How to Renew, Update, and Check Your IEC Code Status Online on DGFT Portal: A Complete Guide (2025)

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Complete international transfers in hours, not days, with real-time tracking

Streamline BOE and Shipping Bill regularization online, and generate e-BRCs effortlessly.

An Importer-Exporter Code (IEC Code) is your vital ticket to international trade out of India. When acquired, this 10 digit special identification number will enable businesses to import and export goods and services, enjoy government benefits and access customs without any hitches. Nevertheless, it is not enough to get an IEC Code once in order to claim attaining one as it is vital to sustain its active status at the level that can be considered equivalent to that of an IEC Code or maybe even greater.

The Directorate General of Foreign Trade (DGFT) mandates an annual online update or confirmation of IEC details. This guide by EximPe will clarify the nuances of this process, walk you through how to update IEC Code details, explain what happens if it's not done, and show you how to check IEC Code status online on the DGFT portal. Stay compliant and keep your global trade flowing smoothly in 2025!

Understanding Your IEC Code: A Quick Recap

Before we dive into the maintenance, let's briefly revisit what the IEC Code is:

The IEC full form is Importer-Exporter Code. It's a unique 10-digit alphanumeric code issued by the DGFT that serves as a mandatory business identification number for anyone engaged in commercial import or export activities in India. Its importance lies in:

- Customs Clearance: Goods cannot be imported or exported without an active IEC.

- Accessing Benefits: Essential for claiming export promotion incentives, subsidies, and GST refunds.

- Foreign Exchange Transactions: Banks require it to process international trade-related payments.

IEC "Renewal" vs. Annual Updation: Clarifying the Terminology

One of the most common misconceptions among traders is the term "how to renew IEC Code." The IEC Code actually has lifelong validity and does not "expire" or require periodic "renewal" in the traditional sense like a license.

However, in February 2021, the DGFT (vide Notification No. 58/2015-20 dated February 12, 2021) made it mandatory for all IEC holders to electronically update or confirm their IEC details annually. This process must be completed between April 1st and June 30th of every financial year. Even if there are no changes to your IEC details, you still need to log in and confirm them.

This annual confirmation ensures that the DGFT's database of importers and exporters remains accurate and up-to-date. Failure to comply with this mandatory annual update leads to the automatic de-activation of the IEC from July 1st onwards.

Why is Annual IEC Updation Mandatory?

This annual exercise, whether a simple confirmation or a detailed modification, serves several critical purposes:

- Ensures Data Accuracy: Keeps the DGFT's records current, which is vital for policy-making, data analytics, and regulatory oversight.

- Prevents De-activation: The primary consequence of non-compliance is the de-activation of your IEC, which will halt all import and export operations.

- Enhances Compliance: Aligns your business with the latest trade regulations and helps in preventing fraudulent activities.

- Facilitates Communication: Ensures that the DGFT has your current contact details for important notifications and updates.

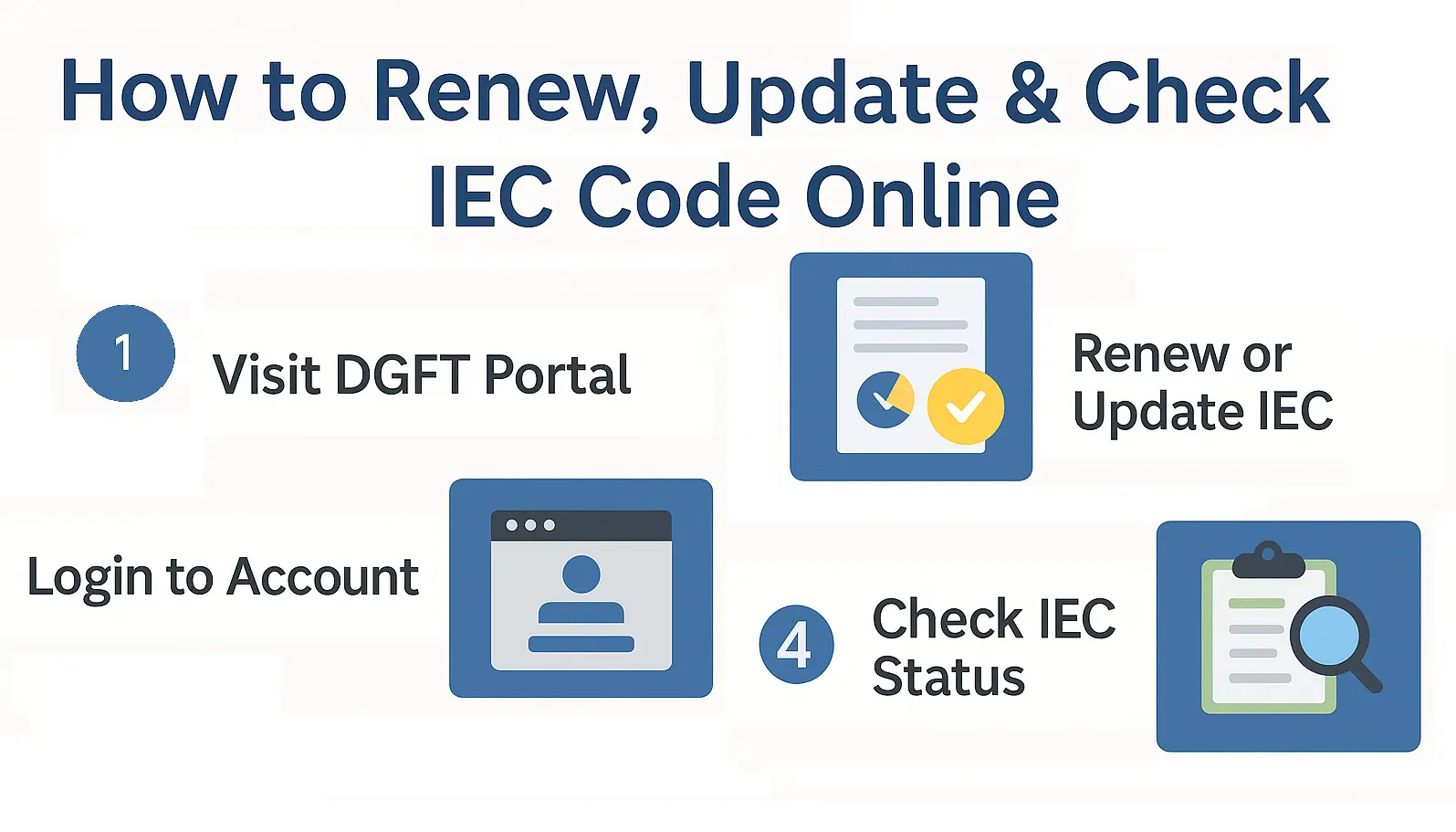

How to Update IEC Code Online on DGFT Portal (2025)

Whether you need to confirm existing details or make actual changes, the process is streamlined and online. Here's how to update IEC Code step-by-step:

Step 1: Log in to the DGFT Website

- Go to the official DGFT website: www.dgft.gov.in.

- Click on "Login" at the top right corner.

- Enter your registered email ID (username) and password. If you've forgotten your password, use the "Forgot Password" option. If you haven't registered on the new portal yet, you'll need to register first using your PAN.

Step 2: Access IEC Profile Management

- Once logged in, navigate to the "Services" menu.

- From the dropdown, select "IEC Profile Management."

- Then, click on "Update IEC."

Step 3: Confirm or Modify IEC Details

- The system will display your current IEC details across various sections (e.g., Firm's Details, Proprietor/Partner/Director Details, Bank Account Details).

- If there are NO CHANGES to your IEC details:

- Simply review each section to ensure the displayed information is correct.

- Move through each section, and at the end, confirm that the details are accurate.

- If there ARE CHANGES to your IEC details:

- Go to the specific section where changes are required (e.g., change in business address, bank account, addition/removal of partners/directors).

- Edit the relevant fields with the new information.

- Upload Supporting Documents: For any changes made, you will need to upload supporting documents. For example:

- Change in Address: New rent agreement, sale deed, or latest utility bill (not older than 2 months) in the firm's name.

- Change in Bank Account: New cancelled cheque or bank certificate for the new account.

- Change in Partners/Directors: Updated Partnership Deed, Board Resolution, KYC documents (PAN, Aadhaar) of new/removed individuals.

- Ensure all uploaded documents are clear, legible, and in the specified format (usually PDF, max 5MB per file).

Step 4: Declaration and Submission

- After reviewing/updating all sections, go to the "Declaration" section.

- Read the declaration carefully and tick the consent box.

- Enter the 'Place' where you are submitting the update from.

- Click "Save and Next" (or similar button) to proceed to the final submission.

Step 5: Sign the Application

- You will be prompted to sign the application. You can use either:

- Digital Signature Certificate (DSC): Ensure your DSC is linked to your DGFT profile.

- Aadhaar-based e-Sign (OTP): An OTP will be sent to your mobile number registered with Aadhaar. Enter the OTP to authenticate.

- Upon successful signing, your IEC update request will be submitted.

Step 6: Confirmation and Verification

- Once submitted, you will receive a confirmation message.

- Your IEC status will be updated almost immediately to "Active" if it was already active or "Active" (after de-activation) once the system validates the updated information.

- Fees for updation: For the mandatory annual confirmation (where no changes are made), there is no government fee. If significant modifications are made that require re-issuance of the IEC, a nominal fee of ₹500 might apply in some rare cases, but generally, the annual update itself is free.

What Happens If You Don't Update Your IEC Code? (De-activation)

The consequences of not performing the mandatory annual update between April 1st and June 30th are significant:

- De-activation: Your IEC Code will be automatically de-activated by the DGFT from July 1st of that year.

- Disruption of Trade: A de-activated IEC means you cannot perform any import or export operations. Your goods will be stuck at customs, leading to costly demurrage charges and potential business losses.

- Ineligibility for Benefits: You will not be able to claim any export incentives, subsidies, or GST refunds until your IEC is reactivated.

- Loss of Credibility: An inactive IEC can signal non-compliance to international partners and financial institutions.

How to Reactivate a Deactivated IEC Code

If your IEC Code has been de-activated due to non-updation, don't panic. It can be reactivated online:

- Perform the Annual Updation: Simply follow the same "How to Update IEC Code Online" steps outlined above. Even though it's past the June 30th deadline, the system allows you to submit the required update/confirmation.

- System Reactivation: Once you successfully submit the update (with DSC or Aadhaar OTP), the system will automatically reactivate your IEC.

- Check Status: Verify the status immediately on the DGFT portal (see next section). It might take a few hours for the status to reflect across all systems (like ICEGATE).

How to Check IEC Code Status Online (Verification Guide)

Regularly checking your IEC Code verification status is a good practice to ensure everything is in order. There are two primary portals for this:

1. On the DGFT Website (Primary Source)

This is the most authoritative source for your IEC status.

- Step 1: Go to www.dgft.gov.in.

- Step 2: Log in to your DGFT account.

- Step 3: Navigate to "Services" -> "IEC Profile Management" -> "View IEC" or "Print IEC."

- Step 4: Your IEC details will be displayed, including its current "IEC Status" (e.g., Active, Inactive, Suspended). You can also download your e-IEC certificate here.

2. On the ICEGATE Portal (Customs System Verification)

ICEGATE (Indian Customs EDI Gateway) is where customs authorities access your IEC information. It's crucial that your IEC is active here for smooth customs clearance.

- Step 1: Visit the ICEGATE website: www.icegate.gov.in.

- Step 2: Look for the "Check IE Code/BIN Status" option, usually under "Enquiry" or "Services."

- Step 3: Enter your 10-digit IEC Code in the provided field.

- Step 4: Enter the Captcha code and click "Submit."

- Step 5: The system will display your IEC details, including your firm name, PAN, and its status as per Customs records.

- Note: If your IEC is newly issued or recently updated/reactivated on DGFT, it might take 24-48 hours for the data to sync and reflect as "Active" on ICEGATE.

Conclusion

The IEC Code is your everlasting passport to foreign trade out of India, but only provided it is looked after with care. Knowing how to update the IEC Code on DGFT portal on annual basis is key in eliminating hick-ups. By checking your IEC Code verification status frequently, and being sure it is current, you enable your business to operate globally with confidence and compliance, and therefore make 2025 the year of international expansion.

FAQs: IEC Renewal, Update, and Status Check

1. How often should I renew my IEC code?

Annually, between April and June each year as per DGFT guidelines.

2. Is there a fee for IEC renewal?

Yes, currently ₹200 is charged for renewal confirmation.

3. How to update bank details in IEC?

Login to DGFT portal, select Modify IEC, edit bank details, upload new cancelled cheque/bank certificate, and submit.

4. Can I update IEC address online?

Yes, address changes can be updated online with valid address proof.

5. What happens if I don’t renew IEC?

Your IEC becomes inactive, and you cannot import or export until reactivation.

6. How to check IEC status?

Use DGFT’s IEC verification tool by entering your IEC number online.

7. Is PAN mandatory for IEC?

Yes, PAN is mandatory for both individuals and businesses applying for IEC.

8. How long does it take to update IEC?

Generally, 1-3 working days after submission and payment.

9. Who issues IEC code?

DGFT (Directorate General of Foreign Trade), Ministry of Commerce, Government of India.

10. Is IEC valid for lifetime?

Yes, but annual renewal confirmation is mandatory to keep it active.

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates