EDPMS Full Form and Meaning: A Complete Guide for Exporters

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Complete international transfers in hours, not days, with real-time tracking

Streamline BOE and Shipping Bill regularization online, and generate e-BRCs effortlessly.

Indian exporters deal with a host of documentation and compliance processes to ensure smooth international trade. One system that has revolutionized export management and compliance in India is EDPMS. Whether you’re a seasoned exporter or new to global markets, understanding EDPMS is crucial for avoiding payment delays, regulatory penalties, and ensuring transparency in foreign exchange earnings.

What is the Full Form of EDPMS?

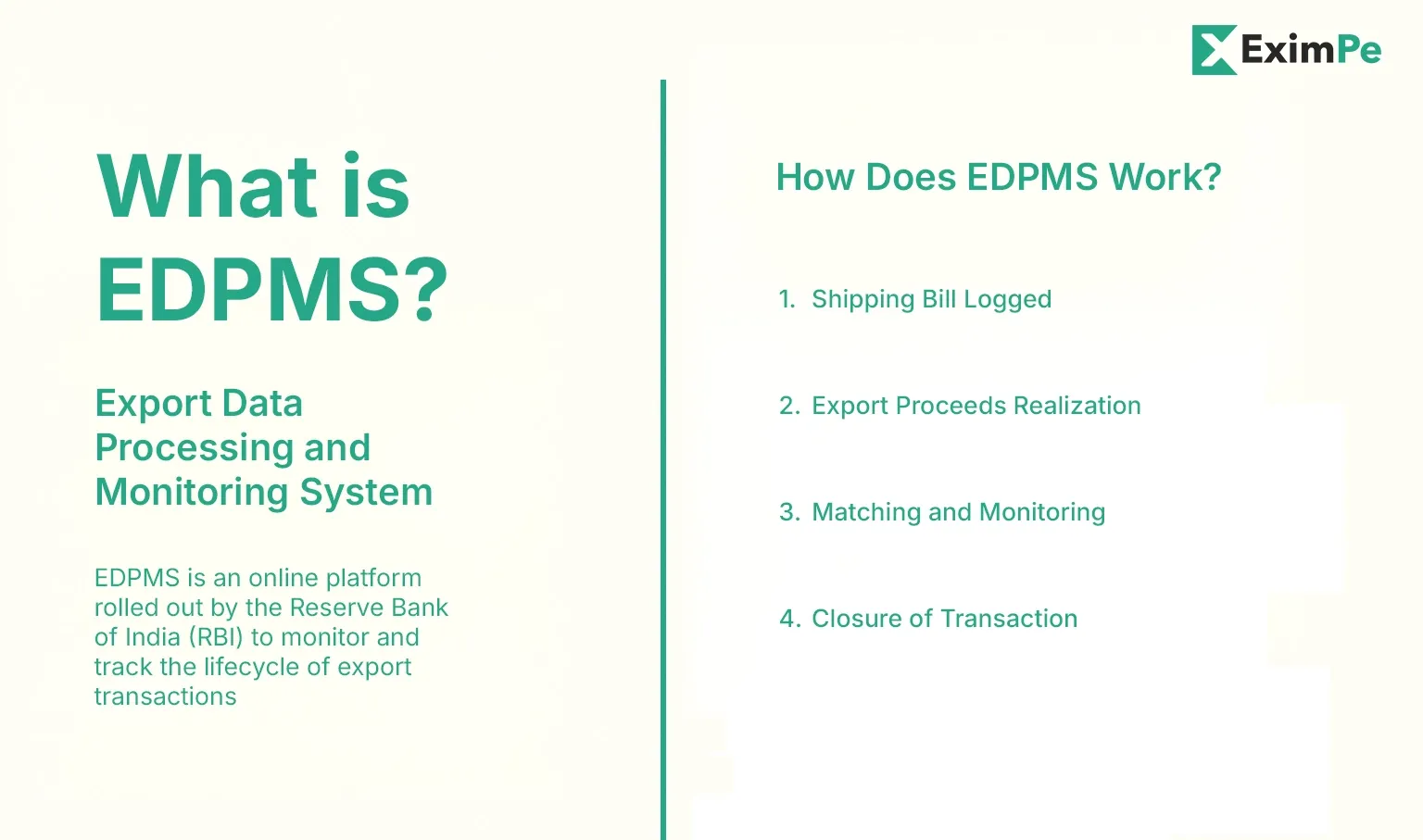

EDPMS stands for Export Data Processing and Monitoring System. It’s an online platform rolled out by the Reserve Bank of India (RBI) to monitor and track the entire lifecycle of export transactions—right from shipment to the realization of export proceeds.

What is EDPMS in Export and Banking?

EDPMS is a digitized monitoring tool connecting exporters, banks, customs, and the RBI. It automatically logs all shipping bills filed with Customs and matches export proceeds received in India, ensuring every US dollar, euro, or any foreign currency entering the country is accounted for.

Key Roles EDPMS Plays in Export:

- Tracks every shipping bill filed electronically with Customs.

- Monitors foreign exchange inflow, matching each export with its corresponding payment.

- Enables RBI and banks to identify overdue or unresolved transactions.

- Reduces paperwork and improves the efficiency of compliance and reporting for exporters.

Why Was EDPMS Introduced?

Earlier, the process was manual and paper-driven, leading to errors, delays, fraud, and compliance risks. EDPMS digitizes and automates this process, helping:

- Exporters track and settle each shipment efficiently.

- Banks monitor export proceeds and close foreign currency transactions accurately.

- Regulators (RBI) maintain strict oversight of India’s forex reserves and detect violations quickly.

How Does EDPMS Work? Step-by-Step Exporter’s Guide

- Shipping Bill Logged: When goods are exported, customs electronically files the shipping bill data into EDPMS.

- Export Proceeds Realization: Exporter receives payment from the foreign buyer. The Authorized Dealer (AD) bank credits funds to the exporter’s account and updates the EDPMS with realization details.

- Matching and Monitoring: The system matches the shipping bill with realized export proceeds. If payment is delayed beyond the permitted period, EDPMS flags it as “overdue.”

- Closure of Transaction: Once payment is received and matched, the shipping bill is “closed” in EDPMS, completing that export’s compliance cycle.

Benefits of EDPMS for Exporters

- Reduced Paperwork: Exporters save time and effort by avoiding repetitive manual filings.

- Transparency: Immediate status updates ensure exporters know if any shipments are pending realization.

- Automated Compliance: The risk of missed or overdue shipments is minimized, helping exporters avoid RBI/FEMA penalties.

- Streamlined Coordination: Banks, customs, and exporters work on a unified digital platform for faster query resolutions.

Key Features of EDPMS

- Centralized digital repository for export transactions

- Automated matching of shipping bills and received foreign currency

- Real-time oversight for banks, exporters, and regulators

- Generation of automated alerts for overdue, partially realized, or misreported transactions

- Easy access for audits, financial reporting, and compliance checks

👉 Learn how to manage your IEC here: How to Renew, Update, and Check Your IEC Code.

👉 Need to send/receive international payments? Use our SWIFT Code Finder Tool for accurate bank details.

EDPMS vs. IDPMS: The Import-Export Link

A related and equally important system for importers is the IDPMS, which stands for Import Data Processing and Monitoring System. The relationship between EDPMS and IDPMS is that they are two sides of the same coin. While EDPMS monitors inbound payments for exports, IDPMS tracks outbound payments for imports.

The EDPMS system ensures money comes in when goods go out, while the IDPMS system ensures money goes out for goods coming in. Both systems were introduced to bring greater transparency and accountability to India's foreign exchange transactions, thereby curbing money laundering and trade-based fraud.

Your Role in EDPMS Compliance

As an exporter, your primary role is to cooperate with your bank to ensure your export payments are correctly reported to the EDPMS.

Here are the key actions you must take:

- Timely Payment: You must receive your export payment within the stipulated time frame, which is generally nine months from the date of export.

- Provide Accurate Documents: You must provide your bank with a clean and clear copy of the Shipping Bill, FIRC, and any other relevant documents (such as the commercial invoice).

- Confirm Transaction Closure: It is good practice to follow up with your bank to confirm that the export payment has been successfully reported to and reconciled in the EDPMS system. An unpaid or unmatched Shipping Bill can lead to severe penalties.

The Consequences of Non-Compliance

If an export payment is not reconciled in the EDPMS system, it raises a red flag with the RBI. Outstanding or mismatched payments can lead to severe consequences, including:

- Caution Listing: The RBI can place the exporter on a "caution list." A business on this list may face restrictions on future exports.

- Legal Action: In cases of severe non-compliance or fraudulent activity, the exporter may face legal action from regulatory authorities.

- Loss of Incentives: Unreconciled export bills may result in the loss of government benefits and incentives related to exports.

Non-compliance can also damage the exporter's reputation with their bank and in the broader financial community.

Conclusion

The Export Data Processing and Monitoring System (EDPMS) is a critical regulatory framework that every Indian exporter must understand. Its full form describes its purpose perfectly: to process and monitor export data for compliance. By understanding the EDPMS meaning and how to coordinate with your bank, you can ensure that your export transactions are transparent, compliant, and free from unnecessary delays. Navigating the world of international trade requires a firm grasp of these systems, and proper compliance with EDPMS is the key to seamless global commerce.

FAQs

1. What is the full form of EDPMS?

The full form of EDPMS is Export Data Processing and Monitoring System. It is a system introduced by the RBI to track and monitor export payments.

2. What is the main purpose of the EDPMS?

The main purpose of the EDPMS is to ensure that all foreign currency proceeds from Indian exports are brought back into the country and are properly accounted for, helping to prevent fraudulent foreign exchange transactions and bringing greater transparency to the export process.

3. How do I check the status of my export bill in EDPMS?

The status of your export bill is managed and updated by your bank. You can inquire with your bank's foreign exchange or trade finance department to get updates on the reconciliation status of your Shipping Bills in the EDPMS system.

4. What is the role of a Shipping Bill in the EDPMS?

The Shipping Bill is the primary document in the EDPMS. The customs department uploads the Shipping Bill data to the system. The bank then links the payment received to the Shipping Bill number, and the EDPMS uses this to reconcile and close the transaction.

5. What happens if I don't comply with EDPMS?

If you fail to comply with the EDPMS, your export bills may remain open in the system. This can lead to penalties, your business being placed on a caution list, and your bank potentially restricting new export transactions on your behalf.

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates