How to Sell International Fashion Jewellery & Accessories in India: A Complete Compliance & Sales Checklist

Learn how to legally sell global fashion jewellery in India. Personal import D2C model, HS code 7117, BIS status, labelling rules, customs duty.

If you’re a Chinese supplier or global ecommerce seller wondering how to sell fashion jewellery in India without setting up a local company, the the answer is personal-import or the D2C model. By combining proper HS classification, compliant labelling, correct duty calculation, and smart Instagram/WhatsApp selling, you can legally ship jewellery and accessories directly to Indian buyers and build a profitable cross-border business.

Why India Is a Massive Opportunity

India is one of the world’s fastest-growing jewellery markets. The overall jewellery market is estimated at around USD 95+ billion in 2025, with fashion and imitation jewellery seeing strong double-digit growth. Affordable, trend-driven accessories dominate among Gen Z and young millennials.

Ideal Target Audience

- Age: 16–35

- Geography: Tier 1 & Tier 2 cities (Delhi, Mumbai, Pune, Jaipur, Lucknow, Indore, etc.)

- Buying triggers: Festivals, college events, weddings, influencer trends

- Platforms: Instagram, Facebook and WhatsApp

What Is the “Personal Import” D2C Model in India?

The personal import D2C model allows you to ship products directly to individual Indian buyers without setting up a commercial importing company in India. The most important benefit of this mode is that it bypasses the strict compliance requirements.

Importing products in India on a B2B level is very difficult due to the implementation of compliances like BIS, WPC, EPR etc. These and many other compliances together cover the majority of the imported products but for personal import none of these are applicable.

Instead of bulk importing inventory into India, you:

- Market products on Instagram / WhatsApp

- Collect payment in INR through EximPe

- Ship directly from China to the Indian customer via Courier/ India Post

- Courier clears customs and delivers

Benefits

- No Indian company setup required

- Low initial investment

- Easy product testing

- Faster market validation

Limitations

- Per-parcel customs duties apply

- Shipping cost per unit can be high

Step 1: Product Compliance Check, BIS & HS Code

Imitation or artificial jewellery falls under HS Code: 7117

This includes:

- Earrings

- Necklaces

- Bracelets

- Rings (non-precious metal)

- Fashion bangles

Is BIS Certification Required?

Currently, imitation jewellery is not under compulsory BIS certification (QCO).

To verify:

- Visit the Bureau of Indian Standards website

- Check the “Products Under Compulsory Certification” section

- Search for jewellery categories

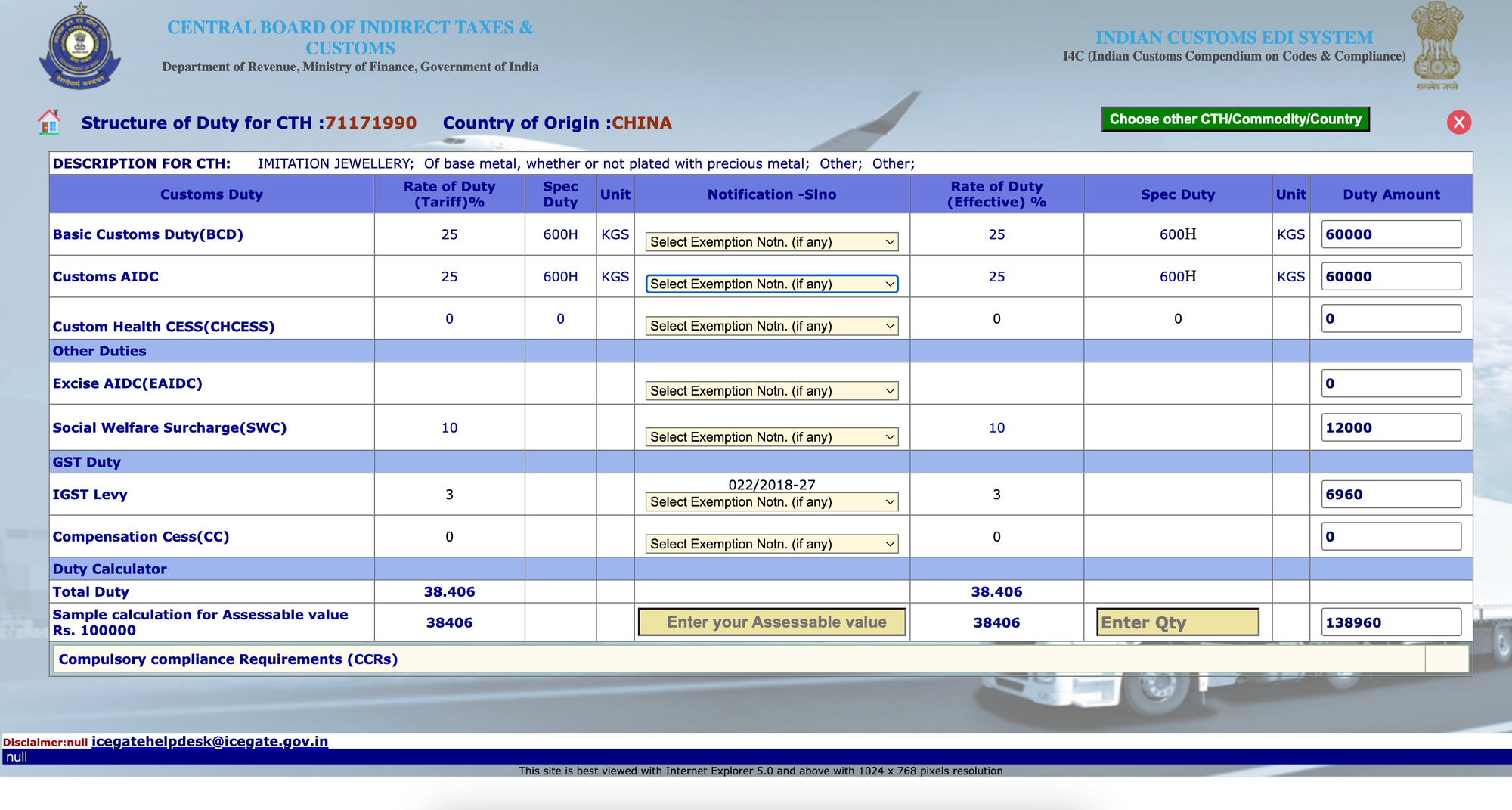

2nd option

- Visit www.icegate.com

- Go to “Customs Duty Calculator”

- Put HS code

- Check the “Compulsory Compliance Requirement”

Step 2: Mandatory Labelling Requirements

Indian import rules require clear English labelling on imported goods.

Required Label Information

- Product name

- Country of origin (“Made in China”)

- MRP in INR (inclusive of all taxes)

- Net quantity / weight

- Importer details (if applicable)

- Batch number

- Manufacturing date

Important: Avoid temporary stickers. Labels must be printed or permanently affixed.

Example Label for Earrings

Product: Gold Plated Stud Earrings (Pair)

Material: Alloy, Rhinestone

Made in China

MRP: ₹899 (Incl. all taxes)

Net Weight: 4 g

Batch No: GSE2025-01

MFG Date: 01/2025

Importer: XYZ Trading, New Delhi, India

Customer Care: +91-XXXXXXXXXX

Clear, professional packaging also increases trust and reduces customs delays.

Step 3: Customs Duty & Tax Breakdown (With Calculator Example)

Now the most important part of any imported product is landed cost. Below is the typical duty structure for HS 7117

- Basic Customs Duty (BCD): 25%

- Social Welfare Surcharge (SWS ): 10% of BCD

- Possible valuation floor: ₹600 per kg (whichever higher)

- IGST: Often 3% (verify subheading)

- Courier handling charges: ₹250–₹550

Landed Cost Example (Earrings)

Lets Assume:

- Product value: ₹200

- Shipping: ₹100

- Total CIF value: ₹300

- Weight: 20 grams

Customs Duty Calculation:

Basic Duty = 25% of ₹300 = ₹75

Social Welfare Surcharge = 10% of ₹75 = ₹7.5

IGST (3%) = 3% of (₹300 + ₹75 + ₹7.5) = ₹11.475

Total before courier fee = ₹386.475

Add clearance & handling = approx ₹100

Final Landed Cost ≈ ₹486.475

Step 4: Setting Up D2C Sales Channels

Instagram Business Setup

- Switch to Business Account

- Add product catalogue

- Use high-quality product photos

- Post 3–4 Reels per week

- Mention price in INR

Example:“College party? These ₹499 studs will upgrade your outfit instantly.”

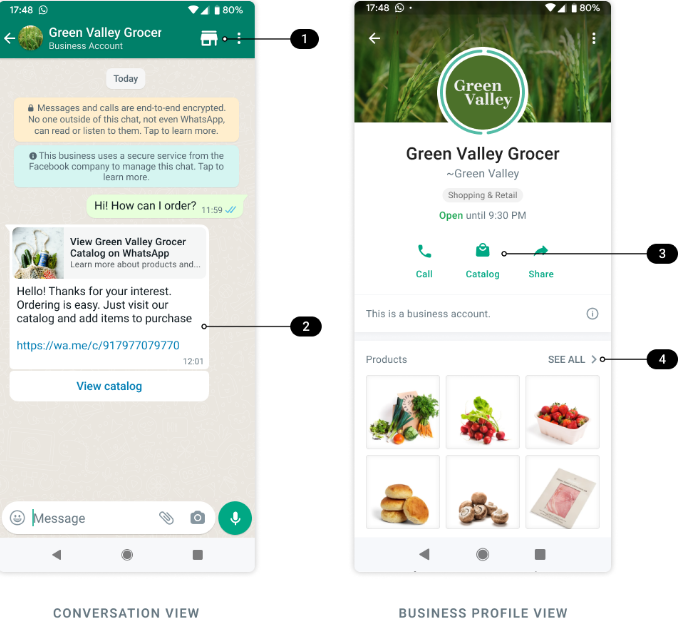

WhatsApp Business

- Add product catalogue

- Add product descriptions + INR pricing

- Use quick reply templates

- Share payment links in chat

Payment Collection

Use EximPe to:

- Generate INR payment links

- Collect applicable taxes

- Settle funds to your account

- Support UPI, cards, wallets

This reduces friction and increases conversions.

Step 5: Logistics — Shipping from China to India

Best Courier Options

Shipping Process

- Pack product properly

- Print label with all required fields

- Create AWB

- Upload tracking to system

- Monitor customs clearance

- Notify customer

Typical delivery window: 5–15 days.

Step 6: Demand Generation Strategy

Localise Your Marketing

Use Hinglish captions:“Diwali Special ✨ Only ₹499 – Limited Stock!”

Tie products to:

- Diwali

- Rakhi

- Navratri

- Valentine’s Day

- Wedding season

Micro-Influencer Strategy

Target:10K–50K follower creators

Offer:

- Free product

- Commission per sale

- Affiliate code

Reels outperform static posts significantly in this category.

Building Customer Trust in D2C Fashion Jewellery

D2C is a very competitive space and Cross-border selling requires extra trust. Below are some of the method that can be used by brands to generate trust:

- Real unboxing videos

- Close-up macro shots

- Clear return policy

- Transparent material description

- Live styling sessions

Address the “Chinese quality” concern directly by:

- Showing plating quality

- Factory tour

- Mentioning nickel-free if applicable

- Offering 7-day replacement for defects

Complete Sales Checklist

Pre-Sale

- HS code verified (7117)

- Label template printed

- Landed cost calculated

- Product photos ready

Payment Stage

- Payment link generated

- Tax & duty clarity given

- Payment confirmed

Post-Sale

- AWB created

- Tracking shared

- Follow-up message sent

- Review requested

Common Mistakes to Avoid

Mistake #1: Wrong HS code

Mistake #2: Missing MRP on packaging

Mistake #3: Under-declaring value

Mistake #4: WhatsApp spamming

Mistake #5: Ignoring festival cycles

Avoid these and you avoid 90% of problems.

Conclusion

India’s fashion jewellery market in 2025 offers a massive opportunity for Chinese suppliers and global ecommerce sellers, especially in the jewellery segment.

The winning GTM should be:

Compliance + Clear labelling + EximPe + Correct duty calculation + Strong Instagram/ Meta marketing + Reliable courier.

Get those six right, and you can build a profitable India D2C pipeline without heavy infrastructure.

FAQs

Do I need BIS for earrings?

No, imitation jewellery is not currently under mandatory BIS certification. Always verify latest updates.

How long does delivery take?

Typically 5–15 days via express courier.

Do I need GST registration?

Not necessarily for personal-import/ D2C model.

How do I calculate price?

Start with landed cost >> add marketing >> add 50–200% margin depending on positioning.

Can I scale to marketplaces?

You will likely need Indian entity setup for major marketplaces.

Dipankar Biswas

I am an international trade, Supply Chain & Logistics Management professional with more than 8 years of in-depth experience in the Industry. I also create youtube videos @Global Vyapar (200K+ Subscribers).