IBAN Number vs Account Number: Key Differences You Should Know

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Complete international transfers in hours, not days, with real-time tracking

Streamline BOE and Shipping Bill regularization online, and generate e-BRCs effortlessly.

If you’ve ever made an international bank transfer, you’ve probably been asked for your IBAN number. This often leads to the question: Is IBAN the same as an account number?

The short answer is no—while an account number is part of your IBAN, the two are not the same. This guide will explain IBAN vs account number in detail, their uses, formats, and why you need to know the difference for secure and successful transactions.

What Is an Account Number?

An account number is a unique identifier assigned to your bank account by your financial institution. It tells the bank which account funds should go to or come from.

Key Points:

- Purpose: Identify your specific account within your bank

- Length: Varies by country and bank (usually 8–16 digits)

- Scope: Used for domestic and sometimes international transfers (with other codes like SWIFT)

- Example (UK): 12345678

- Example (India): 012345678901

Note: Account numbers are essential for all transactions—domestic or international—but alone they are often insufficient for cross-border payments.

What Is an IBAN Number?

An IBAN (International Bank Account Number) is a standardized international format that contains your account number along with additional information to identify your bank and country.

Structure of an IBAN:

- Country code – 2 letters (e.g., GB for United Kingdom)

- Check digits – 2 numbers to validate the IBAN

- Basic Bank Account Number (BBAN) – Includes bank code, branch code, and your account number

Example (UK): GB29 NWBK 6016 1331 9268 19

- GB = Country code

- 29 = Check digits

- NWBK 6016 1331 9268 19 = Bank code + account number

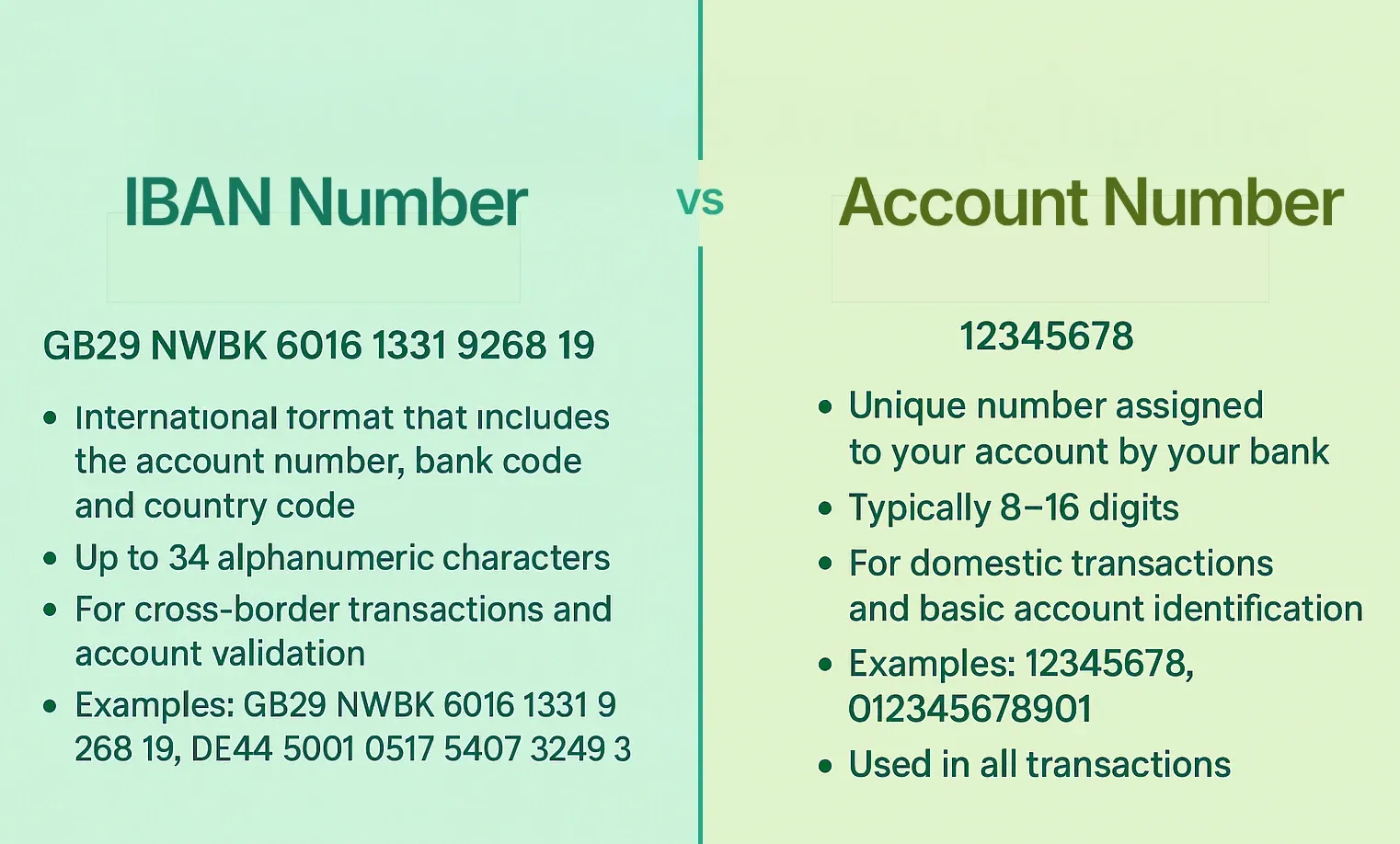

IBAN vs Account Number: Side-by-Side Comparison

How IBAN and Account Number Work Together

The account number forms part of the IBAN. Essentially, the IBAN encapsulates the account number along with additional details like country code, bank code, and validation digits to facilitate seamless international transactions.

For example, if you have an account number in the UK as 12345678, your IBAN will include this number but prefixed with codes like country (GB), bank, branch code, and check digits to form a full IBAN like GB82 WEST 1234 5698 7654 32.

Why the Difference Matters: Local vs. International Payments

The distinction between these two numbers is crucial because they serve different purposes. Using the wrong one can lead to significant problems.

For International Transfers:

When you receive money from an IBAN-compliant country (most of Europe, parts of the Middle East, etc.), the sender's bank will require your IBAN. If you provide your local account number instead, the transfer will likely be flagged, delayed, or outright rejected.

The IBAN is designed to be machine-readable across different banking systems. It contains all the necessary information—the country, the bank, and the specific account—in one single string. This eliminates the need for manual data entry and reduces the likelihood of human error.

For Domestic Transfers:

You would never use an IBAN for a domestic payment. For transfers within your own country, your local account number and a national routing code (like an IFSC in India or a sort code in the UK) are all that's required. Using an IBAN for a domestic transfer is unnecessary and could potentially cause system errors.

Is IBAN the Same as an Account Number?

No. The IBAN is not the same as an account number. While the IBAN includes your account number as a component, it adds multiple other elements—the country code, check digits, and bank identifier—that make it suitable for international use.

Why Do You Need an IBAN Number?

- To avoid errors and delays in international money transfers.

- To comply with standards in countries that require IBANs for cross-border payments.

- To enable banks worldwide to verify the accuracy of the bank account information before processing transactions.

- To allow for faster, smooth processing of international payments.

When to Use IBAN vs Account Number

- Domestic Payments: Usually require only your account number (plus routing code like IFSC, sort code, or ABA).

- International Payments (IBAN countries): Require full IBAN to ensure accurate delivery.

- International Payments (non-IBAN countries): Use account number + SWIFT/BIC code.

Conclusion: IBAN vs account number

The easiest way to remember the difference between proforma invoice and tax invoice is to focus on their purpose:

- Account Number: Your personal, local identifier for use within your own country's banking system.

- IBAN Number: A standardized, international identifier used for sending or receiving money across borders.

Always provide the correct number for the correct transaction type. For domestic payments, use your local account number and any required domestic routing codes. For international payments, use your IBAN and your bank's SWIFT/BIC code. This simple practice will ensure your money is always safe, secure, and arrives on time.

FAQs

1. Is IBAN and account number the same?

No. An IBAN contains your account number along with your bank code, country code, and check digits for international payments.

2. Is IBAN same as account number in India?

No. India does not use IBAN. Only account numbers and SWIFT/IFSC codes are used.

3. Can I use my account number instead of IBAN for international transfers?

Only if the receiving country does not require IBAN. Many banks in Europe and the Middle East will reject payments without IBAN.

4. Does IBAN replace account number?

No. Your IBAN includes your account number but doesn’t replace it—both exist.

5. What if I give the wrong IBAN?

Your transfer could be delayed, rejected, or sent to the wrong account. Always double-check.

6. How long is an IBAN?

It can be up to 34 characters, depending on the country.

7. Can my IBAN change?

Yes, if your account details, bank, or branch change.

8. Where can I find my IBAN?

On bank statements, online banking, or by contacting your bank.

9. Do all banks use IBAN?

No. IBAN is used mainly in Europe, the Middle East, and some other regions.

10. Is it safe to share my IBAN?

Yes, it’s safe for receiving payments. It cannot be used to withdraw money from your account.

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates