How to Find the SWIFT Code for Your Bank

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Complete international transfers in hours, not days, with real-time tracking

Streamline BOE and Shipping Bill regularization online, and generate e-BRCs effortlessly.

Planning to send or receive money from abroad? You must know your bank's SWIFT code. This unique identifier—also called a SWIFT BIC for Bank Identifier Code—makes certain that your funds go to the right place overseas. At Eximpe, we know that getting your international transaction to function properly is job one. So here's a quick, practical guide to making sure you know your bank's SWIFT code and using it correctly.

What is a SWIFT Code?

A SWIFT code is an international financial code used to locate banks and other global financial institutions. It typically contains 8 to 11 characters and is used for secure cross-border finance payments. SWIFT code and SWIFT BIC are interchangeable and are used as your "bank international address" for money transfers.

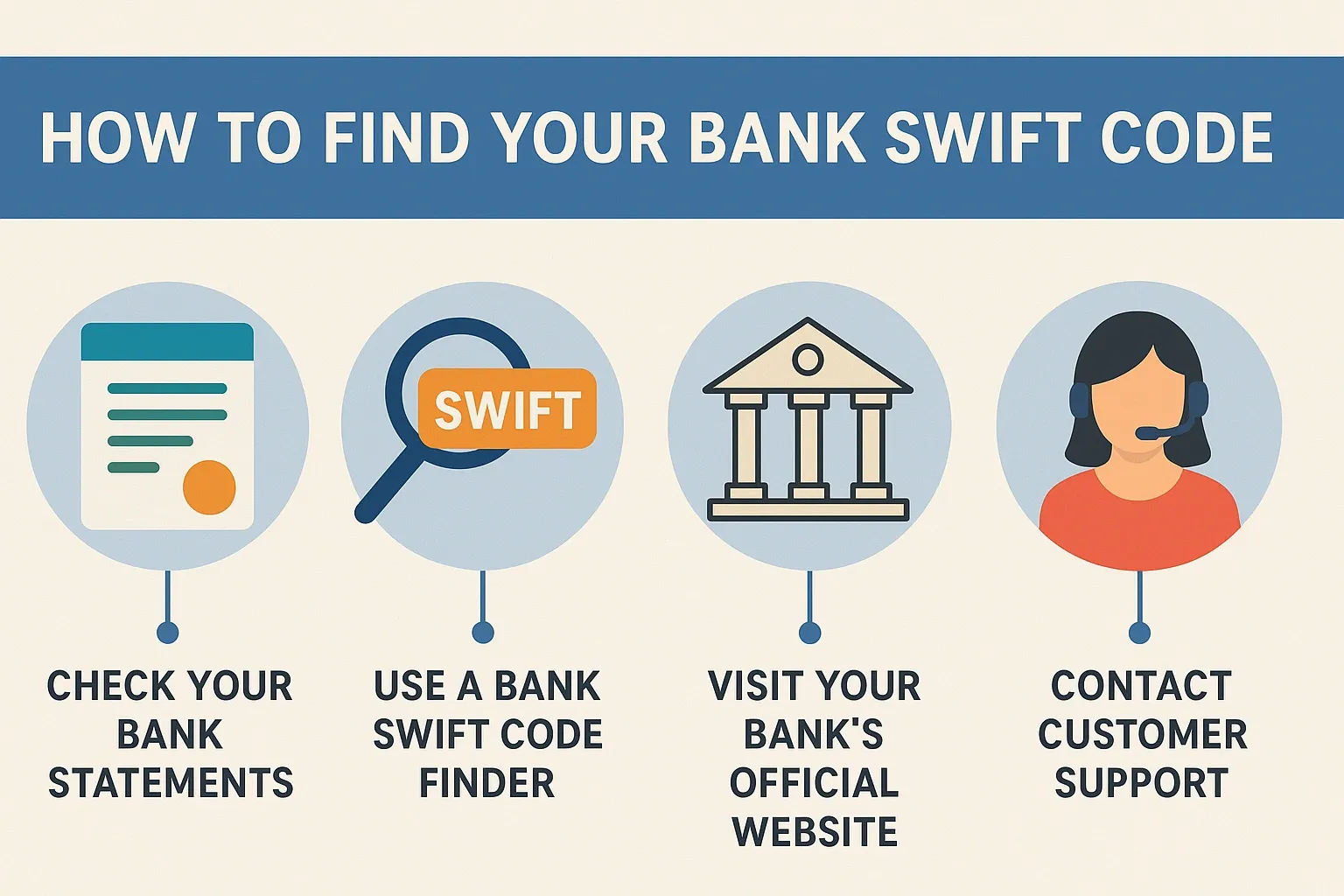

Where to Find Your Bank SWIFT Code

Check Your Bank Statements

Your bank account statements on paper or online also include the SWIFT code. Find segments under headings such as "International Transfers" or "Bank Details." This is usually the fastest way to find out your SWIFT code without additional hassle.

Use a Bank SWIFT Code Finder

There are several bank SWIFT code finders available online. This way, you can try EximPe's SWIFT's search tool or reliable financial websites to look up your bank's SWIFT BIC by name, country, and location. Those platforms are also frequently updated, so you're never going to have the—most current information.

Visit Your Bank's Official Website

Many financial institutions have their SWIFT codes listed on their official website, often in FAQs, International Banking or Wire Transfer area of the website. Just look up "[Your Bank] SWIFT code" on your bank's site to ensure you have the correct information.

Access Online Banking Platforms

Sign in to your bank account online and go to the international transfers or details page. A lot of the banks show the SWIFT BIC in this place for those who can easily reach it.

Contact Customer Support

If you're still unsure or want to double-check, contact your bank's customer service. This is especially important if your bank has multiple branches or you're dealing with a less common financial institution.

Why the Right SWIFT Code Matters

It's important to make sure you have the right bank SWIFT code to avoid delays or lost transfers. Verify the code before sending an international transfer. If your bank doesn't have a SWIFT code (as sometimes happens with smaller or digital-only banks), you may need to use an intermediary bank's SWIFT code.

Quick Reference: Common SWIFT Codes in India (2025)

Note: The last three characters (XXX) often represent the specific branch code or are used as a default for the main branch.

Use a reliable bank SWIFT code finder or check your bank’s official website to confirm the exact SWIFT BIC for your branch before making international transfers. This ensures your funds are routed correctly and without delay.

Conclusion

Finding your bank's SWIFT code is straightforward if you know where to look. Use your bank statements, online banking, official websites, or a reliable bank SWIFT code finder to ensure your international transactions with EximPe are seamless and secure. Always verify the SWIFT BIC before making a transfer-accuracy is key to global banking success.

FAQs

- What is a SWIFT code, and why do I need it for international transfers?

A SWIFT code is a unique identifier for banks used to route international payments securely, ensuring your funds reach the correct institution.

- Where can I find my bank’s SWIFT code?

You can find your bank’s SWIFT code on your bank statements, through online banking, on the bank’s official website, or by contacting customer support.

- Can I use any SWIFT code for my bank, or does it need to match my branch?

You should use the SWIFT code specific to your branch if available; otherwise, the main branch code (ending in XXX) is often used for most transfers.

- What happens if I enter the wrong SWIFT code?

Using the wrong SWIFT code may result in delays, additional fees, or your funds being sent to the wrong bank, so always double-check before making a transfer.

- What should I do if my bank doesn’t have a SWIFT code?

If your bank lacks a SWIFT code, you may need to use an intermediary bank’s SWIFT code to process your international transfer.

Simplify Your International Payments

Skip the complexity of traditional wire transfers with EximPe's smart payment solutions

Lightning Fast

Complete international transfers in hours, not days, with real-time tracking

Bank-Grade Security

Multi-layer encryption and compliance with international banking standards

Global Reach

Send payments to 180+ countries with competitive exchange rates