Section 80D Income Tax: Deductions for Health & Medical Insurance

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Complete international transfers in hours, not days, with real-time tracking

Streamline BOE and Shipping Bill regularization online, and generate e-BRCs effortlessly.

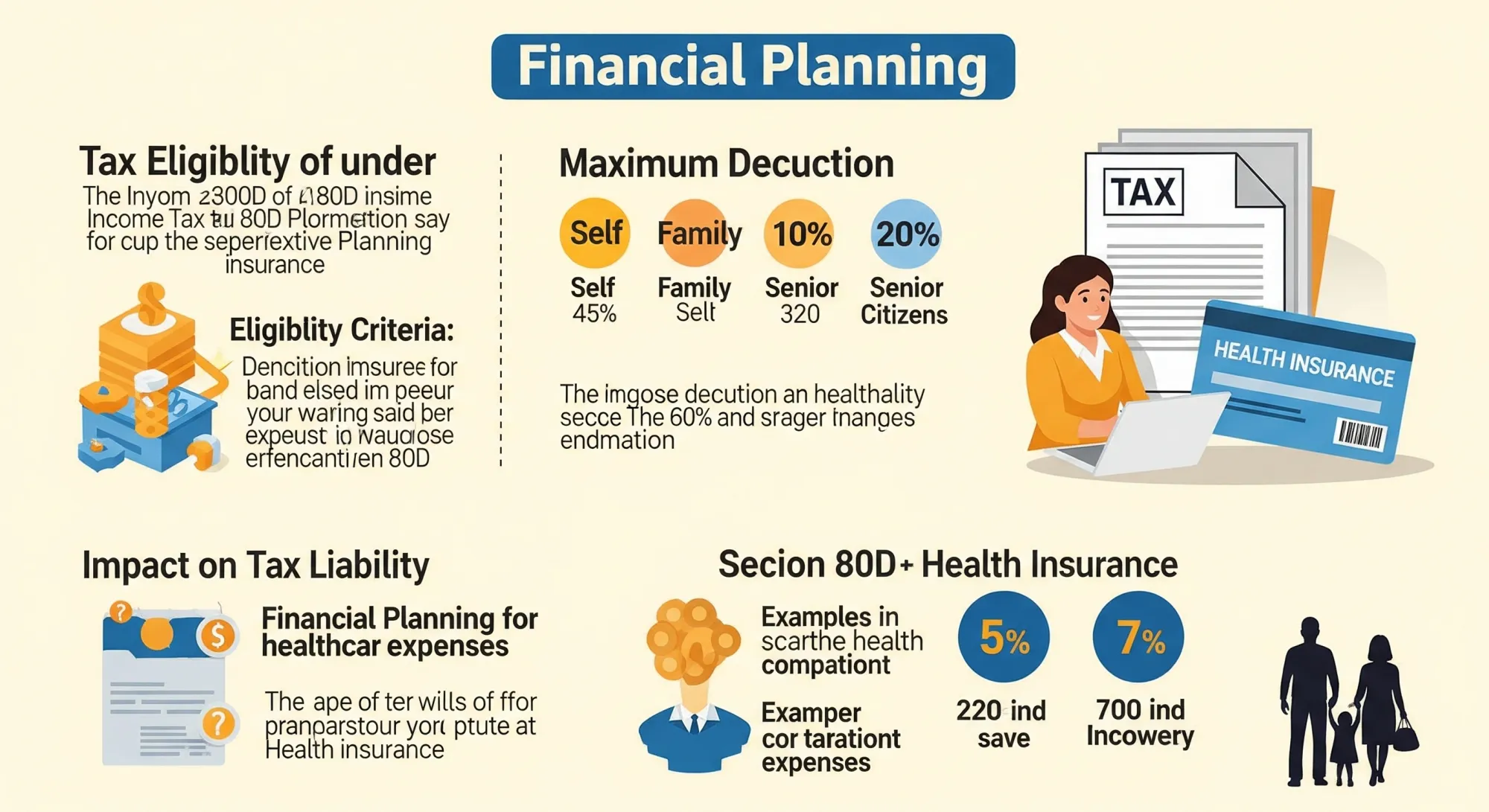

Financial planning always involves knowing what tax benefits are offered for health insurance. We hold that providing current information to our clients could save them tax, highlighting the 80D deduction under the Section 80D Income Tax Act. Here are ways to use your health insurance tax deduction of 80D during the current fiscal year.

What is Section 80D Income Tax?

Section 80D of the Income Tax Act lets individuals and HUFs get a tax reduction for premiums paid toward health insurance. You can claim the Deduction from Section 80D after using the other popular deduction from Section 80C.

Who is Eligible for an 80D Deduction?

- People (including non-resident Indians)

- Hindu Undivided Families(HUF) is the term for this structure.

This sort of benefit is not available to partnership firms, trusts or companies.

What Expenses Qualify for Health Insurance Tax Benefit 80D?

You can claim a deduction for:

- Health insurance premiums paid for yourself, your spouse, dependent children, and parents

- Contributions to the Central Government Health Scheme (CGHS) or other notified schemes

- Preventive health check-ups (up to a specified limit)

- Medical expenses for senior citizens (if no insurance is taken)

Deduction Limits under Section 80D (FY 2024-25)

For example, if you pay a premium for your family (all below 60) and your senior citizen parents, you can claim up to ₹75,000 as a deduction under section 80D in a financial year.

Special Points to Remember

- The old tax regime is the only place the 80D tax benefit on health insurance appears.

- Preventive health check-ups are eligible for up to ₹5,000 toward your 80D deduction maximum.

- The only time you can use cash is for preventive health check-ups; all other payments must be made another way.

- Medical costs faced by people 60 years or older can be claimed up to ₹50,000.

Why Claim Health Insurance Tax Benefit 80D?

- It makes your tax bill much lower.

- Makes sure individuals get or renew health insurance before needing care.

- Offers unique help to older people, as medical costs for seniors are often higher.

Conclusion

If you use the tax deduction from section 80D, you can keep your family healthy and pay less tax. It is important to look over your health insurance each year at EximPe to be sure you are making the most of the health insurance tax benefit 80D.

Be insured and stay on top of your taxes!

If you need assistance with tax-saving strategies, including on Section 80D Income Tax, ask the experts at EximPe.

FAQs

- Who can claim a deduction under Section 80D?

Only individuals (including NRIs) and Hindu Undivided Families (HUFs) are eligible to claim Section 80D deductions. Companies, trusts, and partnership firms cannot claim this benefit.

- What expenses are covered under Section 80D deduction?

You can claim deductions for health insurance premiums paid for yourself, your spouse, dependent children, and parents, as well as expenses for preventive health check-ups and medical expenses for senior citizens if no insurance is taken.

- What is the maximum deduction allowed under Section 80D for FY 2024-25?

You can claim up to ₹25,000 for yourself, spouse, and dependent children (below 60), and an additional ₹25,000 for insuring parents (below 60). If either is a senior citizen (60+), the limit rises to ₹50,000 each, making the maximum possible deduction ₹1,00,000 per year.

- Can I pay the health insurance premium in cash and still claim the deduction?

Only payments for preventive health check-ups (up to ₹5,000) can be made in cash. All other payments must be made through non-cash modes to qualify for the deduction.

- Is Section 80D deduction available under both old and new tax regimes?

No, the Section 80D deduction is available only under the old tax regime.

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates