Understanding LUT Number: Meaning, Importance & Where to Find

What is LUT in GST? Learn the full form, meaning, filing process, documents required, and common mistakes. Complete guide for Indian exporters.

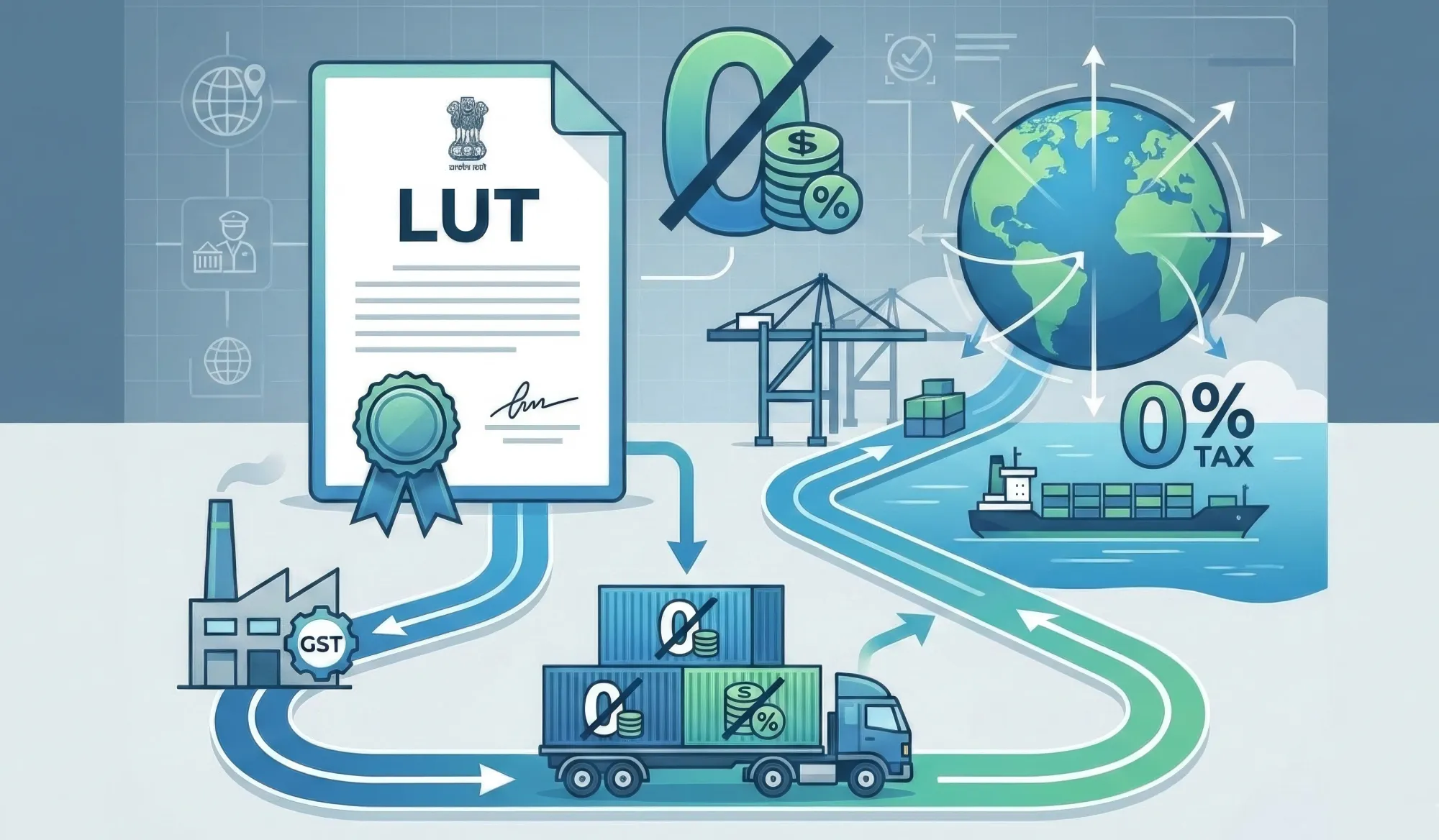

A Letter of Undertaking (LUT) lets you export goods or services without paying IGST upfront, keeping your cash flow intact. Exporters navigate the GST regulations in India for their exports with the help of LUT. In this guide, you'll learn what LUT is, who needs it, how to file it on the GST portal, and the common mistakes that cost exporters money.

What is LUT in GST?

LUT is a formal declaration you file on the GST portal that lets you export goods or services without paying IGST upfront. Instead of paying tax at the time of export and then chasing refunds for months, you declare upfront that you'll comply with all export conditions and the government lets you skip the IGST payment entirely.

LUT is filed under Rule 96A of the CGST Rules, 2017 using Form GST RFD-11.

When you file LUT, you make three key promises to the government:

- You will export goods/services within the prescribed timeline (3 months for goods, 1 year for services)

- You will comply with all GST regulations

- You will pay IGST + 18% interest if export conditions aren't met

One important concept: Exports under GST are "zero-rated supplies" taxed at 0%. LUT is the mechanism that makes this practical without blocking your working capital.

Export with IGST vs Export Under LUT

You have two options when exporting under GST. Here's a detailed comparison:

Majority Indian Exporters choose LUT for exports because it involves no working capital blockage, no monthly refund cycles, and significantly less paperwork. If you export even semi-regularly, LUT is the better route.

Who can file LUT?

Any GST-registered person making zero-rated supplies can file LUT. This covers:

- Goods exporters (manufacturers and traders)

- Service exporters (IT, consulting, design, marketing)

- Freelancers earning in foreign exchange

- IT/SaaS companies with international clients

- Suppliers to SEZ (Special Economic Zone) units/developers

Who is NOT eligible: Anyone prosecuted for tax evasion exceeding ₹2.5 crore under CGST Act, IGST Act, or any existing law. Such persons must furnish an export bond with bank guarantee instead.

LUT is optional, not mandatory. You can always choose to pay IGST and claim a refund. But for regular exporters, LUT saves both money and time.

How to File LUT Online: Step-by-Step

Filing LUT on the GST portal takes under 10 minutes. Here's the process:

Step 1: Go to

and log in with valid credentials.

Step 2: Navigate to Services > User Services > Furnish Letter of Undertaking (LUT).

Step 3: Select the financial year for which LUT is being filed (e.g., 2026-27).

Step 4: GSTIN and legal name auto-populate, verify they are correct.

Step 5: Upload previous year's LUT (if this is a renewal). Max file size: 2 MB.

Step 6: Select all self-declaration checkboxes.

Step 7: Enter details of two independent witnesses — name, address, and occupation. These should not be family members of the proprietor/partners/directors.

Step 8: Enter the place of filing (your city of business).

Step 9: Select authorized signatory and sign using DSC (Digital Signature Certificate) or EVC (Electronic Verification Code).

Step 10: Submit. You'll receive an ARN (Application Reference Number), this serves as your LUT reference number.

Importer Note: File your LUT before April 1 each year, or before your first export of the new financial year. Don't wait until a shipment is ready. Set a calendar reminder for March 25 every year.

Documents Required for LUT

- GST Registration Certificate

- PAN Card of the business

- IEC (Importer Exporter Code), if exporting goods

- Copy of previous year's LUT (if renewal)

- Aadhaar cards of two independent witnesses

- Authorized signatory details (for DSC/EVC)

Note: The GST portal usually doesn't require document uploads at filing time, but keep these ready for audit or verification by GST authorities.

LUT Validity, Renewal & Deadline

- Validity: One financial year, i.e., April 1 to March 31

- Renewal: Must be renewed every year before the first export of the new FY

- No late filing provision: If you miss it, you must pay IGST on exports until LUT is filed

- Renewal process: Identical to fresh filing, same Form GST RFD-11

- Filing fee: ₹0 — there is no government fee for LUT filing

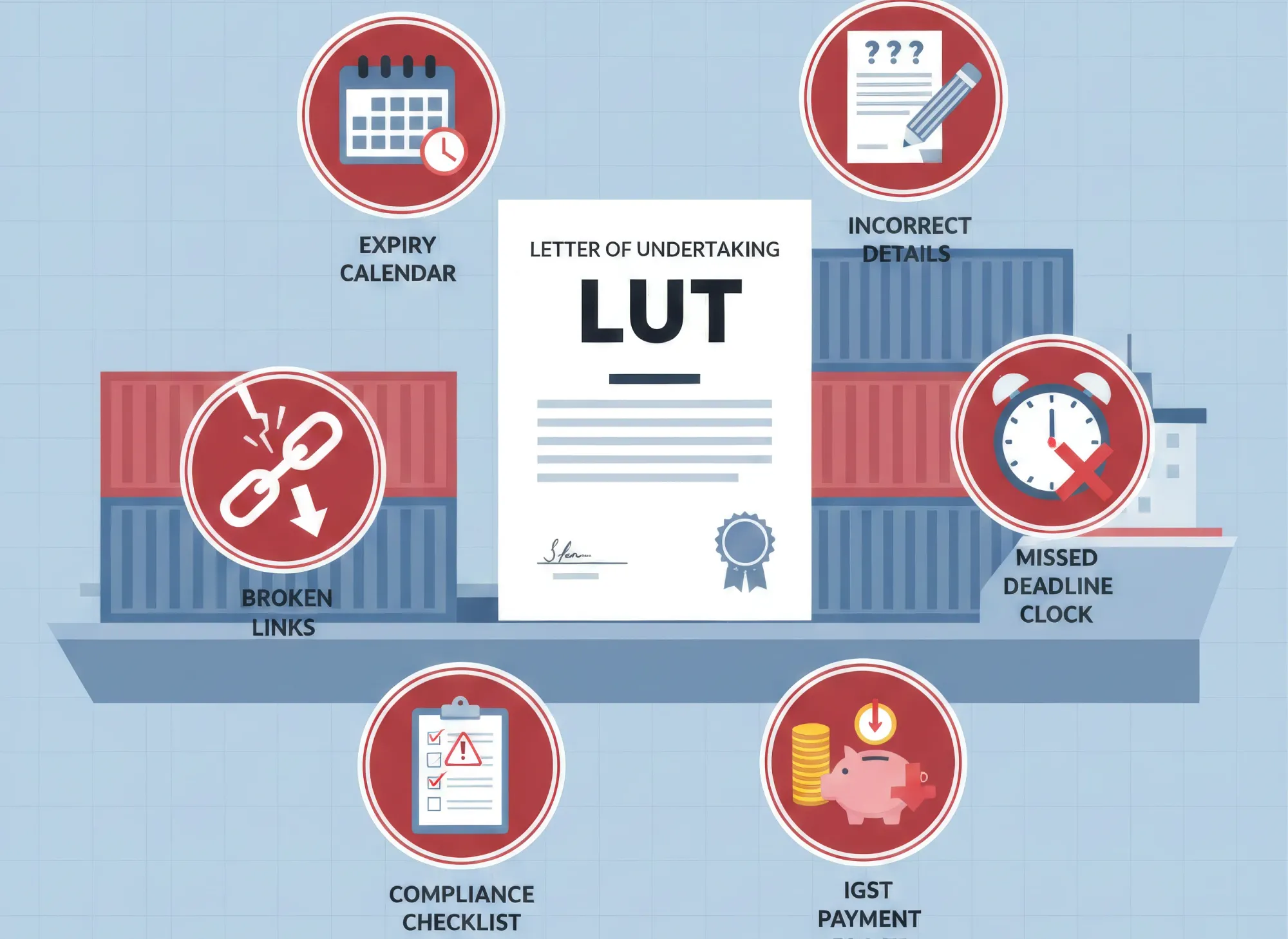

5 Common LUT Filing Mistakes to Avoid

Mistake #1: Forgetting to Renew

LUT expires every March 31. Exporting without a valid LUT means you owe IGST + 18% interest. This is the single most common and most expensive mistake.

Mistake #2: Filing After the First Export

LUT must be filed BEFORE the first export invoice of the financial year. Filing it retroactively doesn't save you, you'll still owe IGST for exports made before the LUT filing date.

Mistake #3: Incorrect GSTIN or PAN Details

Even small errors cause rejection or delays. Always verify auto-populated details before submitting.

Mistake #4: Not Meeting Export Conditions Within Time Limit

For goods: export must happen within 3 months of invoice date. For services: payment must be received in foreign exchange within 1 year (extendable to 15 months via RBI). If conditions aren't met, LUT privileges are withdrawn and IGST + 18% interest becomes due.

Mistake #5: Ignoring Compliance After Filing

Filing LUT doesn't mean you're done. You must still:

- File GSTR-1 accurately with export invoice details

- Maintain complete export documentation

- Quote LUT reference number on all export invoices

Does LUT Apply to Importers?

LUT is exclusively for exports. It does NOT apply when you import goods into India.

When you import, you pay IGST at the port/customs and claim Input Tax Credit (ITC) on it in your GST returns. There's no way around the import IGST payment.

However, if you run an import-export business like many Indian traders, understanding LUT is essential for your export leg.

The IGST you pay on imports becomes your Input Tax Credit. If you export under LUT (without paying IGST on exports), you can claim a refund of this accumulated ITC, effectively recovering the tax you paid on imports.

Example: You import electronics worth ₹50 lakh and pay ₹9 lakh IGST. You export handicrafts worth ₹30 lakh under LUT (zero IGST). The ₹9 lakh import ITC accumulates, and you can claim a refund. Without LUT, you'd pay IGST on exports too, blocking even more cash.

FAQs: Questions Importers & Exporters Ask About LUT

What is the full form of LUT in GST?

LUT stands for Letter of Undertaking. A declaration filed in Form GST RFD-11 that enables exports without upfront IGST payment.

Is LUT mandatory for exporters?

No. LUT is optional. You can choose to pay IGST and claim a refund. But most regular exporters prefer LUT because it avoids working capital blockage.

Can I file LUT if I have pending GST dues?

Yes, pending GST dues alone don't disqualify you. You're only ineligible if you've been prosecuted for tax evasion exceeding ₹2.5 crore.

What happens if I export without LUT?

You must pay IGST on the export and then file for a refund via Form GST RFD-01. Your funds stay blocked until the refund is processed, typically 2-6 months.

How long does LUT approval take?

LUT approval is generally instant upon online submission. You receive an ARN immediately. No manual processing or waiting period in most cases.

Can importers file LUT?

No. LUT applies only to zero-rated supplies, exports and supplies to SEZ. Import IGST must be paid at the port and claimed as ITC.

Is LUT the same as an export bond?

No. LUT is a simpler declaration, no bank guarantee required. An export bond (with bank guarantee worth 15% of bond value) is required only for persons prosecuted for tax evasion exceeding ₹2.5 crore.

Dipankar Biswas

I am an international trade, Supply Chain & Logistics Management professional with more than 8 years of in-depth experience in the Industry. I also create youtube videos @Global Vyapar (200K+ Subscribers).