common Mistakes to Avoid

Mistake #1: Shipping bulk quantities to one address

- Customs may treat this as commercial import and ask for IEC/GST details.

Mistake #2: Under-declaring value on invoices

- Leads to revaluation, fines, and possible seizure.

Mistake #3: Wrong or missing HS codes

- Causes assessment delays and sometimes higher-than-expected duty.

Mistake #4: Not informing buyers about customs duty

- Buyers refuse delivery when asked to pay duty, and parcels get returned or destroyed.

Mistake #5: Poor packaging for fragile items

- Broken glass vases or cracked ceramic frames mean refunds and bad reviews.

Mistake #6: Ignoring KYC

- If buyers don’t submit Aadhaar/PAN to courier, shipments get stuck indefinitely.

Conclusion

Use Personal Import to Test and Grow in India

Selling Chinese home decor into India doesn’t have to start with company registration, BIS licences, or IEC paperwork. The personal import D2C route lets you test the Indian market quickly by shipping directly to end consumers, while couriers handle customs and buyers handle duty.

Once you see consistent demand, you can decide whether to scale into full commercial importing or keep running a lean, cross-border D2C brand.

FAQs: Selling Chinese Home Decor to India via Personal Import

Do I need an IEC to ship home decor to Indian buyers?

No. In the personal import model, the Indian buyer is the importer, so you do not need an Indian IEC. IEC is required only if you or your company appear as the importer of record in India.

Is BIS certification needed for candles, vases, or photo frames?

Not for genuine personal imports. BIS compulsory certification targets goods placed on the Indian market commercially. A few one-off consignments to individual buyers do not normally trigger BIS.

How much customs duty will the Indian buyer pay?

There is no single flat rate, but for most home decor (candles, vases, frames), buyers should expect around 30–45% of CIF value as combined BCD + SWS + IGST, depending on the exact HS code and current notifications.

Is there a maximum parcel value without duty (duty-free limit)?

India effectively does not have a broad de minimis like the US or EU, even low-value shipments are usually assessed customs duty and IGST.

Is there a value limit for personal imports?

There is no explicit fixed ceiling for all personal imports, but parcels with very high CIF values (e.g., above ₹50,000) or repeated shipments to the same buyer may get extra scrutiny. To stay safe, keep order sizes reasonable and make sure the volume truly looks like personal consumption, not resale.

Which courier is best for shipping home decor from China to India?

For fragile, higher-value decor, DHL and FedEx are generally the most reliable for India in terms of tracking and customs handling. For small, low-value items where buyers are price-sensitive and patient, China Post / ePacket via India Post can work as a budget option.

Dipankar Biswas

I am an international trade, Supply Chain & Logistics Management professional with more than 8 years of in-depth experience in the Industry. I also create youtube videos @Global Vyapar (200K+ Subscribers).