SWIFT Code vs. IBAN: A Quick Guide for Your International Payments

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Complete international transfers in hours, not days, with real-time tracking

Streamline BOE and Shipping Bill regularization online, and generate e-BRCs effortlessly.

Today, many businesses deal with other countries, so it’s important to understand SWIFT codes and IBAN codes. These are especially crucial if you’re importing goods, exporting products, or managing international money transfers. At EximPe, we assist Indian businesses by providing easy payment solutions to other countries. A common question we hear is whether IBAN codes and SWIFT codes are the same. Let’s explore the basics to help you send and receive money internationally without any trouble.

What is a SWIFT Code?

A SWIFT code sometimes called a BIC-Bank Identifier Code, is a combination of letters and numbers. It helps identify banks all around the world. When you send money internationally, this code tells the banking system which bank should receive the money. This way, your money gets to the right bank, no matter how far away it is. The SWIFT code usually has 8 to 11 characters. These characters give details about the bank, the country where the bank is located, the specific place, and even the particular branch of the bank.

When do you use a SWIFT code?

Whenever you’re making or receiving an international payment, especially to countries outside the IBAN zone, you’ll need the recipient’s SWIFT code to ensure the funds are routed to the correct bank.

What is an IBAN Code?

An IBAN, or International Bank Account Number, is a global standard format that helps identify bank accounts anywhere in the world. It is designed to be unique for each bank account, no matter which country it is in. Unlike a SWIFT code, which identifies a bank itself, an IBAN tells you the specific account within that bank. An IBAN can be as long as 34 characters, made up of both letters and numbers. This includes a code that shows the country, special check digits to verify the account, and the local bank account number.

When do you use an IBAN code?

You will require an IBAN when transferring funds to nations that embrace this system, primarily in Europe, the Middle East, and certain areas of Latin America and the Caribbean. The IBAN ensures your payment reaches the correct account, minimizing mistakes and delays.

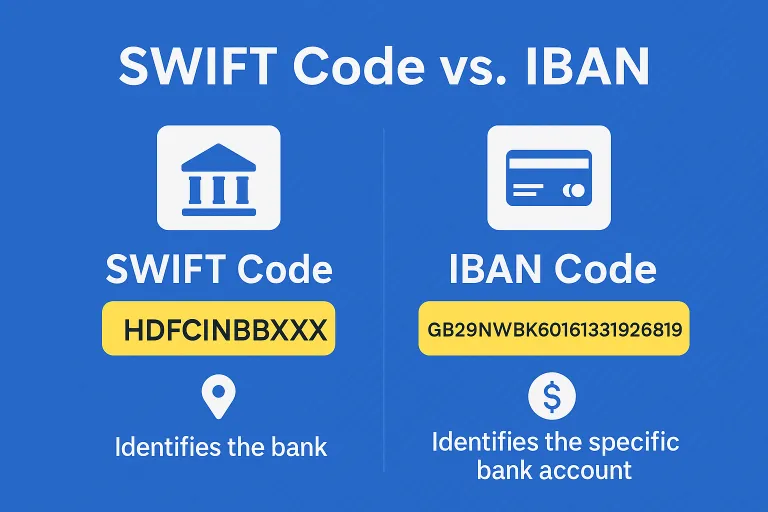

IBAN and SWIFT Code: Are They the Same?

This is a typical question: Are IBAN and SWIFT codes identical? The reply is no. They play distinct yet complementary roles:

- SWIFT code indicates the bank.

- IBAN code identifies the particular account in the bank.

Most cross-border transfers, particularly to IBAN nations, will require both the IBAN and SWIFT codes in order to have the payment made accurately and efficiently.

Key Differences at a Glance

Why Does It Matter for Your Business?

- Accuracy and Speed:

With the proper IBAN and SWIFT code, the risk of failed payments, delays, and expensive mistakes is minimized. Built-in check digits in the IBAN ensure the verification of account numbers, transferring funds more dependably and often more quickly.

- Cost Implications:

Transfers via IBAN codes can be faster, on occasion reducing costs since there’s less human touch. SWIFT transfers can sometimes involve intermediary banks, which, if the routing is complicated, can drive costs up.

- Global Reach:

SWIFT codes are universal, covering over 200 countries. IBANs are more region-specific, but their adoption is growing, making them increasingly relevant for Indian exporters and importers working with Europe and beyond.

How EximPe Makes It Simple

At EximPe, we understand that making international payments can be intimidating. We simplify the process. You require an IBAN and SWIFT code or a SWIFT code alone so your cross-border transactions are seamless, transparent, and affordable. With our online dashboard, you can track payments, view live FX rates, and receive real-time assistance all at one location.

Final Thoughts

Knowing the distinction between IBAN and SWIFT codes is a necessity for anybody working with global payments. Recall:

- IBAN code = designated account

- SWIFT code = specific bank

They are different, but combined, they get your money where it needs to go fast and safely. For easy, digital-first international payments, EximPe is your reliable partner.

Enabling Indian companies to emerge globally and collect payment at the same time.

FAQs

1. Does EximPe support both the SWIFT code and IBAN code for international payments?

Yes, EximPe supports payments using both SWIFT code and IBAN code, enabling you to send and receive funds globally in over 30 currencies, including USD, EUR, GBP, JPY, and AED.

2. Are IBAN and SWIFT codes the same, and do I need both for my EximPe transactions?

No, the IBAN and SWIFT codes are not the same. The SWIFT code identifies the bank, while the IBAN code specifies the individual account. For many international transactions, especially to Europe or the Middle East, you may need to provide both when using EximPe.

3. How do I find the correct IBAN and SWIFT codes for receiving payments via EximPe?

You can find your required swift code and IBAN code details in your EximPe dashboard after account setup. These details are essential for sharing with international clients to ensure smooth and accurate payments.

4. Are there any extra charges for using SWIFT or IBAN codes with EximPe?

EximPe charges transparent, low transaction fees and provides zero hidden bank charges for SWIFT transactions. You can also benefit from real-time FX rates with no markup, helping you save on currency conversion.

5. What documents are required to open an EximPe account for cross-border payments?

To open an EximPe account, you need to complete KYC by submitting basic company documents. For each transaction, you’ll need an invoice, a purpose code, and a request letter.

6. How quickly can I receive international payments using EximPe’s IBAN and SWIFT code system?

With EximPe, you can receive trade payments within 24 hours, and same-day FIRC (Foreign Inward Remittance Certificate) is provided for compliance, ensuring your business operations remain smooth and efficient.

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates